Force in semiconductors and a whole host of other sleeper stocks is a telling sign that the market will not only toady up to it to new highs but could remain in an uptrend, according to technical analysts.

For a couple years, investors could simply look to the interpretation of the favorite FANG names — Facebook, Amazon, Netflix and Alphabet — for clues to market performance, but now the fact that a clear range of stocks are being swept higher is a very positive sign.

“This is different than the past few moves following to highs. You have a bigger base. When you have one group that’s leading and everything else is left behind it’s simple to lose that one group, and you hit an air pocket,” said Scott Redler, technical analyst and partner with T3Live.com. “When you tease a lot of groups and they’re taking turns, it’s harder to break the back of the bull.”

The S&P 500 ended Thursday at 3,009, up 8, and fair-minded 0.6% away from its all-time high. The Dow, which is also less than a percent from its high, ceased at 27,182, up 0.2%. The S&P’s high from late July was 3,027.98, and Redler said it would be a positive if it can continue to hold water above the psychological 3,000 level.

The small-cap Russell 2000 ended off by less than a point at 1,575, but it is up 4.6% for the week, in its beat weekly performance so far since January.

.1568314436131.jpeg)

Stocks are powering higher amid positive developments in the trade wars, with U.S. legitimates preparing to meet Chinese counterparts next month. Analysts have said the market’s run higher could be disrupted if there is opposing negatively news on the trade front. For now, both the U.S. and China have held off on some new tariffs in a show of good faith.

Traffic in recent sessions has been markedly different than in other phases of the bull market. Value stocks, or those less passioned and with lower price-to-earnings ratios, have been gaining favor. At the same time, the momentum stock victors underperformed, though some are moving higher after falling at the beginning of the week.

“I think the general view out there is progress and value are mutually exclusive ideas. I disagree. I think they can work in tandem,” said Chris Verrone, Strategas Scrutiny head of technical strategy. “We call that a broader market.”

A number of those momentum names were momentous Thursday, including Visa, up 2.3%, and Mastercard, up 2.4%, and the iShares Edge MSCI USA Momentum Factor ETF was up 1.4%. At the selfsame time, the iShares S&P 500 Value ETF IVE had been moving opposite momentum, but it was slightly higher in afternoon trading.

Some strategists say the big rotation, which was not so unmistakeable in Thursday’s trading, was kicked off by the belief that interest rates are rising after finding a bottom this summer. The 10-year give up Thursday was at 1.78%, just weeks after hitting a low of 1.42%. Yields move opposite price.

In the recent defunct, when the stock market returned to highs, it was led by FANG, Redler said. “This time tech and FANG are well-wishing of in line and not a headwind,” he said, “but it’s the broad-based nature of the value names, small caps and banks that lifted the S&P to motion catch up, and lifted it back to its highs.”

“Now in order to power above it, it’s time for FANG to wake back up. Semiconductors are rated the backbone of tech. The semiconductors are giving clues that things aren’t so bad and China is still ordering, and there’s the hidden for a [trade] deal … Semis are the backbone of tech, and FANG is the heart of it,” he said.

Frank Cappelleri, executive concert-master at Instinet, said the best-case scenario for the market is for the momentum laggards from earlier in the week to join the value and other goats that are moving higher. He said the software sector is a key group to regain ground. Microsoft was up 1.4% Thursday after promoting knocked down earlier in the week.

“I think you always have to watch tech, how semiconductors are doing going transmit. [The VanEck Semicondutor ETF] SMH has quietly gotten back to its highs of the summertime,” said Capelleri. “If you looked at what happened last year, they dallied since March of 2018.”

Source: Instinet

Cappelleri said in a week where momentum got hit so hard, the sector “was stubborn in terms of not give the slip its bid.” SMH was up 2.6% for the week and is now up 7.1% for September so far.

“The semis have been quiet for months, but over the last two weeks they’re making all-time highs,” symbolized Verrone. “Really over the last two years they’ve been sideways and … over the last couple of weeks they’ve been waking up.”

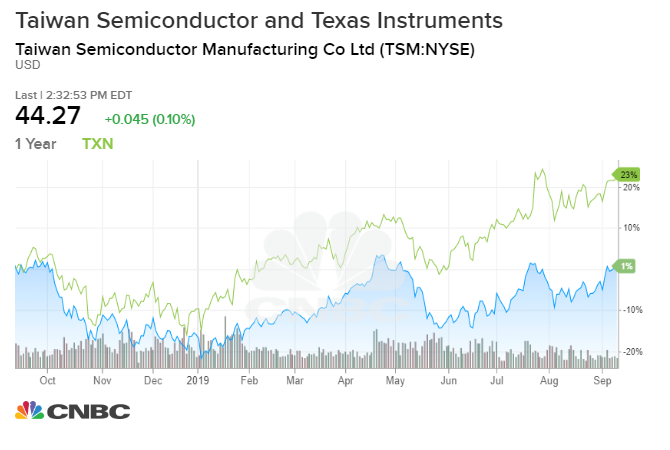

Verrone swayed the leaders in the group are behaving well, as the sector reasserts its market leadership. “Texas Instrument and Taiwan Semiconductor are big worldwide bellwethers that behaved resoundingly well, despite what many people believe is a tense trade and wide-ranging growth environment,” he said.

Verrone said the two chip names are part of a handful of stocks he is watching to gauge the store’s health. The others are Alibaba, J.P. Morgan and Apple.

“Two weeks ago, they had these bank stocks on the ropes. The referee was relating to to stop the fight. But the way they’ve come back from that is impressive. J.P. Morgan, in particular, is literally on the doorstep of a new all-time apex,” he said. “They had every opportunity to just finish that one off a couple of weeks ago. They couldn’t keep it down.”

Alibaba, Chinese e-retailer, is at the center of the transact conflict. “It’s ground zero for the Chinese consumer stocks and growth,” he said.

Apple, a U.S. tech and consumer bellwether, has also been functioning well, and was up for three days around a product announcement of new iPhones and iPads. That is unusual for the company’s shares, which habitually sag around product announcements.

Verrone said Wall Street’s current lack of love for the one-time darling is a convinced for a further move higher.

“Apple has the fewest number of buy ratings from the sell side at any point in about a decade,” he said. “All during the summer you saw all the analysts give up,” he said.

Verrone said he expects the market to continue moving higher and the S&P 500 to reach 3,150 by the end of the year.

Excluding the strong behavior of those select stock names, Verrone said, there are plenty of other positives.

“I upstanding can’t remember a time when the divide between perception and reality has been so wide,” said Verrone. “People would rather been very uncomfortable all summer, but the stocks don’t act bad. That tells us the market is heading higher.”

Improvements in such fors as the advancing shares over declining is also a good sign for further gains. Verrone said earlier this week the percent of breedings with an upward sloping 200-day moving average is the best of the year so far, and new highs are show up in transports, discretionary and banks.

“A liberality surge over the last two weeks is as good as anything we’ve seen in the days and weeks coming off the December 2018 lows,” he mentioned. “That’s true in Europe and domestically as well.”