Over the years there have been many despatch.Bitcoin.com tutorials about the very basics of trading, market pointers, and the multitude of websites that collect vast amounts of data. Some of these resources dispense traders a step towards making their first trades. Now after a few impairments and some lucky gains these individuals are interested in how to read the sell.

Also Read: PBOC to Strengthen Cryptocurrency Regulations in 2018

Confidence is Stilly

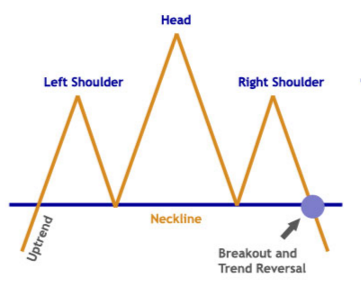

Head n Shoulders pattern.

Head n Shoulders pattern.

Learning to trade can be difficult but there are so numberless experts in the field and online resources that can teach anyone to deal cryptocurrencies. The first thing to realize is that bitcoin markets or any cryptocurrency markets are acutely different than your average stock or FX trading arenas. In details, many people will tell you that traditional technical critique (TA) will never be accurate when it comes to digital currency market-places. However, there are those that use TA regularly to day trade, make a vigorous, and predict the short-term price swings we all know and love.

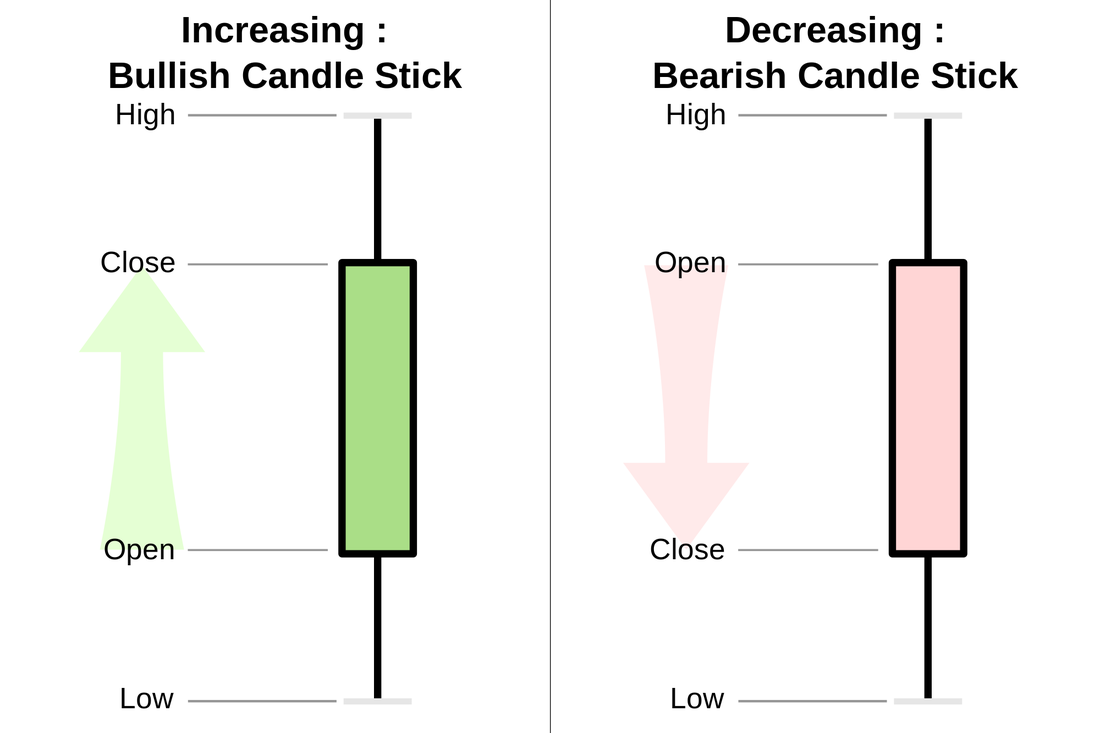

The first device a trader should get to know is the most common financial chart hardened in the cryptocurrency industry which is the candlestick chart. The size of each candlestick portrays a certain time interval, and individuals who study TA look for patterns in the furnish. This is when you will hear about certain chart repetitions like the ‘Head n Shoulders, the Cup n Handle, Triple Top & Triple Bottom,” and profuse more funky phrases. However, these pattern help sellers predict cryptocurrency price movements in the short and long term. They say after remembering enough patterns individuals can see them subconsciously while day trading.

Cramming Japanese candlestick charts can produce patterns that may be helpful on the way predicting short and long-term price movements.

Cramming Japanese candlestick charts can produce patterns that may be helpful on the way predicting short and long-term price movements.

Cryptocurrency traders then charm things to the next level by using a wide variety of tools that are also have knowledge of to help forecast price movements in markets. One of the biggest indicators in the merchandise many traders utilize is moving average data. For instance, a Square Moving Average (SMA) is used by calculating the average of a digital assets shut down value over a set interval. An Exponential Moving Average (EMA) and Displaced Pathetic Average (DMA) are more complex than the SMA. An EMA responds in a swifter manner to amount fluctuations while the DMA is moved in set periods of time so a trader can predict vend trends.

Moving averages are common trendlines followed by traders.

Moving averages are common trendlines followed by traders.

