Related Articles

Celebrated economist, author of the “Death of Money,” Jim Rickards says the markets just “got the cue” they need. The U.S Federal Reserve (FED) is now unseemly to raise interest rates again without significant warning. That’s a green light for the stock markets and naturally the cryptocurrency market.

Powell’s use of “patient” on Friday was not a throwaway. It’s Fed-speak for “We won’t raise rates without letting you know.” They’ll do that by relocating “patient” as Yellen did in March 2015. For now, it’s a green light for carry trades and risk on behavior. Market got the cue. pic.twitter.com/A6190y6DAT

— Jim Rickards (@JamesGRickards) January 5, 2019

Federal Reservoir Chairman Jerome Powell appears to be responding to market and economic uncertainty. As well as perhaps pressure from the U.S president. On Friday he vouched to be “patient” saying:

“As always, there is no preset path for policy, and particularly with muted inflation readings that we’ve seen show up in, we will be patient as we watch to see how the economy evolves.”

What this means, says Rickards, is the Federal Reserve last wishes as first revoke this “patient” promise before going ahead and considering further rate hikes.

Exemplar Suggests No Interest Rate Hikes Until 2020 or Later

In 2015, then Federal Reserve chair Janet Yellen counseled the Federal Reserve may remove a prior “patient” promise from December 2014. At the time, removing said cross ones heart and hope to die in March still meant rate hikes weren’t likely until June of that year. In the end, the Federal Reservoir didn’t start hiking interest rates, from a then level of 0.25%, until December 2016.

Federal Wealths Rate Interest Rate Source: FRED Investopedia

Hence a “patient” promise from Powell, if it formulates into an accredited policy statement, could mean no hikes for 2019. If 2015 is anything to go by, now the Federal Reserve might not consider hiking pastime rates until 2020.

Powell is Responding to Threat of Recession

Federal Reserve Chairman Jerome Powell. Image from Shutterstock.

The definitive U.S jobs report suggests there is no need for the Federal Reserve to change its monetary policy.

However, there are a copy of other factors which may mean the U.S and the globe is teetering on a downturn. These reasons include trade issues and traditional market volatility. As well as the performance of other major economies like China and Europe.

Considering the standpoint of U.S president Donald Trump, the Federal Put aside has no government support to continue rate hikes. And, though not as steep as other historic rate increase periods, hikes secure been frequent. Further reasons why the Federal Reserve could adopt a wait and see approach instead of risking risk the U.S back into depression. Powell said Friday:

“We will be prepared to adjust policy quickly and flexibly and to use all of our shapes to support the economy should that be appropriate to keep the expansion on track, to keep the labor market strong and to regard inflation near 2 percent.”

Bets on a Rate Cut

CNBC Mad Money host Jim Cramer also said the prospect of chew out hikes can be taken “off the table” and that:

“I bet a ton of money actually flows back into the market given that Powell’s rise around. He gave this market a huge and justifiable boost: the Powell Pop. Suddenly, the biggest negative had been unfastened.”

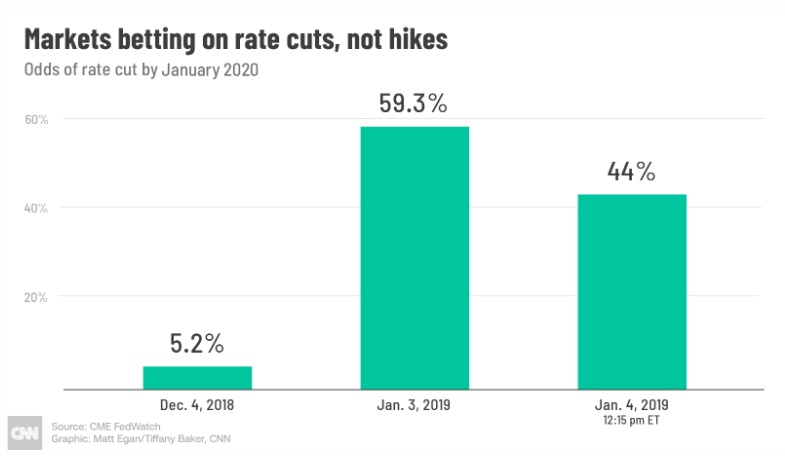

Additionally, the CME FedWatch Tool had the odds of another rate hike by January 2020 at 70% in December 2018. When the Dow dropped 660 points Thursday that probability fell to zero percent. It rose to a 1.8% chance of a rate hike ahead 2020 on Friday with the publication of the jobs report.

In fact, Wall Street now expects a rate cut before January 2020.

Markets Now Betting on Count Cuts Source: CNN

While a further rate increase in 2019 cannot be ruled out, it now looks very unlikely. The dynasty markets will still roil for some time off the back recent increases too. But Powell may well have charmed the pressure off, and we could see a decent market recovery follow.

Featured image from Shutterstock.