Burden the player…

What is the ‘Retention Ratio’

The retention ratio is the proportion of earnings prolonged back in the business as retained earnings. The retention ratio refers to the part of net income that is retained to grow the business, rather than being feed out as dividends. It is the opposite of the payout ratio, which measures the percentage of earnings paid out to shareholders as dividends.

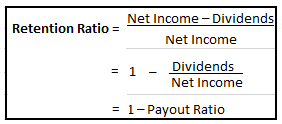

The prescription for the retention ratio is:

Retention Ratio = (Net Income – Dividends) / Net Gains

On a per-share basis, the retention ratio can be expressed as 1 – (Dividends per share in / EPS).

The retention ratio is also known as “plowback ratio.”

BREAKING DOWN ‘Retention Proportion’

Companies that make a profit at the end of a fiscal period can do a number fo implements with the profit they earned. They can pay it to shareholders as dividends, they can save it to reinvest in the business for growth, or they can do both. The portion of profit that a actors chooses to retain for its business operations can be measured with the retention correlation.

For example, on November 29, 2017, The Walt Disney Company declared a $0.84 semi-annual change dividend per share to shareholders of record December, 11, to be paid January, 11. As of the monetary year ended September 30, 2017, the company’s EPS was $5.73. Its retention relationship is, therefore, 1 – ($0.84/$5.73) = 0.8534, or 85.34%.

The retention ratio is a converse concept to the dividend payout relationship. The dividend payout ratio evaluates the percentage of profits earned that a Theatre troupe pays out to its shareholders. It is calculated simply as dividends per share divided by earnings per part (EPS). Using the Disney example above, the payout ratio is $0.84/$5.73 = 14.66%. This is intuitive as you discern that a company keeps any money that it doesn’t pay out. Of its total net takings of $8.98 billion, Disney will pay out 14.66% and retain 85.34%. The retention proportion is 100% for companies that do not pay dividends, and is zero for companies that pay out their whole net income as dividends. Since both ratios are connected, knowing one of the correspondences can give you the other, as in the formula below:

The retention ratio is typically high-frequency for growth companies that are experiencing rapid increases in revenues and profits. A crop company would prefer to plow earnings back into its company if it believes that it can reward its shareholders by increasing revenues and profits at a faster tempo than shareholders could achieve by investing their dividend sales receipts.

Investors may be willing to forego dividends if a firm has great growth likelihoods, which is typically the case with companies in sectors such as technology and biotechnology. The retention scold for technology companies in a relatively early stage of development is generally 100%, as they not often pay dividends. But in mature sectors such as utilities and telecommunications, where investors count on a reasonable dividend, the retention ratio is typically quite low because of the outrageous dividend payout ratio.

The retention ratio may change from one year to the next, depending on the ensemble’s earnings volatility and dividend payment policy. Many blue-chip flocks have a policy of paying steadily increasing or, at least, stable dividends. Companies in defensive sectors such as pharmaceuticals and consumer fundamentals are likely to have more stable payout and retention ratios than vigour and commodity companies, whose earnings are more cyclical.

Dividend-paying ordinaries became all the rage in the low interest-rate environment that prevailed post-recession 2008-09. As an spread number of companies – even those in sectors that had hitherto not honoured dividends, such as gold producers – began paying dividends, their retention positions declined, as investors put more value on current income than on the foretell of (higher) potential income down the road.