A Kyushu Railroad Co. 800 series Shinkansen bullet train arrives at Kurume Station in Kurume City, Fukuoka Prefecture, Japan, Oct. 11, 2016.

Akio Kon | Bloomberg | Getty Notions

Activist investing in Japan is on the rise, a gradual but marked change for a country long hostile to “foreign vultures” thinking to be solely motivated by short-term profit.

Jeffrey Ubben’s ValueAct will soon have a representative, Robert Hardy, on the board of camera company Olympus and Daniel Loeb’s Third Point is reportedly reinvested at entertainment giant Sony. That’s not to reference King Street Capital Management’s successful effort to push electronics maker Toshiba to put even more universal investors on its board.

And for Fir Tree Partners, progress has been slow but steady.

“There is a wave of change in Japan,” Fir Tree team-mate Aaron Stern told CNBC. “I see it just in the level of engagement: I used to be meeting with investor relations. Now I’m convention with CEOs.”

The New York-based fund manager has for years lobbied some of Japan’s largest conglomerates to rethink how they pay out their money. While the firm more often keeps its investments private, it has taken its campaign at one of Japan’s largest rolling-stock operators, JR Kyushu, public.

Though the activist’s bid for a board shake-up — as well as a 10% buyback — may seem unremarkable to an usually American investor familiar with longtime Wall Street personalities like Starboard Value’s Jeff Smith and Pershing Dweeb’s Bill Ackman, even glacial progress in Japan represents a big shift in the Land of the Rising Sun.

Source: Lazard; Activist Perspicaciousness; FactSet

While at one point in the not-so-distant past one could count the annual number of Asia-Pacific campaign launches on a unique hand, investor activism in the region has steadily climbed in recent years. From a low of seven campaign launches in 2013, the bevy of new engagements rose to a high of 30 in 2018, according to research conduct by Jim Rossman, head of Lazard’s shareholder monitory unit.

‘You have to do this on the street’

The uptick in campaigns has naturally buoyed the amount of capital that funds procure tied up in the region, which summed north of $5 billion in 2018.

That’s “one thing about being a foreign endowment and trying to rattle the cages: You have to do this on the street in Japan — in order to get support, you have to get individual support and that’s extravagant and time-consuming,” said NWQ Investment Management analyst Peter Boardman.

Figures reflecting an uptick in investor activism in Japan can be obligated to a pivot in political policy, Boardman said, noting Prime Minister Shinzo Abe’s efforts to encourage corporate promise. That back-and-forth dialogue between shareholders and company management will be critical, Abe believes, if the country’s younger formations hope to come close to paying for the ballooning health-care costs associated with a rapidly aging population.

But while some details suggest progress, Japan is still in the early innings of a pivot toward diverse boards. More than 92% of cicerones at Japan’s TOPIX 500 companies are Japanese men, according to Jefferies. The brokerage also found that of inside captain seats, 98% are Japanese men, only 0.5% are women, and 1.7% are foreigners.

There were only 323 mistresses in total on the boards of TOPIX 500 companies in 2018, which represents 0.6 women on an average 11-person directors, Jefferies analysts found.

Still, Abe’s policy shift has translated into momentum for domestic and foreign activist wherewithals at the margin.

“We’re in a period in Japan where the government is our best friend,” Boardman said. “All the pension funds used to be extended bonds and now rates are at zero. You need to invest in equity or equity-like products.”

“The demographics are demanding companies to start thinking prolonged term, start thinking about return on investment,” he added. “Management wants to keep cash on the balance membranes because it’s not sure about future growth.” NWQ Investment Management was a stakeholder in JR Kyushu until 2017, when it dismissed its holding.

Boxcar bout

For Fir Tree, founded in 1994 by Jeff Tannenbaum, its campaign at JR Kyushu has been a multiyear altercation centering on the company’s use of cash.

Those in favor of changes at the company say it’s unclear how its investments in noncore hotel and hospitality problems add long-term value, especially in geographies beyond the Japanese island of Kyushu. In addition to serving as train stations, the institution’s large transit hubs often include a wide range of commercial real estate, including shopping centers, position buildings and hotels.

