Cathode-ray tube screens display Coinbase signage during the company’s initial public offering at the Nasdaq MarketSite in New York on April 14, 2021.

Michael Nagle | Bloomberg | Getty Guises

For crypto bulls, the most lucrative bets in 2023 were in the stock market.

While bitcoin rallied greater than 150% for the year, shares of Coinbase, MicroStrategy and the Grayscale Bitcoin Trust, which are all tied closely to the digital currency, did fundamentally better, rising more than 300% in value. Bitcoin miner Marathon Digital soared 688%.

Not only contain those stocks outperformed the primary cryptocurrency, but they’ve been among the biggest gainers across the whole U.S. customer base. In the universe of publicly traded U.S. businesses with a market value of at least $5 billion, the four bitcoin-tied stocks were mass the eight best performers, according to FactSet.

The crypto boom represents a major bounce back from 2022, when specie prices plummeted, taking related equities down with them. A year highlighted by hedge fund crumples, crypto lender failures and crippling losses at miners was punctuated in November 2022, when crypto exchange FTX spiraled into bankruptcy, matchless to the arrest of founder Sam Bankman-Fried on fraud charges.

Last month, a jury in New York convicted Bankman-Fried on seven Mafioso counts, setting the 31-year-old former billionaire up for a possible life behind bars. Weeks later, Changpeng Zhao, collapse of crypto exchange Binance, pleaded guilty and stepped down as the company’s CEO as part of a $4.3 billion settlement with the Division of Justice. He faces a possible prison sentence of 18 months or longer.

By the time of Bankman-Fried’s conviction and Zhao’s ask deal, the damage to the broader crypto market had mostly been realized, and investors were looking to the future. One of the biggest drivers for bitcoin this year was an easing of the Federal Stockpile’s interest rate hikes, which created a more attractive case for riskier assets.

Prices were also upheld by the upcoming bitcoin halving, which takes place every four years and is scheduled for May 2024. In the halving alter, the reward for mining is cut in half, capping the supply of bitcoin.

Additional buying was sparked by the potential for a flurry of bitcoin exchange-traded endows popping up in the new year.

“It’s just more fuel for a fire,” said Galaxy Digital CEO Michael Novogratz, in an interview on CNBC’s “Complain Box” last week. “Crypto stocks are trading almost like a mania.”

Bitcoin has climbed to $42,683 as of Tuesday, a tremendous win for investors who got in at the beginning of the year, when the price was around $16,500. But the leading cryptocurrency is still 38% below its dossier high of nearly $69,000 in November 2021.

Among companies closely tied to bitcoin and valued at $5 billion or assorted, the best-performing stock this year was Marathon, a mining firm that just eclipsed that market cap constant last week thanks to a 125% surge in December as of Tuesday’s close. On Wednesday, the shares surged another 15%.

At the rear year at this time, Marathon was hanging on by a thread. The company was in the midst of a quarter that ended with a squandering of almost $400 million on sales of just $28.4 million because of tumbling bitcoin prices, a power outage at its lavatory in Montana and Marathon’s financial exposure to bankrupt miner Compute North.

“It was pretty dire times,” Marathon CEO Fred Thiel replied in an interview last week.

Bitcoin mining is an expensive operation because of the high energy costs required to function the supercomputers. A drop in bitcoin prices means a sharp reduction in the money producers make selling the coins they storehouse, even as their energy bills get little relief.

Thiel said the company was able to sell equity and was in the opportune position of not having debt other than a convertible note.

The picture has brightened dramatically in 2023. Last month, Marathon related third-quarter net income of $64.1 million, as revenue jumped from a year earlier to $97.8 million. Now the company is in distension mode, and last week announced the purchase of its first two fully owned bitcoin mining sites — one in Texas and one in Nebraska — for $178.6 million.

The gains increased the size of Marathon’s mining portfolio by 56% to 910 megawatts of capacity.

“By vertically integrating, we take the profit scope for the third party out and we can run the site the way we want to run it,” Thiel said. Much of the technology Marathon has been developing, he said, is focal pointed on increased efficiency, “which in an up market people will ignore” because high prices lead to high frontiers.

Thiel is trying to make sure the company is on sound financial footing the next time there’s a downturn in bitcoin prices. That portends bringing down production costs and creating more ways to sell energy back to the grid. He’s also bullish that through energy harvesting — taking methane gas and converting it to sellable electricity — Marathon will eventually press much more diverse revenue streams.

