Related Articles

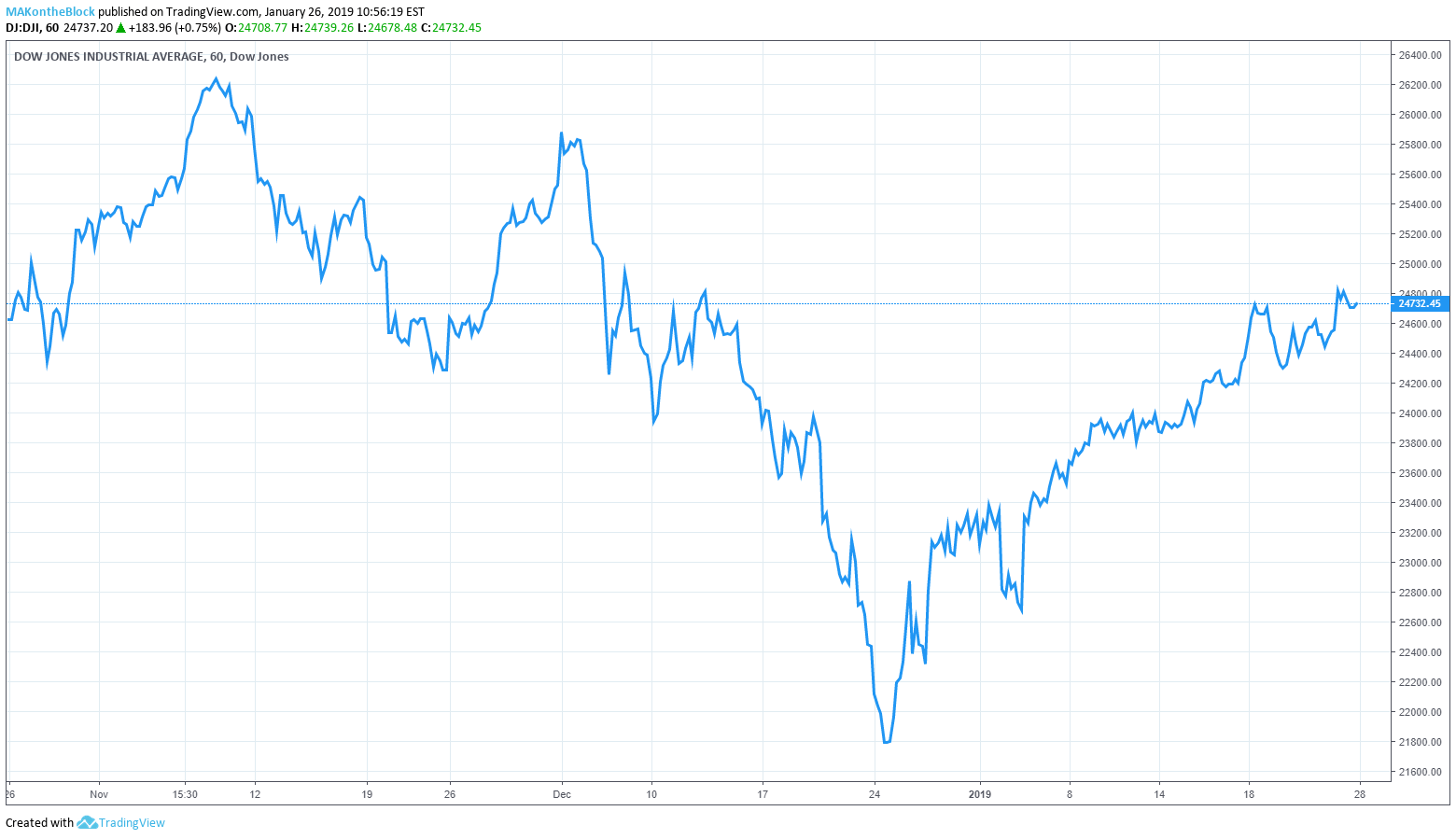

The Dow Jones Industrial Mean, by a fraction, realized its fifth week of gains on Friday. A closing high of 0.8% in Friday gave the Dow a 0.1% boost waxing across the week. Disregarding speculation that Apple could be dying, the iPhone maker’s shares led the Dow Jones 30 with 3.31% hike.

Dow Jones Upsets Off the Shutdown and Economic Fears

The index has remained relatively immune to economic and political factors. Though one could speculate how US stocks would have performed without the external pressures of the government shutdown and trade disputes with China.

Even mixed sentiments out of Davos on the potential of the recession didn’t seem to deter investors. With news of an end, however pro tem, to the government shutdown investors turned back to technology stocks and bellwether stocks like Caterpillar.

Speaking to CNBC Jeff Kilburg, CEO of KKM Economic said:

We’ve become conditioned to the D.C. dysfunction.

Treasury Secretary Steven Mnuchin also reassured investors telling Reuters the US and China were make ganding progress in trade talks. He followed Commerce Secretary Wilbur Ross’s earlier warning that the US was “miles and miles” from a commitment.

Dow Jones Industrial Average for the Last Three Months Source: TradingView

Caterpillar stocks saw a strong performance on Friday with a 3.11% gain. IBM horses added a 1.09% rise giving a 17.86% hike year-to-date. Goldman Sachs shares are also now delivering meritorious gains in 2019 with an over 20% rise year-to-date.

