Goldman Sachs has enlist ined the flight of institutional investors from Fisher Investments.

The giant investment bank is pulling $234 million from Camas, Washington-based Fisher, according to a rise close to the matter.

However, the end tally could be even greater, a source told CNBC.

Goldman Sachs and Fisher Investments both slanted to comment.

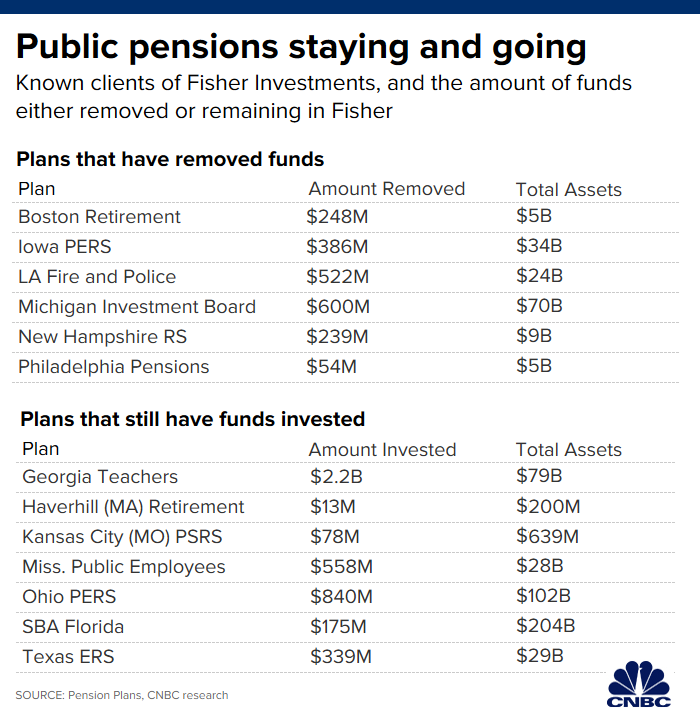

In all, institutional investors, along with Goldman, are withdrawing more than $2.7 billion from Fisher Investments in descend of Ken Fisher’s lewd comments made at a conference on Oct. 8.

Meanwhile on Thursday, the Los Angeles fire and police pension plan voted to fire up Fisher, where it held $522 million.

The Los Angeles pension has $24 billion in total assets.

The board of commissioners weighted they had invited Fisher himself to speak at the meeting, which was webcast live, but he did not attend.

“The only explanation is that Mr. Fisher was powerless to attend and had business in the office,” Ray Ciranna, general manager of the Los Angeles Fire and Police Pension System, wrote in an email to CNBC.

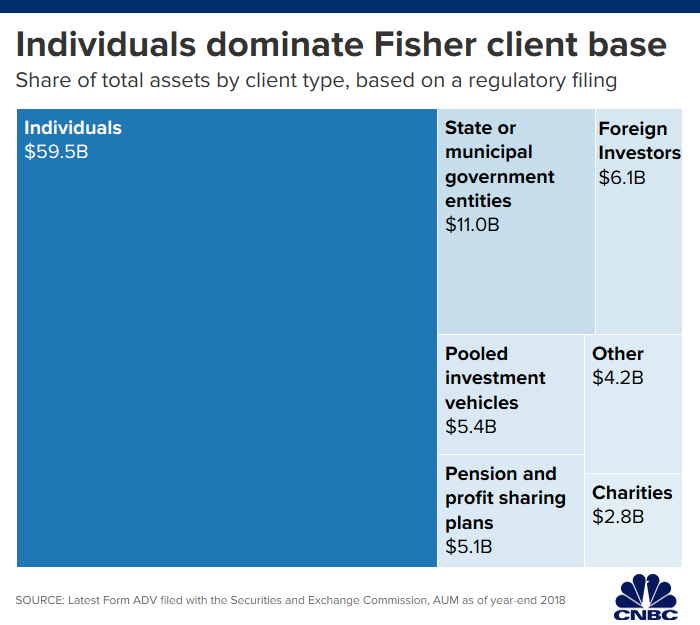

In all-out, Fisher Investments has lost more than $2.7 billion in recent weeks as eight institutional clients — six of which were administration pensions — parted ways with the firm. Fisher had $94 billion in assets under management as of Dec. 31, 2018, according to their SEC chronologizing.

That figure reached $112 billion as of Sept. 30, 2019, according to the firm.

On Monday, Fidelity said it transfer remove its money from Fisher. The firm managed $500 million for Fidelity’s Strategic Advisers Small-Mid Cap Wealth.

Additionally, the New Hampshire Retirement System voted on Tuesday to terminate its $239 million relationship with the firm as OK. That same day, the Public Employees Retirement System of Mississippi, which has $558 million invested with Fisher, rumoured it would put the firm on a watch list due to “organizational concerns,” according to Ray Higgins, executive director of the plan.

Conference expansions

CNBC obtained an audio recording of Fisher’s comments at the Tiburon CEO Summit, as well as audio of him speaking at a previous symposium.

Clips from both were featured on CNBC’s “Power Lunch.” Combined, they show that the wherewithal manager made flippant remarks about sex.

In the audio obtained by CNBC, Fisher, 68, said at the Tiburon seminar, “Money, sex, those are the two most private things for most people,” so when trying to win new clients you need to be careful.

He express, “It’s like going up to a girl in a bar … [inaudible] … going up to a woman in a bar and saying, hey, I want to talk about what’s in your cut-offs.”

Further, when Fisher was a speaker at the Evidence-Based Investing conference in 2018 he compared marketing mutual funds to propositioning a skirt for sex at a bar.

“I mean the, the most stupid thing you can do, which is what every mutual fund firm in the world always did, was to vaunt about performance, uh, in, in a direct mail piece, which is a little bit like walking into a bar if you’re a single guy and you want to get demanded and walking up to some girl and saying, ‘Hey, you want to have sex?'” Fisher said, according to audio obtained by CNBC.

The billionaire has since apologized for his explanations.

“Some of the words and phrases I used during a recent conference to make certain points were clearly mistaken and I shouldn’t have made them,” Fisher said in a statement. “I realize this kind of language has no place in our guests or industry. I sincerely apologize.”

Organizers of both conferences subsequently banned him from speaking again in the future.

More from Insulting Finance:

Here’s how much income tax you’re paying to your state

A parent’s guide to helping their kid get into college

Michael Avenatti allegedly weakened to file tax returns. That’s a bad idea