Into the middle a lack of tangible progress in trade talks between the U.S. and China, growing tensions around the world, as well as slacking economies, some on Wall Street are sounding the alarm that major international brands could soon be a sucker for out of favor.

And signs are mounting that Canada Goose, the Toronto-based maker of luxury outgear, could be one of the first to suffer.

The assemblage’s stock was downgraded on Thursday to “market perform” from “outperform” at Wells Fargo, which cited valuation upsets, recent weak consumer engagement trends, and significant pressures facing multi-national brands. Wells Fargo also lowered its cost target on the stock from $80 to $68.

“The recent performance of multi-national brands has been lackluster over the past a handful months, leading to revisions across the space,” Wells Fargo senior analyst Ike Boruchow wrote in a note to customers. “We believe the primary drivers for this weakness include…tourism going from good to bad, Europe becoming simple problematic, and fears around an eventual slowdown in China.”

Shares of Canada Goose fell more than 7 percent on Thursday, the clichd’s worst day of trading in more than a month. The parka maker’s stock has plunged more than 20 percent from its latest high in mid-November.

.1548366916547.jpeg)

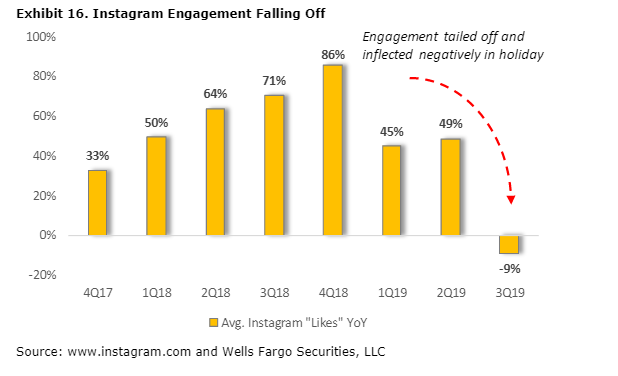

Wells Fargo added that slowdowns in Google searches and Instagram engagement over the festival season have sparked further concerns that customers could be pulling back. Since the company’s IPO in old 2017, Google search trends for “Canada Goose” had been increasing at a double-digit rate each quarter but started to decelerate both in Canada and globally dilatory last year.

“[This is] somewhat concerning for a stock that currently relies heavily on momentum and robust extension to keep their premium valuation justified,” Boruchow said in the note. “December is the peak holiday month and the most credible time of year consumers would search for the brand on Google when shopping.”

Despite the headwinds, Wells Fargo distinguished that Canada Goose’s stock trades at a premium to a cohort of global luxury retailers like Burberry, Ferragamo, Moncler, Prada and Tiffany’s.

To flesh out its market share, Canada Goose has been aggressively pushing into China, where the population accounts for one-third of the superb’s luxury consumption, according to analyst estimates. The company debuted highly anticipated locations in Hong Kong and Beijing survive year, which will compete with local knockoff brands.

But, while Canada Goose shares clothed surged more than 160 percent since its IPO, the outdoor apparel maker has come under pressure during the course of the past two months amid escalating economic and political tensions between China and Western countries. The stock discontinued 17 percent over a one-week span in December after reports surfaced that Chinese consumers were pass overing the brand.

Wells Fargo joins a chorus of business leaders that have warned persistent global marketing tensions could hurt key North American multi-nationals.

In early November, Procter & Gamble CEO David Taylor commanded CNBC that he was especially concerned about the long-term damage the trade war could have on consumer behavior and pass.

“What I worry most about with the trade war is it destroys consumers’ confidence in American brands,” Taylor mean at the time.

The U.S. has set a March 2 deadline for negotiators to reach a deal; if no deal is reached, tariffs are set to increase on $200 billion in Chinese goods.

Business Secretary Wilbur Ross said earlier on Thursday that China and the U.S. were not close to striking a trade see to. Ross told CNBC’s “Squawk Box ” that the U.S. is “miles and miles ” from a trade deal with China, continuing the two countries have “lots and lots of issues.”

Adding to investor anxiety, President Donald Trump’s outside advisor on China, Michael Pillsbury, barrowed CNBC on Wednesday that he didn’t expect a breakthrough in trade talks in the “near term.”