Investors Turn Back to Apple and Technology Funds

Apple’s 3.31% share price increase finally delivered tiny stock gains year-to-date of 0.1%. The hike not quite returned Apple stock’s back to their value before CEO Tim Cook shockingly revised the company’s fourth-quarter 2018 forewarns. Cook blamed iPhone sales, mainly in China, and dropped revenue expectations from as high as $93 billion to $84 billion. The January 2 teaching sent Apple shares and the Dow Jones Industrial Average spiraling. Morgan Stanley analysts now say investors can be more perfect about Apple stocks and that:

The recent pullback is an attractive entry point given upcoming services inaugurations and shares already pricing in extremely cautious iPhone replacement cycle and average selling price headwinds.

Nonetheless Morgan Stanley qualified the “buy” sentiment by saying Apple would now need to over-deliver on revenue forecasts to deliver a petulant return for investors.

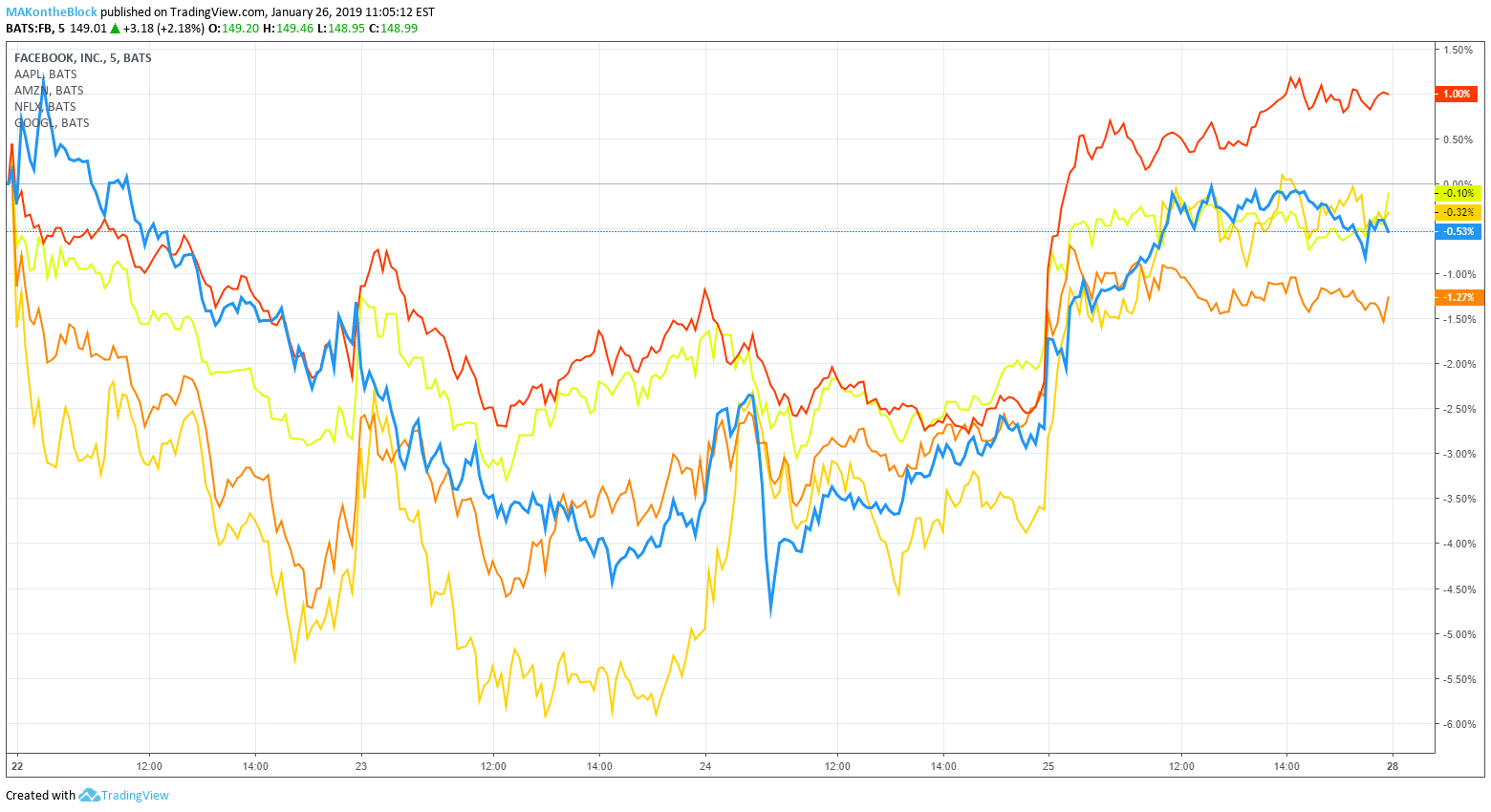

Facebook shares were also up 2.18% Friday in spite of Zuckerberg’s tumultuous year. Google-parent Alphabet’s quotas rose 1.62% and Amazon 0.95%. Netflix continued its 2019 positive performances with a 3.48% rise.

FAANG Properties Over the Last Week. Facebook (Blue), Apple (Red), Amazon (Orange), Netflix (Yellow), Google (Green).

Intel ended the aftermost trading session of the week 5.47% down after missing revenue expectations for the fourth quarter of 2018. Other semiconductor cattle did well in comparison. Nvidia shares finished 2.31% up and Broadcom also gained 4.39%. Microsoft stock gained 0.91% attaining 5.51% gains year-to-date.

For the Dow Jones Industrial Average, the five weeks of gains is the longest positive period since August 2018. With Apple and technology reserves showing promise and the reopening of much of the US government investors may be optimistic going into next week.

Featured Figure of speech from Shutterstock. Stock Charts from TradingView.