MercadoLibre, a Latin American e-commerce behemoth with a presence in nearly 20 countries, recently started warning users that cryptocurrency-related listings on be banned from its platform. The company made the announcement just days after receiving a $750 million investment from PayPal.

$22 Billion Latin American E-Commerce Goliath Bans Crypto Listings

The e-commerce retailer’s move comes as it also cracks down on pre-paid cards and digital currencies acclimated to in games. The measure will take effect from March 19 onward, according to an email the company has been sending its vendors.

Sign up with CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to clue up.

MercadoLibre will bar users from selling cryptocurrency on its platform. | Source: MercadoLibre/Criptomoedas Facil

In the email, MercadoLibre notes that the vendor has listings affiliated to cryptocurrencies or pre-paid cards for games and asks them to finalize them as soon as possible, as they’ll be automatically offed on March 19.

Local news outlet Criptomoedas Fácil reports that in Brazil alone – one of the 18 countries MercadoLibre provides – there are over 5,630 bitcoin-related ads and over 9,320 cryptocurrency-related listings. Ripple (XRP), reportedly the most popular cryptocurrency on the Latin American policy, appears in more than 11,100 ads.

Last year, a bitcoin wallet and merchant processing service called Ripio registered a partnership with MercadoLibre, so the platform could allow its users to withdraw received funds directly in bitcoin. Both MercadoLibre and Ripio are Argentine firms.

Why the e-commerce retailer is smidgen cryptocurrency-related listings is currently unclear. Platforms that have banned ads and products related to the crypto space in the existence pointed to various reasons revolving around fraud, potential illicit activities, and user security.

MeradoLibre Dig up $1.85 Billion – with PayPal’s Help

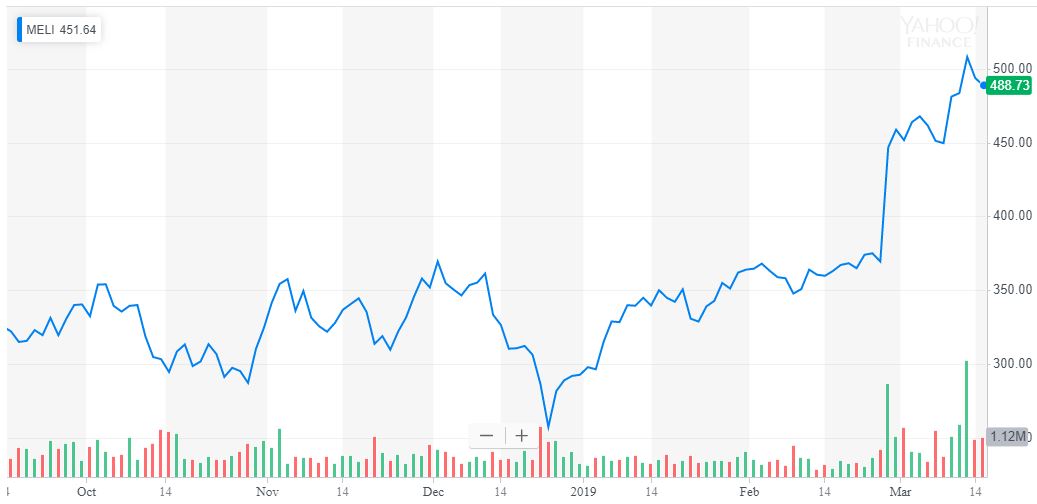

MercadoLibre stock has rapidly appreciated over the past several months, with the new jump coming after PayPal dumped $750 million into MELI shares. | Source: Yahoo Resources

Notably, the e-commerce giant has recently raised $1.85 billion to boost its investment in logistics and invest in fintech and payment figuring outs. The company’s main market, Brazil, has been under pressure thanks to Amazon‘s presence in the region.

According to Bloomberg, MercadoLibre got that massive amount of capital through a public share offering and through direct investments from coteries that included PayPal Holdings.

The e-commerce firm reportedly made a $1 billion offering of common trade in, priced at $480 a share, making it one of the largest equity sales an Argentine firm has made in the past ten years. At the measure, bids for the sale surpassed $6 billion, helping its stock rise nearly 5% to trade at over $500. Since then, it has slacked to $488.

The sale saw PayPal agree to make a $750 million strategic investment in the company, while an affiliate of Dragoneer Investment Assemblage was set to purchase $100 million of perpetual convertible preferred stock.

Colocamos exitosamente más de US$1 billón en el Nasdaq y sumando la inversión de Paypal un all-out de US$2 billones. Un orgullo para @Mercadolibre y @mercadopago. Un hito p la región y el sector. A seguir democratizando el comercio y el dinero! https://t.co/PaSfGIziXR

— Marcos Galperin (@marcos_galperin) Step 13, 2019

Sean Summers, MarcadoLibre’s chief marketing officer, claimed at the time that the firm’s investors have a “reason that Latin America is at a tipping point in terms of e-commerce growth.” The funds the company raised are to be used on its largest calls – Brazil, Mexico, and Argentina – and will be split evenly among e-commerce and fintech.

While PayPal itself won’t participate on the Argentine superhuman’s board or take an active role in its day-to-day operations, it started having meetings with it to “work together on most practices in financial technology.”

Summers stated:

“This deal opens the door to communication channels between our controls teams. We’re going to identify collaboration areas, to understand how PayPal’s global know-how best complements MercadoLibre’s regional know-how.”

Before the pooling round, MercadoLibre had already started increasing the use of online payments through QR codes and mobile devices. While it isn’t patent whether PayPal was directly involved in the Argentine firm’s move to bar crypto sales, analysts have in the past sought bitcoin is “potentially disruptive” to its business model.