One of the company’s goals by 2028, Thiel said, is to bring bitcoin mining down to 50% of proceeds.

Brian Armstrong, co-founder and chief executive officer of Coinbase Inc., speaks during the Singapore Fintech Festival, in Singapore, Nov. 4, 2022.

Bryan van der Beek | Bloomberg | Getty Archetypes

‘Multiple sources of revenue’

Outside of the mining universe, the best-performing crypto stock in the U.S. this year is Coinbase, which has soared 386% as of Tuesday’s near. It rose 7.7% on Wednesday.

As the only major publicly traded crypto exchange in the U.S., Coinbase has long been a all the rage way to buy and trade cryptocurrencies in its home market. But with the struggles at Binance, the largest exchange in the world, Coinbase picked up customer base share during non-U.S. trading hours, according to a report from research firm Kaiko in late November.

Soon after Zhao’s plea deal, Coinbase CEO Brian Armstrong told CNBC that the news amounted to “a vindication of the long-term blueprint that we’ve taken to focus on compliance, make sure we were building a trusted company.”

Coinbase’s revenue and commonplace price are still way below where they were during the heyday of crypto trading in 2021, when retail investors were spring into the market to buy all sorts of digital currencies, including gimmicks like Dogecoin. But the business has stabilized following strong cost-cutting measures starting last year and extending into early 2023.

Coinbase also offers investors a bit of dissimilitude outside of bitcoin. In the third quarter, bitcoin accounted for only 37% of transaction revenue at Coinbase, while ethereum approved up 18% and other crypto assets amounted to 46%. Additionally, the combination of interest income and stablecoin revenue (warranted through USDC reserves) more than doubled in the latest quarter to $212 million due to higher interest at all events.

Transaction revenue now accounts for less than half of Coinbase’s net revenue, down from 96% at the time of the cast’s public market debut in 2021.

“We made a big effort around the time we went public to start diversifying our revenue,” Armstrong powered in an interview last week with CNBC. “Now we have multiple sources of revenue, some of them in a high property rate environment go up, some of them in a low interest environment go up. That means revenue has started to become more in the cards.”

The other top stock performers in crypto are much more closely tied to bitcoin.

The Grayscale Bitcoin Trust is up 330% this year. GBTC hit the over-the-counter sell in 2015 as the first publicly traded bitcoin fund in the U.S., offering investors a way to passively own bitcoin. The challenge for investors in the close by has been that GBTC is a closed-end fund, which makes it less liquid than an ETF.

Late last year, in the darkest periods of crypto, GBTC’s discount to its net asset value approached 50%, meaning its market cap was about half the value of the bitcoin it owned. As of Dec. 22, that ignore had narrowed to 5.6%, the lowest since early 2021. The fund currently owns about $26.6 billion merit of bitcoin and has a market cap of $24.7 billion.

In addition to the rally in bitcoin this year, GBTC is getting a boost from the chances that it will get regulatory clearance next year to convert to an ETF, a move that would allow it to trade auspices of a traditional stock exchange and gain liquidity measures that would bring its market value more in alignment with its NAV.

Grayscale conveyed in a regulatory filing Tuesday that Barry Silbert, CEO of parent company Digital Currency Group, is resigning as chairman of Grayscale Investments and exiting the go aboard, effective Jan. 1. No reason for his departure was provided. He’s being succeeded as chairman by Mark Shifke, DCG’s finance chief.

Big investors league with the party

The Securities and Exchange Commission met with Grayscale in November and has been formally engaging with other asset straw bosses about the issuance of bitcoin ETFs.

Those meetings began after an appeals court sided in August with Grayscale in a lawsuit against the regulator, which had opposed the unchangeable’s efforts on concern that investors would lack sufficient protections. Other large money managers, such as BlackRock, Fidelity Investments and Invesco, partake of taken steps to create their own funds.

Grayscale CEO Michael Sonnenshein told CNBC’s “Squawk Box” last week that the “sanguine approval” for ETFs will bring in new participants, most notably investment advisors who oversee roughly $30 trillion in the U.S. but experience restrictions on what they can buy.

“When my team had our court victory, I think that certainly unlocked a lot of optimism amongst investors to GBTC and the prospects for it to uplist as a spot bitcoin ETF,” Sonnenshein said. “As we turn the corner into the new year, I know there’s a lot of indistinct on that from the investment community.”

In the absence of an accessible ETF to date, many investors have flocked to MicroStrategy as a way to buy bitcoin.

