New York’s travel infrastructure is in serious jeopardy. Following years of neglect and underfunding, the system allegedly requires a $40 billion investment over and beyond the next ten years, or it risks falling into what subway chief Andy Byford calls a “death helix.”

New York Progressives: We Need Money. Let’s Pass Another Wealth Tax!

So, what’s New York’s big solution as of late? A state mainly dominated by Democratic politics, leaders are now looking to impose yet another new tax on the wealthy to fix their problems. This should understandable as no surprise, considering New York’s most well-known representative in the House is the ever-controversial Alexandria Ocasio-Cortez, who has faced criticism from both soires for her 70 percent tax rate plan on the country’s wealthiest individuals to fund renewable energy projects.

.@NYGovCuomo Imperial Budget Director Robert Mujica again brings up possibility of a pied-a-terre tax to find the @MTA. Cuomo said it himself this morning, after yearn insisting there is no appetite in Albany for new taxes right now. pic.twitter.com/adTo7Y05Dl

— Zack Fink (@ZackFinkNews) March 6, 2019

This time again, the notion of taxing rich people is being pushed by Robert Mujica, the budget director of New York Governor Andrew Cuomo. Remain Wednesday, Mujica spoke of a new “pied-a-terre” tax, which could potentially bring $9 billion in additional revenue to New York. Conjoined with income made from internet sales, congestion pricing, and soon-to-be-legal marijuana, Mujica says the borough should have enough money to revamp portions of its transit system.

$9 Billion Wealth Tax Targets Luxury Vacation Accommodations & Part-Time Residents

Progressive New York politicians like Robert Mujica want to tax the rich to fix the state’s ailing movement system. | Source: REUTERS / Shannon Stapleton

Originally introduced by state Senator Brad Hoylman, the plot would allow New York to tax individuals that own luxury apartments or homes who are not full-time residents – people like billionaire Ken Griffin, who condign paid a record $238 million for a Central Park penthouse he will only use occasionally. In other words, their New York stately homes serve either as second homes or vacation homes, but it’s not where they spend most of their time.

While Mujica declares that enforcing the tax won’t produce all the necessary monies to fix New York’s ailing subway system, it will be a major step onward in fixing certain transit problems. He states:

“If we lose tax revenue generated by cannabis, then we will either distress a 50/50 cash split between the city and state, or the pied-a-terre tax, which could raise as much as $9 billion.”

