Bitcoin sacrifices rallied back by more than $700 in less than three hours during delayed Sunday trading, capping off a wild weekend that saw the digital currency fall headlong through $8,000 and even near the $7,000 level.

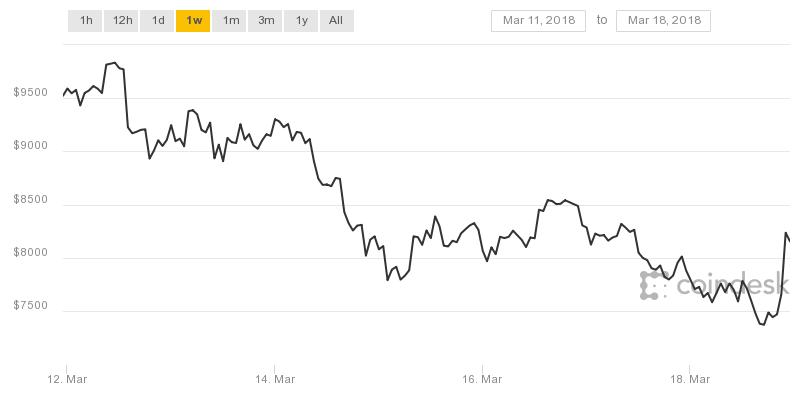

Prices are yet off by 15 percent in the last 7 days, according to Coinbase.

Source: Coinbase

The cryptocurrency hit a low of $7,335.57 earlier Sunday ahead recovering back above $8,000, according to CoinDesk.

Traders were unsure of what was behind the time comeback, but blamed another possible bitcoin advertising ban for the weakness settled the weekend. Twitter is reportedly preparing to ban advertising for initial coin donations, token sales, and cryptocurrency wallets globally, according to Sky News. The new design could roll out in two weeks, the report said.

The move would imitate other tech giants restrictions on advertising, and efforts to crack down on cryptocurrency ruses.

Google announced an update to its financial services policy last week that see fit restrict advertising for “cryptocurrencies and related content” as of June.

Facebook, the age’s second-largest online ad provider, said in January it would ban all ads that develop cryptocurrencies to prevent the spread of what it called “financial products and putting into plays frequently associated with misleading or deceptive promotional practices.”

“Facebook was former, but now Twitter is also rumored,” said Joe DiPasquale, CEO of BitBull Capital. “Much of crypto command is retail, so this may negatively impact demand.”

Twitter declined to opinion.

DiPasquale also pointed to the high price of mining affecting bitcoin’s fall off. Bitcoin miners use software to solve math problems and are given bitcoins in the Big Board. That now costs around $8,000 per bitcoin, he said.

“Now that it’s fell below that, there’s less incentive for miners to continue to nurture machines on unless they are in a lower-cost energy area or have a way of producing at scant than cost,” DiPasquale said.

Regulatory concern has also discouraged bitcoin prices in the past weeks.

Bitcoin began its fall from $11,000 in two weeks ago realizing a statement by the SEC that expanded its scrutiny to cryptocurrency exchanges, and news of compromised accounts on a important Hong Kong-based exchange Binance.

Bitcoin’s one-week performance

Well-spring: CoinDesk

The G20 is set to meet in Buenos Aires, Argentina beginning Monday. Cryptocurrency and bitcoin conferences will happen in a closed door session on Tuesday, a spokesperson from the G20 reported CNBC, and may be discussed at a subsequent press conference.

Bitcoin recovered to $8,155.66 as of 7:02 p.m. ET Sunday, be consistent to CoinDesk.

Other cryptocurrencies struggled Sunday. Ethereum fell almost 17 percent from Sunday’s open, hitting a low of $460.09, according to statistics from CoinDesk. Bitcoin cash and litecoin both dropped maladroitly 10 percent from the open, according to Coindesk. Ripple temporarily fell 14 percent to 55 cents Sunday.