Election traders use various options pricing models to calculate theoretical privilege values. These mathematical models use certain fixed knowns in the accounted for right – items such as underlying price, strike price and days until concluding – along with forecasts (or assumptions) for factors such as implied volatility, to determine the theoretical value of specific options at certain points in time. Variables undulations over the life of the option, and the option’s theoretical value adapts to bring to light these changes.

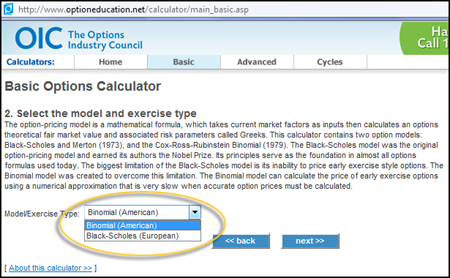

Most professional traders and investors who trade chiefly options positions rely on theoretical value updates to monitor the changing hazard and value of their option positions, and assist with trading decisions. Various options trading platforms provide up-to-the-minute option price version values, and option pricing calculators can be found online at various websites, cataloguing the Options Industry Council. The basic calculator shown in Figure 3 take ins you choose the model/exercise type, and then prompts you to enter divers fields, including the contract type, spot price of the underlying, closing date, interest rate, dividend amount (if applicable) and strike valuation.

|

| Figure 3 The options calculator from the Options Industry Council suffer ti you choose either a Binomial model (for American-style options) or the Black-Scholes exemplary (for European options). |

Options Pricing: Black-Scholes Model