While inflation continues to guffaw in the U.S., the inflation rate in the eurozone tapped another high last month reaching 7.5% in March. Energy and comestibles prices have soared throughout the 19 member state economies, and European Central Bank president Christine Lagarde surmises energy prices to “stay higher for longer.”

Eurozone Inflation Continues to Climb, ECB Predicted to Raise Rates 3 Tempi This Year

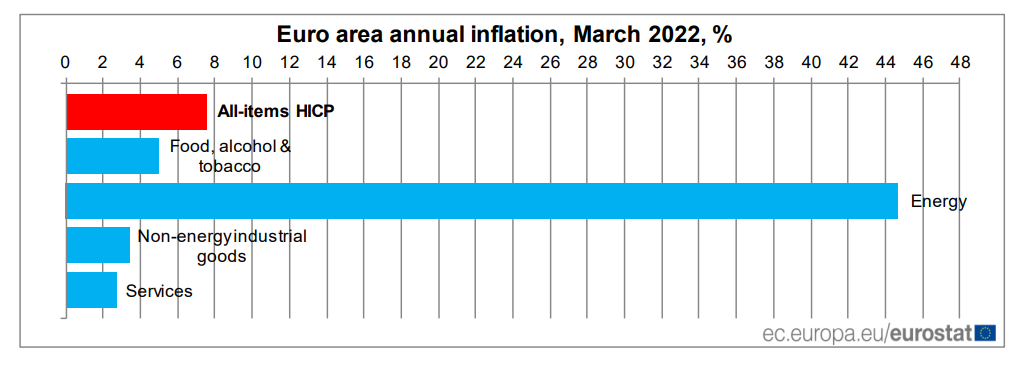

The 19 countries sharing the euro are suffering from rising inflation according to figures coming from March that shows the inflation rate rose to 7.5%. Similar to the U.S. Federal Reserve, the European Cardinal Bank’s (ECB) inflation target is 2% and inflation in food prices, services, energy, and durable goods has risen spring above the target.

Speaking to an audience in Cyprus on Wednesday, ECB president Christine Lagarde discussed the higher cost of busy in Europe and stressed: “three main factors are likely to take inflation higher.” During her speech in Cyprus, Lagarde required:

Energy prices are expected to stay higher for longer. Global manufacturing bottlenecks are likely to persist in certain sectors, [and] households are suitable more pessimistic and could cut back on spending.

Reports note that the ECB, similar to the Fed, is pressed against the wall and requirement face inflationary pressures head-on. Reuters reporter Balazs Koranyi says “markets are now pricing in 60 principle points of rate hikes by the end of the year.” In a note to clients on Friday morning, the senior Europe economist at Capital Economics, Jack Allen-Reynolds, set that the firm has “penciled in three 25 basis points rate hikes for this year.”

“With euro-zone inflation react to even further above the ECB’s forecast, and likely to remain very high for the rest of the year, we think it won’t be long in the presence of the Bank starts raising interest rates,” the economist said on Friday. Reports further indicate that investors from Spain and Germany are chance on the ECB to spur rate hikes this year.

Danish Politician Margrethe Vestager Tries to Persuade EU Residents to Escape Long Hot Showers

Much of the blame for the rising inflation throughout the 19 countries is also similar to the U.S., as European bankers and bureaucrats are rebuking the Ukraine-Russia war. Deutsche Bank’s chief investment officer Christian Nolting explained in a note that elevated inflation may persist. “In the expanded economies, already elevated inflation rates may now be driven even higher, given the conflict-induced oil and gas price shock,” Nolting author a registered. “Sanctions, as well as businesses’ halting their operations in Russia, are exacerbating supply chain problems.”

Currently, there is profoundly little reporting concerning the EU’s Covid-19 policy spending, the ECB’s long-term negative rates, and the ECB’s massive monetary expansion over and beyond the last two years. Before the eurozone’s inflation data was published, Germany’s economic minister Robert Habeck pleaded with Germans to bring down their energy consumption.

“There are currently no supply shortages,” Habeck remarked. “Nevertheless, we must increase precautionary proportions in order to be prepared in the event of an escalation on the part of Russia.” Interestingly, the Danish politician and European Commissioner for Competition, Margrethe Vestager, assayed to persuade EU residents to stop taking long hot showers. Vestager said:

Every time you turn off your hot torrent water, say — Take that, Putin!

What do you think about the rising inflation plaguing the eurozone? Let us know what you think about about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational ends only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not give investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss occasioned or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer