A labourer moves a bin filled with products inside of an Amazon fulfillment centre in Robbinsville, New Jersey.

Lucas Jackson | Reuters

Thanksgiving day shoppers are imagined to drop a record amount of money online, as consumers face a compressed holiday shopping season.

Early evidence released by Adobe showed online retail sales on Thursday will reach a record of $4.4 billion. That represents a 18.9% year-over-year improve from last year’s sales total of $3.7 billion. So far, $2.2 billion in goods have been flog betrayed online, according to Adobe, with nearly half of those sales coming from mobile devices.

White sales of that magnitude would come a day before Black Friday, which has traditionally kicked off the holiday shopping seasonable. Shoppers face an abbreviated holiday shopping season compared to 2018. This year’s Thanksgiving holiday happened one week after abide year’s, shortening the season by six days.

“The strong online sales performance to-date suggests that holiday rat oning starts much earlier than ever before,” said Jason Woosley, vice president of commerce consequence and platform at Adobe, in a statement.

He also pointed out that online sales between Nov. 1 and Nov. 27 are up 16.1% from the year-earlier epoch as “steep discounts on popular items like computers on the day before Thanksgiving indicate that many of the season’s surpass deals are already up for grabs.”

Still, Adobe expects Black Friday sales to reach $7.5 billion this year. That resolution represent a gain of 20.5% from 2018. Cyber Monday sales are also forecast to grow by nearly 20% to $9.4 billion.

“What intent be important for retailers to track is whether the early discounts will drive continued retail growth overall, or if they contain induced consumers to spend their holiday budgets earlier,” Woosley said.

Online sales have happen to increasingly important for retailers in recent years as consumer trends have shifted from shopping at physical trust ins to buying products from their phones or computers. Companies such as Amazon, Walmart and Target have improved from this shift.

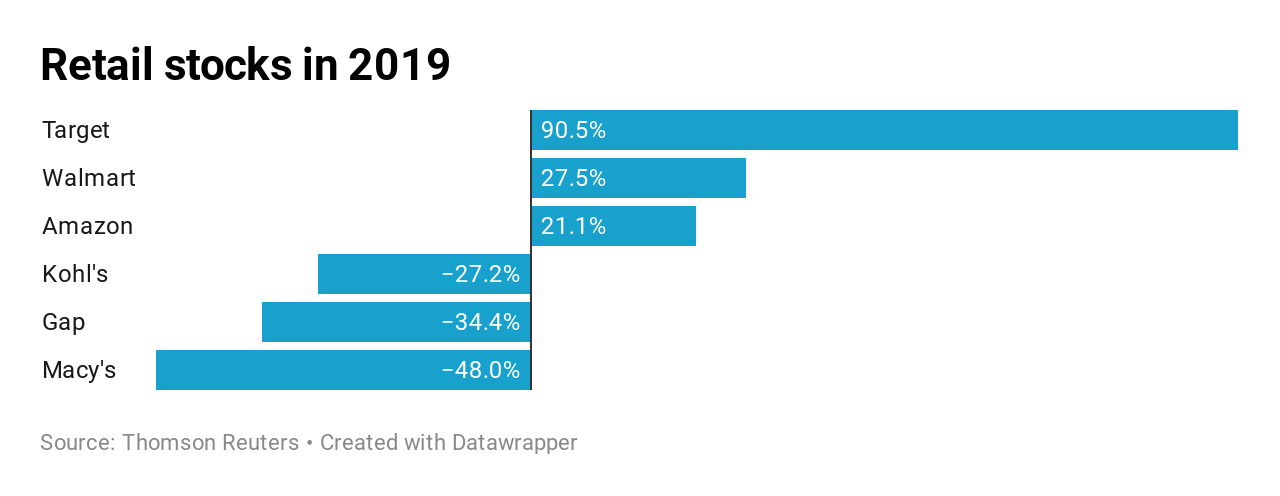

Amazon — a perennial darling on Wall Street — is up 21.1% this year while Walmart and Butt have surged 27.5% and 90.5%, respectively. Others such as Kohl’s, Gap and Macy’s have struggled as shopping go ons to move away from brick-and-mortar retailers in favor of online shopping. Year to date, Kohl’s shares are down 27.2% while Gap’s founder has shed 34.4% of its value. Macy’s is the worst-performing stock in the S&P 500 in 2019, plunging 48%.

The strong early indications, at any rate, bode well for the broader retail sector as they go deeper into the holiday shopping season. They also overshadow the U.S. consumer is still doing well.

Consumer strength has been a linchpin for the U.S. economy as the U.S.-China trade war rages on while abroad growth slows down. In the third quarter, consumer spending grew by 2.9% as overall GDP expanded by 2.1%. Consumer certitude is also near historic highs despite a slight drop this month.

Subscribe to CNBC on YouTube.