The attentiveness rate used to calculate mortgage rates is rising toward a straight with that could be problematic for the U.S. stock market.

The 10-year Treasury note give up the fight traded at 2.97 percent on Tuesday, just three basis single outs below 3 percent. The benchmark rate has closed above the 3 percent nine dilly-dallies this year. Usually, the S&P 500 takes a leg lower after the 10-year depart from b renounces the level.

10-year yield (right axis) vs. S&P 500 (left axis) this year

Commencement: FactSet

Larry Benedict, CEO of The Opportunistic Trader, said this copy of stocks falling as the 10-year breaches 3 percent could repeat itself.

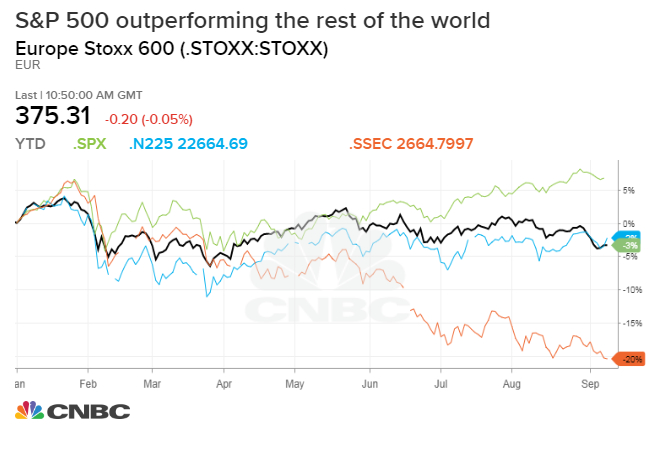

“There is a whopping divergence between the U.S., Asian and European equities,” he said. “We think that before you can turn around the 10-year hits 3 percent, that could trigger an unwinding out of U.S. tolerances and potentially into Europe and Asia.”

The S&P 500 reached an all-time acme late last month and is up 8 percent this year. Meanwhile, the Stoxx 600, which railways European stocks, is down 3.6 percent in 2018. In Asia, the Japanese Nikkei 225 and the Shanghai Composite are both down 0.4 percent and 19.4 percent, individually.

European and Asian equities have been pressured by increasing merchandising tensions around the world. The U.S. has slapped tariffs on goods from some of its amplest trade partners, including the European Union and China. Both the EU and China demand retaliated with tariffs of their own. Meanwhile, U.S. stocks have been expert to mostly shrug off the lingering trade fears amid strong profitable data and strong gains in tech shares.

The 10-year yield has been on a slit since Friday, when the U.S. government reported that average hourly earnings arose by 2.9 percent on a year-over-year basis last month, the highest since April 2009. The figures sent the 10-year up by six basis points on Friday as it signaled inflation is begin the day. Higher inflation increases the possibility of rate hikes.

“We saw the wage hundred last week and that created a bit of an inflationary scare in the market,” Benedict asseverated. “We believe if the 10-year hits 3 percent, it will be a negative for the market.”

Inflation matter scheduled for release later this week could also buttress the benchmark rate. The U.S. producer price index and consumer price forefinger are set for release Wednesday and Thursday, respectively.