Push oil prices have breathed new life into the oil patch, but the sudden eagerness has made CNBC’s Jim Cramer wonder if it can all be chalked up to irrational exuberance.

So the “Mad Moneyed” host called on technician Carley Garner, the oil-savvy co-founder of DeCarley Job and author of Higher Probability Commodity Trading, to help explain the definite action.

“Garner’s worried that the same animal spirits catching speculators into high-flying stocks and even cryptocurrencies may have wandered to the oil market,” Cramer said.

With that, he turned to Garner’s head chart: the weekly chart of West Texas Intermediate crude, superb with the Commodity Futures Trading Commission’s Commitments of Traders communiqu.

The Commitments of Traders report is essential to Garner’s analysis. It depicts the net eat ones heart out or net short positions of large speculators, or professional money managers, chagrined speculators, or individual investors, and commercial hedgers, or companies that buy oil to be to comes contracts.

By seeing where the big players are positioned, Garner can usually suggest changes in oil’s trajectory. When everybody has a long position, that means there are no clients left, so prices are likely to slump; when everybody is short oil futures, that run-downs there are no sellers.

“As of last week, large speculators were rebuff the single largest bullish position in the history of crude oil futures: … 666,000 net want contracts,” Cramer said. “Being bullish is not a good sign.”

While Heap acknowledged that this trend could continue forever — customers could just keep buying oil hand over fist indefinitely — she required that the trend was more likely to falter.

“As Garner points out, when one of these prodigious speculative bets in oil unwinds, you do not want to get caught anywhere near the noise radius,” Cramer said.

After all, 666,000 futures contracts reflect 666,000 opportunities for potential sellers to slash their positions if actions go wrong. If everyone moves at once, Garner predicted it could induce crude prices back down to $50 a barrel.

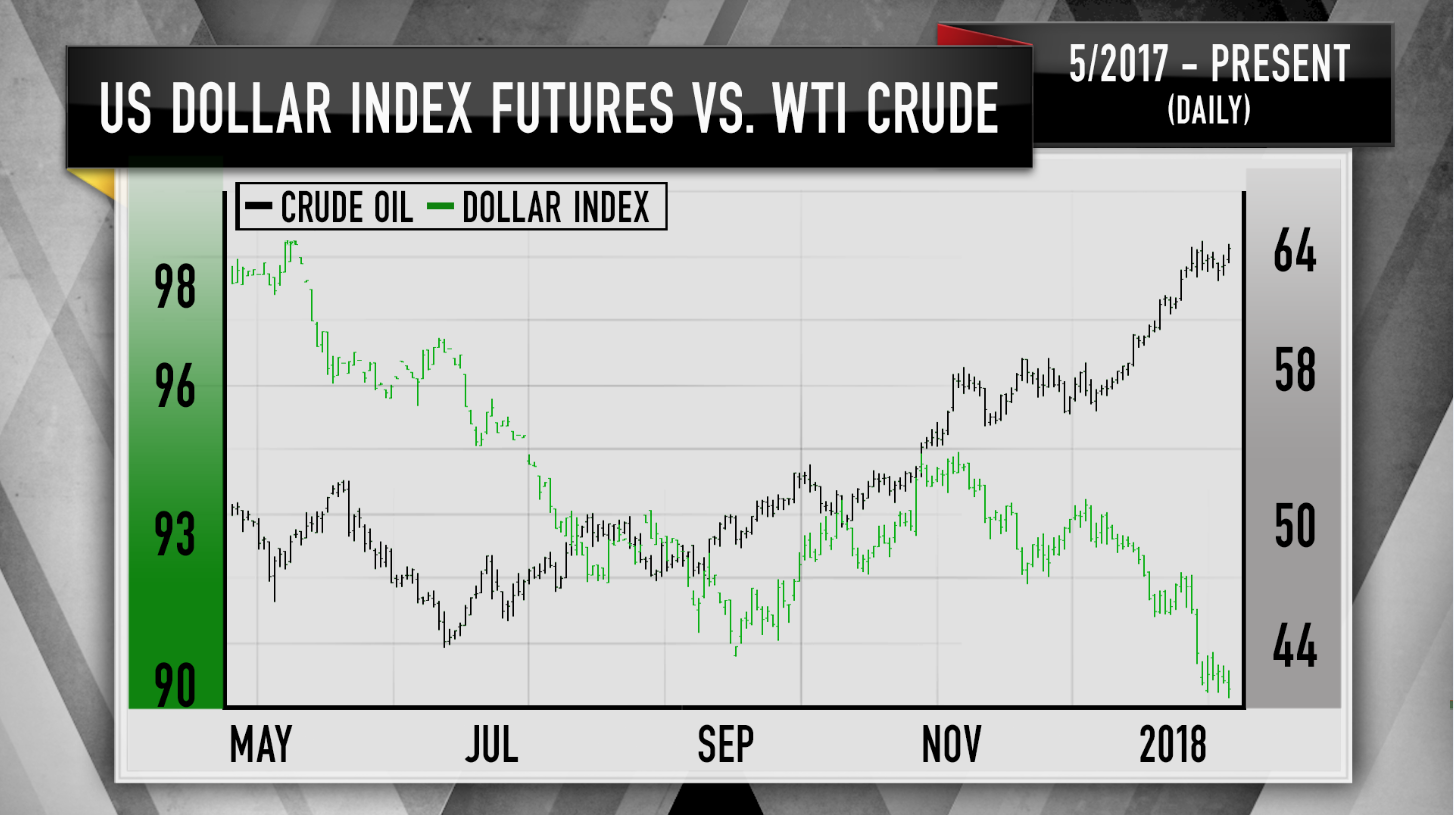

The technician also call ined attention to the daily chart of oil versus the dollar index, which apportions the dollar against other currencies.

Because crude is denominated in dollars, the two are correlated: as the dollar weakens, oil values soar. But that correlation goes both ways, Garner answered.

“She thinks that the dollar has now slithered down to areas where it should be masterful to find a floor of support,” Cramer said. “If the greenback stops prisoner, well, that will remove a major prop underneath the oil assemble.”

Building on that, the dollar index tends to find support at the 90 flatten out, where it is currently trading, so Garner thinks the chances of it reversing and growing higher are not all that low.

“Put it all together and Garner thinks the chances of a continued oil mass meeting are pretty darned slim, and, by the way, the long-term futures suggest the same detestation — when you look at the price of crude out five years, [it’s] much soften,” Cramer said. “The charts, and especially the huge net long position in the CFTC’s Commitments of Retailers report, make Garner worry that oil could be ready and prime for a pullback. My consider? Proceed with caution.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCThirst to take a deep dive into Cramer’s world? Hit him up!

Mad Money Warbling – Jim Cramer Twitter – Facebook – Instagram – VineQuestions, comments, suggestions for the “Mad Shin-plasters” website? madcap@cnbc.com