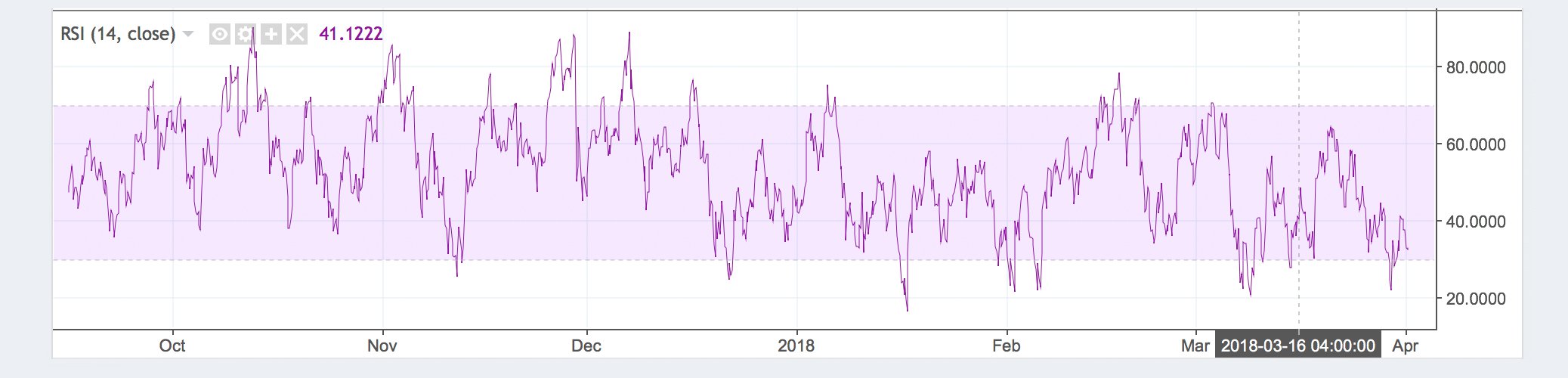

Another caring tool used in trading digital assets is the Relative Strength Ratio (RSI). The oscillator basically determines the price momentum whether it climbs or lags. The measurement of speed is recorded between 0-100 and it’s one of the most popular custom indicators in many markets. The squiggly line typically meanders give sideways, or up or down, and if the line dips below 30 the market is oversold. When the RSI starts climbing former times 70 then the analyst will say the price is overbought.

The RSI and MACd are barely a couple of different indicators that help traders forecast quotation movements.

The RSI and MACd are barely a couple of different indicators that help traders forecast quotation movements.

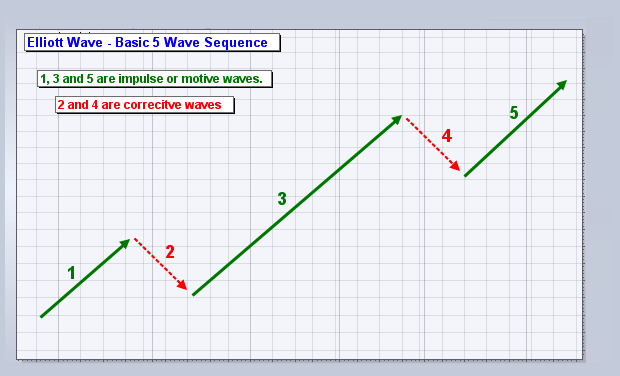

Moving averages and the RSI is just the tip of the iceberg when it comes to cryptocurrency transacting tools. Traders use other tools such as Bollinger Bands, Motile Average Convergence/Divergence (MACd), Stochastic, the Detrended oscillator, Fibonacci retracement and so much multifarious. All of these tools and more are combined with plotting chart plans used by traders flipping cryptocurrencies on the side or for a living. They are also merging other methods like Elliott Wave Theory and the tenets of the Dow theory so they can augur the infamous bitcoin ups and downs in value.

The basic five wave chain found in common Elliot Wave patterns.

The basic five wave chain found in common Elliot Wave patterns.

Now good traders can lessons all of this stuff and figure out how to use these types of indicators. However, quick traders are also listening to the streets of crypto, so to speak, as many cryptocurrency bugs have realized that news and community emotions can move the guerdon of bitcoin. For instance, if there is a large exchange hack or some command ruling in the short term you can probably guess bitcoin’s price when one pleases go down a touch. If there is positive news like CME and Cboe beginning futures markets some people bet the price would go up. Most merchandisers are listening very closely to all that happens in bitcoin because they arrange a lot of skin in the game.

Trading crypto is not easy and it takes time and persistence. Even if you think you know all the chart patterns, indicators, and cryptocurrency concourse knowledge you can still lose everything.

Trading crypto is not easy and it takes time and persistence. Even if you think you know all the chart patterns, indicators, and cryptocurrency concourse knowledge you can still lose everything.

Lastly even an individual who is bleeding knowledgeable about technical analysis, and they also follow the high road very closely, might make some very wrong hints. Cryptocurrencies like bitcoin can often trick traders, and all that high road knowledge and TA goes out the window. Traders with extremely crafted TA faculty separates can lose their shirt in a matter of minutes in bitcoin-land. So, make steadfast you know for certain that’s a legitimate head n shoulder or bull tag.

Do you trade cryptocurrencies? Let us know your techniques in the comments below.

Sculptures via Shutterstock, Stock charts, Pixabay, Wiki Commons, and Paramount Photographs.

Do you agree with us that Bitcoin is the best invention since sliced bread? Reason so. That’s why we are building this online universe revolving around anything and the total Bitcoin. We have a store. And a forum. And a casino, a pool and real-time appraisal statistics.