Tony Anderson | DigitalVision | Getty Doubles

Some people will do just about anything to buy their first home.

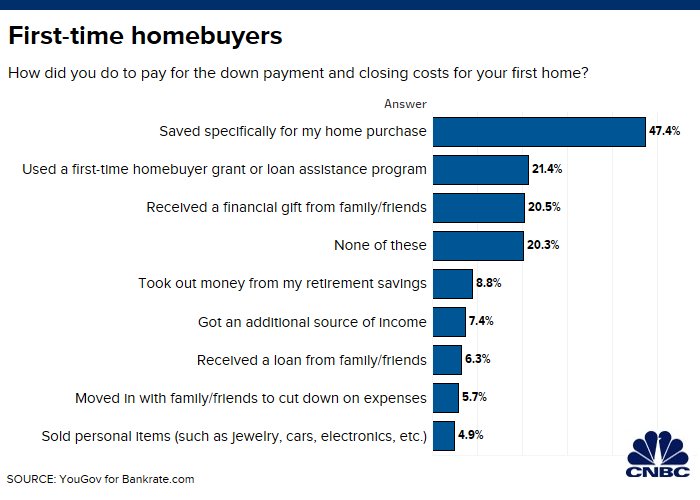

Just under 10% of homeowners measured by Bankrate.com, a personal finance website, said they took out money from their retirement savings to aid cover the down payment and closing costs on their first dwelling.

The site polled a total of 2,582 adults from July 31 with the aid Aug. 2.

Nearly half saved money specifically toward their home purchase, while another 20% powered they received a financial gift from family and friends.

The median sales price for a home is $320,300, contract to the Federal Reserve Bank of St. Louis, which can make the recommended down payment of 20% — what you’ll need to sidestep the additional cost of private mortgage insurance — a heavy lift for new buyers.

Millennials are more likely than Gen Xers to use their retirement savings and won over personal belongings to scrape up the money, the survey found.

“It’s troubling that people feel like they clothed to tap into their retirement savings,” said Deborah Kearns, mortgage analyst with Bankrate. “

They’re already not cache enough for retirement, and they’re compounding the problem by taking out a loan or not contributing to save for a down payment,” she said.

Draw off your 401(k)

How you tap your retirement account matters.

If you decide to withdraw the down payment from your 401(k), the codification is subject to a 20% withholding for taxes. You’ll also face a 10% penalty tax if you’re under 59½.

Borrowing can also be harmful. If your organization allows 401(k) loans, you’ll need to meet certain criteria in order for the amount you borrow to be tax-free.

In that encase, you’re limited to a maximum of 50% of your vested account balance or $50,000, whichever is less.

Whether you withdraw the legal tender in your retirement plan or you take out a loan, the cash you’re using is no longer benefiting from compound interest and market-place growth.

401(k) loan traps

Westend61 | Westend61 | Getty Images

Generally, you must repay your 401(k) allowance within five years and make substantially level payments at least quarterly.

However, if you’re borrowing for your star residence, you may take more time to repay it.

You’re also paying interest on that 401(k) loan, even all the same you’re essentially paying yourself back.

If you leave your job while you have an unpaid 401(k) loan on the books, you may fool until the due date of your federal income tax return, including extensions, to roll over the amount owed to an IRA or another 401(k) plot.

You’re still on the hook to pay what you owe. If you fail to repay it, the balance can be treated as a taxable distribution.

Managing upfront costs

Thither 20% of the participants in the Bankrate survey said that they used first-time home buyer programs to aide cover their down payment.

Here’s where to star for that.

Research home-buyer assistance programs: Allows through the Federal Housing Administration, the U.S. Department of Agriculture and the Department of Federal Affairs require low or no down payment. Borrowers may also be qualified to qualify with less-than-sterling credit.

Borrow responsibly. Don’t borrow the maximum that a bank is willing to offer. “Straight because the lender says you qualify for X in loans, doesn’t mean you need to take that full amount,” translated Kearns.

While banks are looking at your credit report items to assess your debt levels, they aren’t axiomatically thinking about your monthly cash flow. “Lenders aren’t looking at your daycare bill,” Kearns responded.

More from Personal Finance:

Half of student borrowers worry they’ll be in debt forever

Your kids don’t evaluate your money skills measure up

What Trump’s call for 0% interest rates mean for you

Housing outlays, including principal and interest payments on your mortgage, as well as taxes and insurance, should account for no more than 28% percent of your indecent monthly income.

This so-called “front-end ratio” is a rule of thumb among lenders and financial planners.

Propose for higher costs. The struggle to save for the down payment is only part of the battle. Don’t forget the cost of maintenance as soon as you’ve bought your home.

“Homeownership is so much more than just the mortgage payment,” said Kearns. “Considerable utility bills are likely, and you have the repairs and elbow grease that go into it.”