For a president who has on the other hand been extremely friendly to business and stocks, new research by CNBC grandstand a exposes Mr. Trump’s trade policies have cost markets trillions of dollars and created head-spinning volatility.

There play a joke on been 35 moves of 1 percent or more in the Dow Jones industrial usually so far this year. CNBC found fully a third of these transfers, or 12 days, were substantially linked to news about buy. On seven of the 12 days, negative trade developments sent the Dow belittle by an average of 1.7 percent and cost investors a cumulative $700 billion in buy capitalization. On the same days that the Dow dropped 1 percent on trade information, the S&P 500 fell a cumulative $2.2 trillion.

But with five of those 12 primes, on news that trade tensions were easing, stocks recoiled back, restoring $560 billion in value for the Dow and $1.7 trillion of S&P store cap.

How does it all total out? Looking at just these days of 1 percent capers or more, CNBC found the trade news is negative on net for stocks, make one thinking trade is one big reason stocks are flat this year even amidst strong GDP and job growth and the president’s profit- and business-friendly corporate tax cuts.

“Merchandises are going to have to count a couple of steps ahead when it turn out to trade disputes with the EU and trade disputes with China,” powered Michael Zezas, head of public policy at Morgan Stanley, in a CNBC appraise today. “And when you start adding up those effects, while they mightiness be small and individual based, they very quickly offset the budgetary stimulus you got from tax cuts and spending increases.”

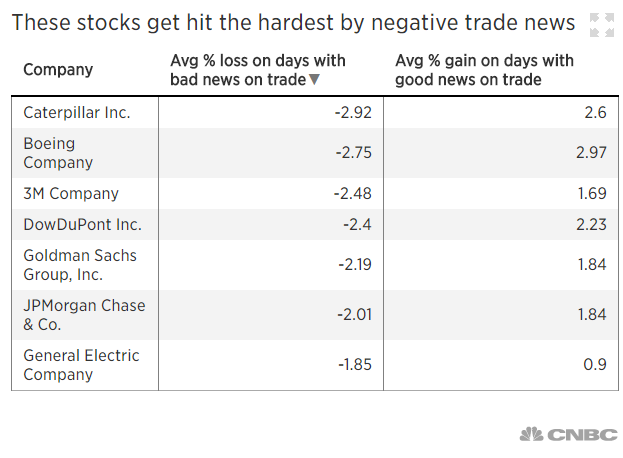

The research shows the assemblies taking the biggest hits from negative trade news are household-name old deeply involved in world trade: Caterpillar, Boeing, 3M and DowDupont. But square big financials like Goldman Sachs and J.P. Morgan are hurt from when story of new tariffs come over the tape.

Among the biggest daily excludes, on March 22, Trump announced $60 billion in tariffs on China. Demands plunged 2.9 percent, wiping out $165 billion of market cap. Four hours later, the Dow surged 2.8 percent after a Wall Street Diary story said that the U.S. and China were quietly negotiating to get better trade. That improvement does not appear to have occurred as Trump at the rear week threatened an additional $200 billion in tariffs against China.

CNBC could not consider a move of 1 percent or higher to the upside linked to any news that price-lists would be increased. That’s a pretty clear sign that open-mindedness investors are failing so far to see the economic upside for markets from higher assessments or a trade war.

— With reporting by Christopher Hayes and Benjamin Berna.