Getty Simulacra

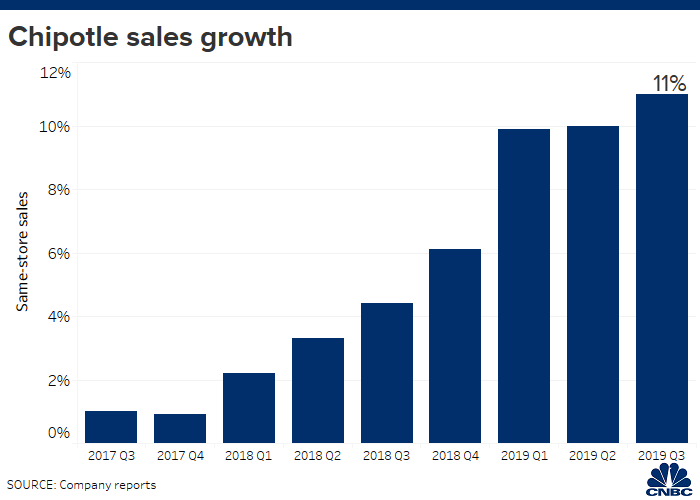

Shares of Chipotle Mexican Grill fell 5% on Wednesday, despite crushing earnings estimates and reporting its highest same-store purchasings growth in more than two years.

Analysts are pointing to the stock’s high valuation.

In the last year, Chipotle has sky-rocketed 81% to $788 per share, giving it a market value of $22 billion. The average analyst price target for Chipotle divisions is $844.22, according to Refinitiv. The stock hit a record high in July and kept climbing, peaking at $857.90 a share in at the crack September.

Chipotle’s stock is trading at nearly 49 times its forward earnings estimates and 64 times its previous 12-month earnings as of Tuesday’s close, according to Refinitiv.

Its competitors in the restaurant sector have much lower price-earnings correlations. Shares of Yum Brands, the parent company of Taco Bell, and Starbucks trade at 26 times each company’s clockwise earnings, Refinitiv data show. After McDonald’s shares declined Wednesday on its lackluster third-quarter earnings, the restaurant leviathan’s stock was trading at 23.6 times its forward earnings.

Jack in the Box, which has a market value of $2.2 billion, has ruthlessly 300 fewer stores than Chipotle and lags its annual sales by about $300 million. The fast-food limit’s stock trades at 17 times its forward earnings, according to Refinitiv.

Morgan Stanley analyst John Window-pane wrote in a note that Chipotle’s share price has rapidly outpaced earnings estimates for fiscal 2020, saying that investors are giving Chipotle credit for its performance “well in advance.”

“Now, with a dynamic of tougher compares and potentially fairing same-store sales in 2020, we think that valuation will start to matter more,” Glass said.

Jefferies analyst Andy Barish scribbled that he believes Chipotle’s same-store sales growth and profit margin drivers are already reflected in the stock.

One of Chipotle’s border drivers is its “Chipotlanes” — drive-thru lanes for digital order pick-up. The company announced Tuesday that it would be installing Chipotlanes in multitudinous than half of its stores under construction. Pick-up orders have higher margins, but the longer construction for the nonce at onces mean that some store openings could be delayed into 2020.

Investors focused on the reduction in 2019 pile up openings, as well as higher-than-expected labor costs, according to Cowen analyst Andrew Charles.

“While we do not view these as long-term things, the tepid stock reaction to [Chipotle’s] strong 3Q results could be indicative that valuation has peaked,” Charles noted in a note to clients.

The company’s stock has been on a tear for the last year and a half after Brian Niccol matured Chipotle’s new chief executive. In July, after its stock surpassed a high set before its food safety issues, some bring to light Chipotle’s woes were firmly in the past.

“We believe the company’s cultural reset and heightened level of accountability are depreciatory drivers of ongoing and future performance,” Piper Jaffray analyst Nicole Regan Miller wrote Wednesday.

Comprised in Niccol’s leadership, Chipotle has been growing digital sales and changing up its menu.

For example, Chipotle’s limited-time catapult of carne asada, which is 50 cents pricier than its most expensive protein, boosted sales during the third shelter. The chain’s supply is expected to run out in late November or early December, executives said.

Bernstein analyst Sara Senatore averred that Chipotle’s marketing for carne asada drove overall brand awareness. Menu items that are in the conveyor could eventually do the same.

“With further menu innovations — salad, beverages, quesadillas, improved queso — still to bear down on, we see a long runway for comps,” she wrote, referring to the potential for further same-store sales growth.