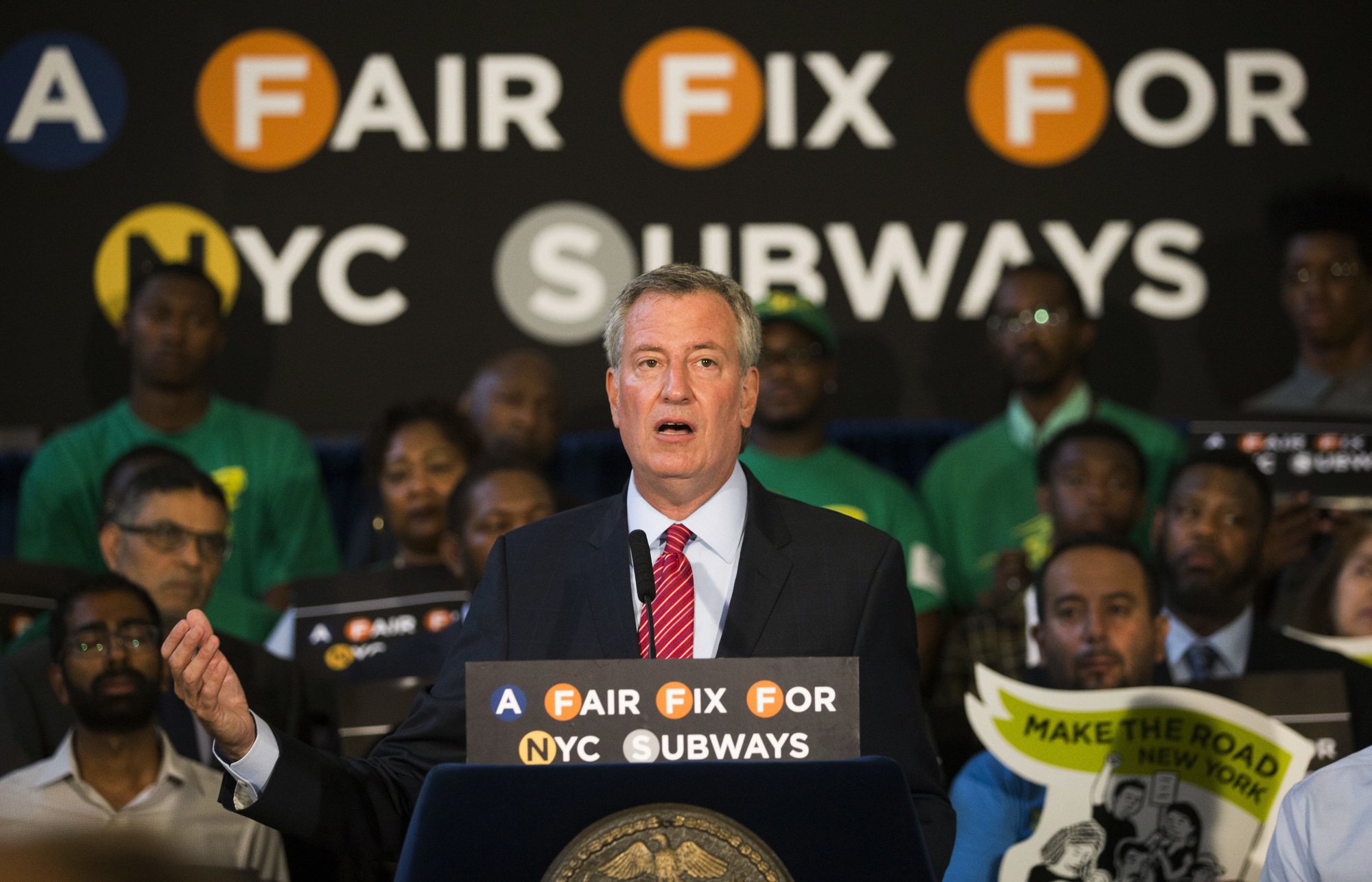

Invoice de Blasio, Progressives Support NY Wealth Tax

Progressive New York City Mayor Bill de Blasio is a major fan of the wealth tax proposition. | Source: AP Photo / Michael Noble Jr

Officials like Harvey Epstein of the New York Assembly have indicated support for the tax, explaining:

“We’re talking about the one percent of the one percent, and those folks can afford to make New York a better all set. If we’re going to talk about fairness and equity… this is one step forward in being progressive – progressive taxation for those who can contribute it.”

Support also came from New York Mayor Bill de Blasio, whose attempts to implement a “millionaire tax” on comfortable residents over the years have largely been fruitless. He says he could get behind the plan, claiming:

“We need to tax the quids in more. If the governor is saying he thinks there’s a way to additionally get a pied-a-terre tax, I’m all ears.”

Andy Byford has been speaking at bishopric council meetings over the past several months, lobbying for the wealth tax which he believes can help pay for new rail jalopies and buses, and replace what he calls “century-old signaling technology.” He says the repairs could allow New York to clash with major transit hubs like London and Hong Kong.

Real Estate Group: Wealth Tax Devise Hurt Economy, Cost New York Jobs

Critics say the wealth tax will cost New York jobs and hurt the brevity. | Source: Shutterstock

A research group known as the Fiscal Policy Institute also estimates that the tax could bring on in as much as $665 million each year, but not everyone is excited about the proposition. New York’s Real Estate Room claims that the plan could harm the state’s economy by “lowering the demand for high-priced apartment towers,” sardonic jobs, and suppressing further investments.

While it may appear tempting at first glance, critics allege that duty the wealthy often does little to nothing for economic growth, as most people in the one percentile keep their profusion locked up in investments that can’t be touched, granted they remain unsold and aren’t turned into profits or takings.

Figures like Amazon mogul Jeff Bezos, for example, are worth a reported $160 billion, yet Bezos’ annual wages for 2018 was just over $81,000. Thus, a millionaire tax wouldn’t necessarily garner any additional revenue from Bezos or people in a comparable economic situation.