Over the last few weeks, bitcoin has been struggling to stay exceeding $10,000. The bullish steam that pushed the dominant crypto to $13,880 is fading away. Armchair traders are energetic to notice the coin’s growing weakness.

A pseudonymous trader named Escobar has closed short-term long positions. While doing so, the analyst is also maintaining shorts in excess of $12,000.

#Bitcoin 1D TF-

Closing short term long play here. Completely out market aside from Long in the matter of a payment Short @ 12.2k. I scanned all Binance Alt charts only two bullish market structures I see is WABI and ENJ, Wabi is on 4th corrective gesture and Enj could get hurt from potential BTC drop. pic.twitter.com/hC2vxzL30k

— ESCO₿AR ? (@TraderEscobar) September 4, 2019

Escobar is not abandoned fearing that long positions will likely lead to losses.

Fear Is Gripping Cryptocurrencies

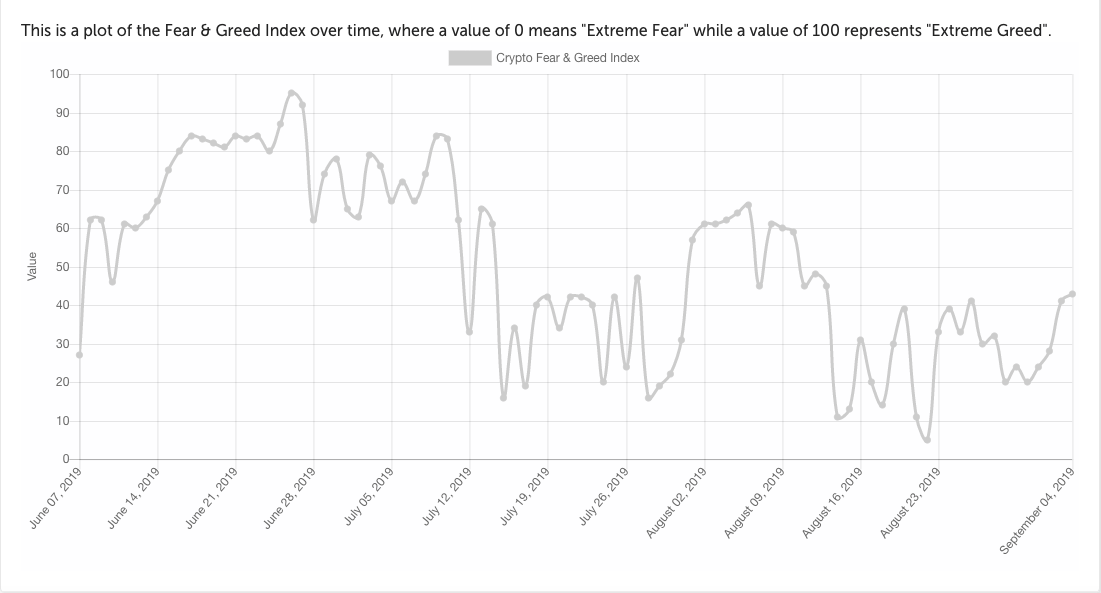

Sentiment in cryptocurrencies has dramatically taken in over the last two months. The value of the Fear and Greed Index has plunged since late June, around the anyhow time bitcoin recorded its 2019 high. This is an indication that market participants are worried that the cryptocurrency has varied downside potential.

The overall revere in the cryptocurrency market may not be unfounded. Todd Butterfield, a leading expert in Wyckoffian analysis and owner of the Wyckoff Stock Retail Institute, predicts that bitcoin will likely plummet in the coming weeks. However, the move down purposefulness be nothing but a setup for a strong comeback.

Todd Butterfield on Bitcoin

Richard Wyckoff created the Wyckoff Method because he saw how retail retailers were “being repeatedly fleeced” by large institutions. Thus, he created a strategy that helps everyday retailers to identify market trends and move in unison with the big players.

Todd Butterfield created the Wyckoff Stock Sell Institute with Richard Wyckoff. Using Wyckoffian principles, he’s been on the money with his calls on bitcoin this year.

The Wyckoff whiz exclusively talk about discuss to CCN and revealed his latest forecast on the leading cryptocurrency. He noted that bitcoin had gone through predictable steps such as the Precedence Supply (PS), Buying Climax (BC), Automatic Reaction (AR), and Secondary Test (ST).

In furthermore, the analyst said:

“Since that time, you can see we have traded sideways with volatility and volume diminishing. This is reaccumulation preparing for the next ahead of to all-time highs.”

Mr. Butterfield then issued a warning:

“Usually this accumulation will be followed by ending liveliness, which could come in the shape of a ‘Spring’ or ‘Shakeout.’ This would be a break of the support at $9,100, followed by a swift recovery back into the blue trading range, and then sharply out of the upside resistance at $14,000.”