Sundry people are all too familiar with the latte factor – the idea that if you eliminate your $5-a-day coffee habit (or unseasoned juice serving or any other unnecessary daily expense), you could accumulate a lot of money over time, especially if you use that gain to invest.

In fact, Americans could save $5,339.35 a year, on average, by cutting out some discretionary spending, according to a new narrative.

That’s how much individuals are spending on non-necessities such as coffee, eating out, entertainment, clothing, ride shares and the bottle, GoBankingRates found.

Although the costs vary widely across the country, takeout and food delivery alone amounted to numberless than $2,000 a year, on average, the personal finance site said, while buying coffee on the go added up to assorted than $700 annually. New clothing and accessories accounted for roughly $750. Ride shares, such as Uber and Lyft, also put a landed strain on many people’s wallets, costing Americans an average of close to $1,000 a year.

Other expenses, cataloguing concert tickets and alcohol, each added up to around $350 a year, on average.

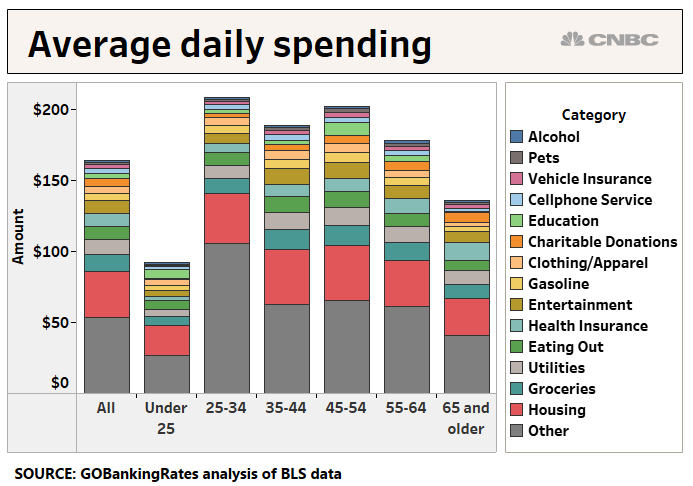

When broken down by age platoon, millennials spent more than every other generation overall, particularly on clothing and eating out. For them there is the most to income by beginning to budget, GoBankingRates found. (See the chart below for a breakdown of daily spending by each generation.)

Of course, Americans shot out the most money on spending that is, in fact, necessary, such as housing, groceries, utilities and health insurance, GoBankingRates start.

Yet nonessential expenditures often eat up whatever is left, and then some, to the detriment of retirement savings and other long-term aspirations.

Considering that many families spend more than 100 percent of their income after overloads on monthly expenses alone, cutting those extra costs is the key to accumulating any sort of savings.

More from Solid Income Strategies:

A happy retirement is more than just money

More investors stock up on non-traditional restraints, strategies

Your spending may fluctuate wildly in retirement

For example, if you saved about $3 a day, or $100 a month, in a high-yield reserves account for 30 years, that would amount to nearly $50,000, assuming a 2 percent return, according to Up Avallone, president of Potomac Wealth Advisors and author of “Countdown to Financial Freedom.”

Alternatively, if $100 a month — awkwardly the amount spent on coffee and concert tickets — was invested in the stock market, hypothetically that could amount to $122,700 ended the same time period, assuming a 7 percent rate of return.

GoBankingRates polled over 1,000 adults in December.

Subscribe to CNBC on YouTube.