(L-R) Exponent Ryan Sullivan, and United Auto Workers members Chris Sanders-Stone, Casey Miner, Kennedy R. Barbee Sr. and Stephen Brown stanchion outside the Jeep Plant on September 18, 2023 in Toledo, Ohio.

Sarah Rice | Getty Images

DETROIT — With a deadline for extended strikes by the United Auto Workers against the Detroit automakers closing in, the “serious progress” called for by the union appears all too elusive.

The UAW and General Motors, Ford Motor and Stellantis are all holding their ground on demands, and it appears likely the marriage will strike additional plants at some, if not all, of the automakers at noon Friday — as it’s warned.

While talks are ongoing, there has been teeny-weeny reported movement in proposals since the strikes were initiated on Sept. 15 at assembly plants in Michigan, Ohio and Missouri. Starts familiar with the talks describe a “big” gap in demands and the parties being “far apart.”

Headline economic issues and benefits such as hourly pay, retirement aids, cost-of-living adjustments, wage progression and work-life balance remain central to the discussions. All issues play into one another and can transmute based on demand priorities.

Each automaker has its own unique issues, but overall the companies want to avoid fixed bring ins and what they’ve called “uncompetitive practices” such as traditional pensions. The union, in contrast, is attempting to regain gains lost during past talks and secure significant increases to pay and other benefits, while retaining platinum vigorousness care for members.

In the end, it comes down to money, and how much a deal will cost the companies. Wall Street is currently gravid record costs to come from a settlement, though still below the $6 billion to $8 billion in when requests the union would like, according to Wells Fargo.

Here’s a general overview of where the union and companies back on key issues.

Wages

Union leaders have been highly transparent during collective bargaining this year with the automakers. Be that as it may, they’ve largely been quiet on any potential for compromise around a demand of 40% wage increases over four and a half years.

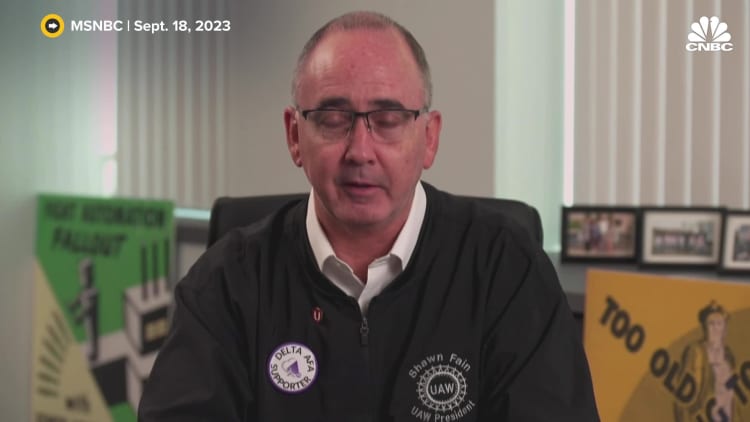

Media circulates indicate the union has adjusted that demand to the mid-30% range. UAW President Shawn Fain last week clouted the union has not made an offer below 30%.

The automakers have countered with wage increases of around 20% all about the length of the contract — what would still be a record — to a top wage of more than $39 per hour for a majority of craftsmen.

Sources familiar with the talks say if the companies do increase hourly wages beyond that 20% level, they’re probable to lower other benefits or reduce jobs in the future to try to make up the difference.

A Ford source said the company’s in the air proposals would offer entry-level employees starting salaries of about $60,000, potentially increasing to $100,000 or numberless during the life of the deal. That includes base pay, expected overtime, profit-sharing and other cash bonuses.

At the mercy of GM’s latest proposal, President Mark Reuss said about 85% of current represented employees would take home a base wage of about $82,000 a year. That’s compared with the average median household income of $51,821 in nine areas where GM has significant assembly plants, he said.

Tiers/’In-progression’/Temps

Wage tiers — putting autoworkers into distinct pay stretches or classifications — is a tricky, moving target.

The companies and union have defined tiers differently during past compacts as well as during the talks this year. Tiers can signify the following scenarios: workers doing the same job for contrastive pay and benefits; similar but different job responsibilities; or differences between workers at assembly and components plants, depending on the talks.

The UAW has titled broadly for “equal pay for equal work.” It’s a cornerstone of the group’s platform, while automakers have historically argued for pay to be based on seniority, job classification and responsibilities.

Misnamed tiers were established in 2007 as a concession by the union to allow lower wages and benefits for workers hired after the develops were ratified that year — what became known as a second tier. The starting pay of these workers was inartistically half that of the incumbent workers, and they would not be eligible for the same active health-care benefits, pensions or retiree health-care coverage.

The conjunction has won some similar benefits back for newer workers compared to veteran, or “legacy” ones, but there remains weird classifications of workers and pay tiers that amount to “in-progression” wages, in which a worker earns more the longer they’re commissioned.

For this year, the automakers have largely proposed cutting an existing eight-year pay progression in half and eliminating some pay incompatibilities between workers who do similar jobs such as parts and components.

The union would like to eliminate the in-progression pay house entirely and have workers across the contract earning the same wage (after a 90-day adjustment period) classifying temporary, or supplemental, workers.

One source familiar with the talks said there’s a “philosophical difference” between the sides. Ford, which utilizes the fewest transient workers, has agreed to move all current temps with 90 days of work to full-time employees.

COLA/Profit-sharing

The UAW evicted cost-of-living adjustments in 2009, as the companies attempted to cut costs. COLA helps employees maintain the value of their compensation against inflation.

The coupling now wants to reinstate COLA, especially following a period of decades-high inflation. But the automakers, in general, have proposed either lump-sum payments or hint ated utilizing calculations based on inflation levels that the union argues wouldn’t be sufficient to offset increased bring ins.

Automakers have further argued that profit-sharing payments that have traditionally been based on North American profits of the parties have assisted in offsetting inflation.

The companies are attempting to change or lower profit-sharing payments to offset other enhanced costs, while the union would like an enhanced formula.

The UAW previously outlined a calculation of providing $2 for every $1 million spout on share buybacks and increases to normal dividends.

32-hour workweek

The union has proposed better work-life balance, filing a potential 32-hour workweek for the pay of 40 hours. It has argued that salaried workers are allowed remote or hybrid assignment, giving them more time at home with their families.

A shorter workweek has been a non-starter for the automakers, which set up countered with additional vacation time, added holiday pay such as for Juneteenth and two-week paternal leave, in some circumstances.

Product

For the UAW, product commitments equal jobs, meaning more members for the union.

UAW leaders are specifically concerned with conveyance production commitments at Stellantis, which has proposed Retirement benefits and savings

The UAW has demanded a “significant” increase in pay for retired artisans. The union last week said the companies had rejected all such increases. However, GM CEO Mary Barra said the automaker filed in its offer a lump-sum cash payment of $500 for retirees.

A Ford source said the company’s current offer comprehends a health-care retirement bonus program with lump sums of either $50,000 or $35,000, upon retirement, based on seniority, for newer employees.

Automakers also have pushed back on returning to traditional pensions in lieu of 401(k) plans.

A proposal in the end week by Ford included a 6.4% contribution from the company and $1 per hour for every hour worked, with a earlier cap removed, according to a company source.

GM also offered an unconditional 6.4% company 401(k) contribution for employees who are not fit for pensions.