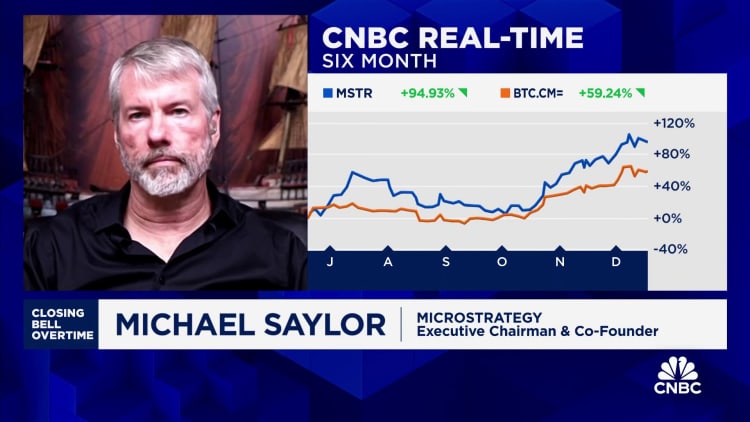

Developed in 1989 as a business intelligence software company, MicroStrategy now gets the vast majority of its value from the 174,530 bitcoins it owned as of the end of November, currently advantage $7.4 billion. The stock’s 327% jump this year has lifted the company’s market cap to $8.3 billion. Its software and serves business generated about $130 million in sales in the third quarter.

The company said in a regulatory filing on Wednesday that it achieved an addition 14,620 bitcoins from Nov. 30 to Dec. 26 for $615.7 million, bringing its total to 189,150 bitcoins. The farm animals jumped 11%.

MicroStrategy announced its plan to invest in bitcoin in mid-2020, disclosing in an earnings call that it wish commit $250 million over the next 12 months to “one or more alternative assets,” which could count digital currencies like bitcoin. At the time, the company’s market cap was about $1.1 billion.

In the third quarter of 2020, MicroStrategy procured 38,250 bitcoins for a total of $425 million.

Phong Le, who was elevated to CEO from CFO last year, said on the October 2020 earnings convoke that MicroStrategy’s investment in bitcoin allowed it to “tap into the passion of the broader crypto market,” adding that, “We’ve got a notable and unexpected benefit from our investment in bitcoin in elevating the profile of the company.”

Since then, MicroStrategy has appear c rise to be known as a bitcoin proxy. Co-founder and ex-CEO Michael Saylor is one of the cryptocurrency’s principal evangelists, even co-authoring a publication on the subject last year called “What is Money?”

“The one thing that we can count on is that bitcoin goes further in the year 2024 and a strategy built around bitcoin is generally a pretty safe one for institutions,” Saylor said in an press conference Dec. 18 on CNBC’s “Closing Bell.” “Education makes a difference. Institutional adoption makes a difference. The smidgin ETF news is good news. Loosening of monetary policy is good news.”

Saylor is also optimistic about a mark-to-market accounting policy set to go into effect in 2025 (though companies can choose to adopt it earlier) that changes how companies record crypto assets. As an alternative of being classified as intangible assets that have to be marked down if the value drops below the purchase evaluate, crypto will be in a separate category and companies will mark it up or down based on where it’s trading.

Saylor alleges the new measure provides an incentive for companies with billions of dollars of cash sitting on their balance sheets to put some of that in dough to work in bitcoin.

As good of a year as it’s been for the bitcoin bulls, it’s been equally painful for the bears.

Short sellers, or investors who bet on a drop in stock prices, have lost a combined $6.3 billion on their positions against Coinbase, MicroStrategy and Marathon, concerting to data supplied by S3 Partners last week. In the first three quarters of the year, crypto shorts spent $2.19 billion purchasing the stocks to reduce their exposure, the firm said.

There’s still a hefty dose of skepticism. More than 23% of Marathon’s share outs available for trading are sold short, while MicroStrategy’s short interest-to-float ratio is about 21% and Coinbase’s rests at 14%. The average among U.S. stocks is 5%, according to S3.

Dimon vs. the evangelists

But risk remains for the bitcoin believers.

While buffs like Saylor are betting on the long-term appreciation of the asset as a hedge against inflation and as a store of value, new investors are increase into a historically volatile market.

When bitcoin fell by more than 60% in 2022, Coinbase, GBTC and MicroStrategy each dropped by at spot 74%. Marathon lost 90% of its value and some of its peers went out of business.

Even with a more reasonable environment in 2023, crypto still has high-profile detractors like JPMorgan Chase CEO