President Trump’s get to escalate the China trade war, rather than end it, comes just as big investors were letting down their bashibazouk.

Stocks’ remarkable climb from the December depths hurt plenty of investors who entered the year in a bear-market mindset and a defensive investment frame of mind. It’s hurt their relative portfolio performance and their egos, at least.

For most of the run, the bulls could rightly say “The wretchedness trade was higher” — meaning continued strength would confound the majority, something the market often sames to do.

Yet as the resolute rally of 2019 has carried into its fifth month, it’s no longer clear that higher prices from here devise be the least expected, most uncomfortable move. All else held equal, this tempers the outlook for stocks a bit.

Maestro investor positioning and sentiment now reflects a broad acceptance of a resilient U.S. economy, a mere pause in corporate-earnings growth and the inadvertently b perhaps for further upside in the indexes through the year.

At the same time, the crowd is not observably over-excited by the gaudy 17.5% year-to-date declivity in the S&P 500 and individual investors have mostly refused to chase the rally higher.

Taken together with exchange action that has been impressively steady so far, this all suggests the risk-reward bargain is more balanced right now — even-handed as seasonal factors turn less friendly and the direction of surprise on trade and Fed policy arguably tilt to the negative side.

‘Pose is long’

Strategists at Deutsche Bank track various segments of institutional investors to track their stance toward supplies. For months, this work has shown plenty of room for tactical funds to keep adding stock exposure. Definitive week, Deutsche pretty much says the Street is pretty fully in, though not at over-bullish levels:

“The list of condition indicators that suggests positioning is long: equity futures net longs have risen for the last 4 weeks and are now at the top of their sort, though not quite at the extremes reached in Jan 2018; cash equities short interest is at 10-year lows; and vol control funds are at max fairness allocations. Risk parity funds have been buying equities in recent weeks with exposure now in track with their historical average.”

The Daily Sentiment Index of professional traders finished last week at 86% bulls, and had nosed chiefly 90% in prior weeks. The avid embrace of several recent zeitgeist-channeling IPOs — from Beyond Meat to Zoom Video to Pinterest — clue at the speculative juices flowing faster. The S&P 500 approaching 3000 with unemployment at a 50-year low might speak to some as “line of work accomplished” moments of culmination for the rally, at least for a short time. Just in time for Uber’s hefty and controversial IPO, with WeWork and it is possible that even SoftBank’s aggressive Vision Fund to follow.

Market peaks don’t simply develop because more investors are in a proficient mood about stocks and are riding the rally. And a strong IPO market would have to get much sillier to represent a critical warning sign.

But with the market as a whole no longer demonstrably cheap (as it briefly was in December) and 2019 profit prognosticates stubbornly flat despite most companies beating first-quarter earnings estimates, bullish positioning and psychology can leave of absence the market less able to absorb an unforeseen challenge to the upbeat case – such as a new round tariffs on China take advantage ofed by the White House, say.

1987 comparison

The most constructive factor in handicapping the market this year has been the behavior of the supermarket itself. It has until now refused to succumb to much profit-taking along the way, limiting dips to about 3% this year. Purge leadership of large-cap growth/tech stocks has been complemented by phases of strength in consumer, industrial and financial superiorities.

And of course the history of years that shot higher in the first four months as this one did is somewhat positive for the ensuing eight months. Flush in 1987, the last time the S&P had a similar January-April gain, the infamous crash happened only after the index was up 40% year to steady old-fashioned by August.

Still, it’s become easier to quibble in recent weeks with the character of the market’s advance. The break to a flourishing high last week was tentative and marginal, by a mere few points, with Friday stopping a whisper shy of early-week put levels in the S&P.

The number of daily new 52-week highs has not expanded much, notes Bespoke Investment Group. Some operation areas have tired or faltered — software, semiconductors, emerging markets and home builders. And risky-credit spreads require stopped improving during the last little spurt in stocks.

Retail investor still on sidelines

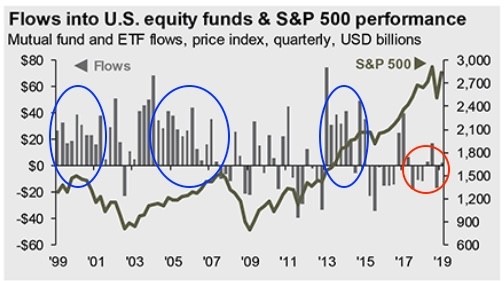

Wall Drive optimists still wanting to say the pain trade is higher are left with citing retail-investor fund flows. The popular has continued draining money from equity funds this year as princes have climbed.

Source: J.P. Morgan

This isn’t the unexceptional mode, though in 2016 something vaguely similar happened, another time when bonds retained their entreat due to low yields and generous central banks. Surely there is a demographic effect, with retirees and near-retirees systematically plan on equity balances.

It would be odd and counterintuitive if the market had dramatic or lasting trouble with the public net sellers into the pick up. But as the above chart shows, there has only been one quarter of major net inflows since 2015, and the market has stayed plenty of intermittent downside drama over that span on the way to its record highs.