The pep market may be in for more pain.

Crude oil prices had their worst weekly performance of 2019 last week, enchanting some reprieve on Tuesday as flooding in the Midwestern United States restricted supply from several key distribution centers. Blanket, this year has been choppy for prices, which are often tied to global macroeconomic developments such as the running U.S.-China trade war.

And there could be more weakness ahead for the commodity, warns top technician Louise Yamada, who foresaw in April that the crude rally would stop if prices broke below the $60 level.

Now that they partake of, with U.S. West Texas Intermediate crude settling just above $59 on Tuesday, “obviously, the upside is minimal,” said Yamada, who founded and runs Yamada Technical Research Advisors.

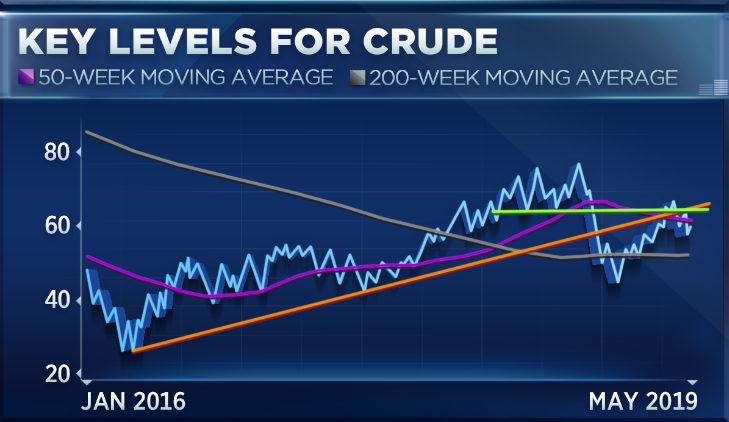

“It’s intriguing if you look at the chart. You can see where it encountered guerrilla, right at the resistance from the 2018 peak,” she said. “Now, it looks as though things have broken down, and you’re perhaps in a trading range between [$]52, where the … 200-week moving average is, and [$]62, which is now our resistance accepting broken as a support level.”

That could lead to some sideways trading within that range, but will later give way to a few concerning momentum trends that seem to be coming to a fore, Yamada said.

“You could have some interim mercantilism. However, the weekly momentum is right on the verge of going negative, which suggests further downside, and the monthly power … has been on a sell for quite some time,” the technician said. “So, at the moment, I think the path of least opposition may be to lower levels.”

If oil prices break below last week’s low around $57, Yamada’s more conservative downside aims would be around $55 or $54 a barrel.

“But $52 would be a target, let’s say, if this continued decline is without vaults,” she warned, pointing out that her firm’s outlook is still relatively bleak given oil’s inability to break above a downtrend from the 2008 consummation for the last 10 years.

“It does appear to us that we’ve got some kind of a problem with energy,” Yamada influenced. “The relative strength on the sector has been very poor. It broke down in 2014 structurally, and nothing has changed to benefit our view of the sector, the stocks or the commodity.”