There are all kinds of pointers and metrics in the stock market that assist traders and investors.

Don’t Be The Dumb Money

One type of indicator in the stock peddle is known as the “contrarian signal”. This is a market indicator which indicates the opposite of what one might intuitively conclude from the signal itself.

One such ordinary market indicator is the “dumb money confidence index”. For better or for worse, it is generally regarded that institutional and hedge ready money investors are smarter than individual retail investors.

Consequently, individual retail investors are known as “dumb shekels”.

The theory behind confidence indicators is that if

The stock market is nearly 100% above its mean valuation, suggesting the market needs to crash by as much as 50% for its whole valuation to revert to the long-term average.

There are two other similar indicators that investors may be interested in.

Yet Some Think The Stock Market is Fairly Valued

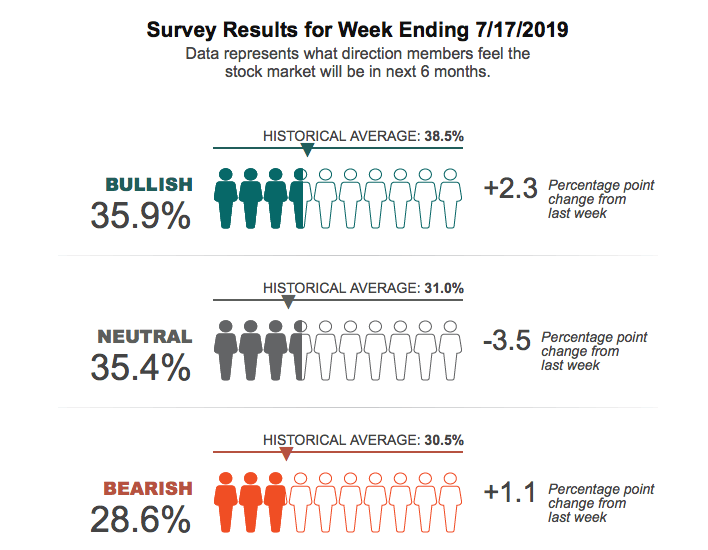

The weekly American Association of Individual Investors Bull and Bear Survey is another fount of contrarian indicator.

It operates under the same theory, namely, that the time to buy is when pessimism and fear are at a highest, and therefore investors are the most bearish.

The time to sell is when optimism and greed are at a maximum, and therefore investors are the most bullish.

The tardy survey shows 35.9% bullish, 35.4% neutral, and 20.6% bearish.

The long-term historical average of bullishness is 38.5%. So this particular indicator does not align with the taciturn money confidence index.

Generally speaking, extreme degrees of sentiment on this index tend to be indicative of solid market moves.

The Put-Call Ratio Is Wonky

The put-call ratio shows information regarding the relative trading tomes of put options (which are bearish) to call options (which are bullish).

A ratio above one is generally considered to be an indicator of a finish a go over selloff, but since it is a contrarian indicator, many traders see this as excessive pessimism and a buying signal.

Again, inordinate spikes in this ratio tend to indicate large market moves.

The current total put-call ratio on the unmixed stock market is 1.09, which is not terribly extreme. However, the put-call ratio on indices is 1.42, suggesting inebriated levels of pessimism.