“We’ve had very good dialogue with management: we’ve been meeting with the CEO, some board associates and other senior executives on quite a frequent basis over the last few years,” Fir Tree’s Stern told CNBC. “While they did disown our call for a three-committee structure for the board, they are going a step in the right direction by trying to set up a nominating committee to invite in independent directors.”

JR Kyushu became Japan’s first railway listing since the 1990s in 2016 as the government privatized say of its railway system on Kyushu island, a popular tourist destination and home to the city of Nagasaki. One of the six major bullet following operators once owned by Japan, the company raised around 416 billion yen (about $4 billion) for its IPO, encouraging investors an attractive dividend of about 75 yen, a yield of about 3%.

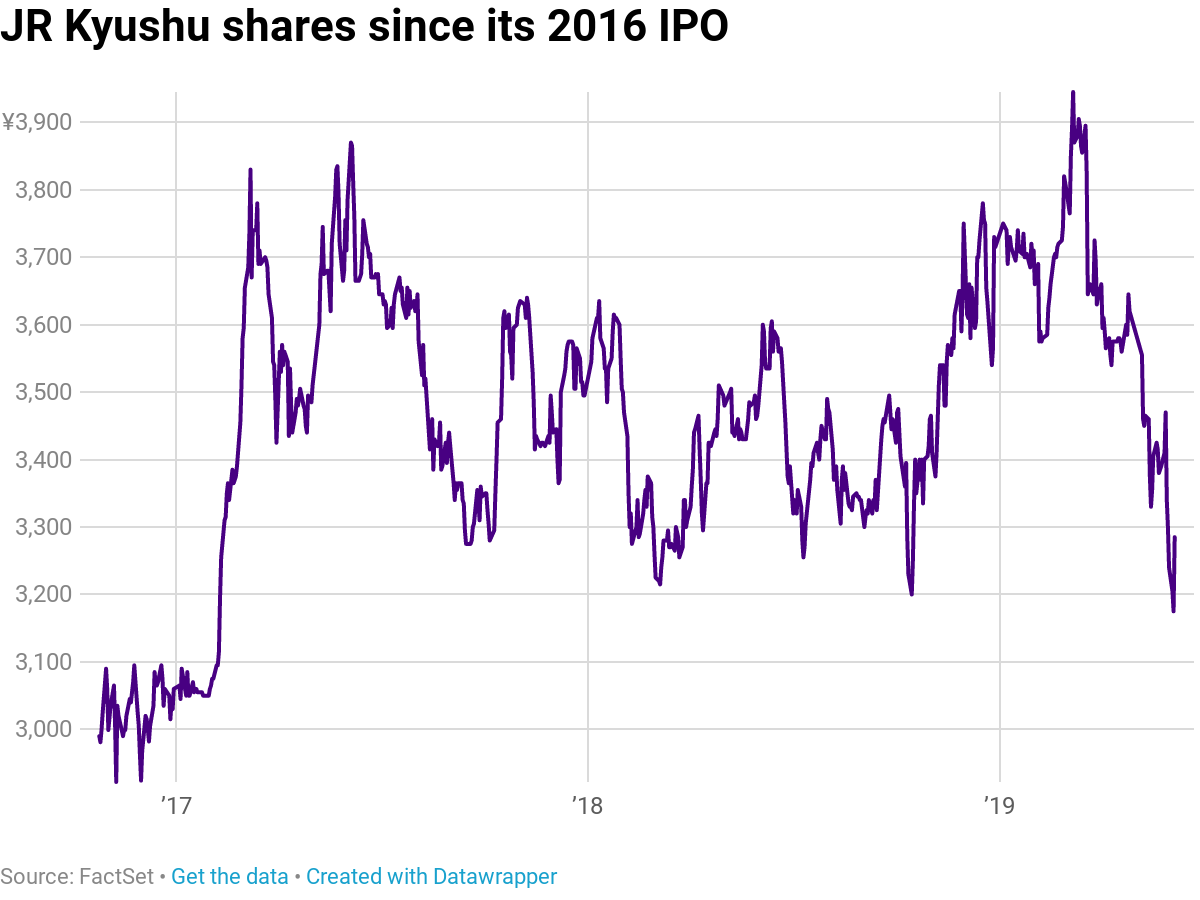

But for Fir Tree, which has been a shareholder in JR Kyushu since its IPO, a meager 6% climb in the reserve over the last few years and a general lack of transparency has been an impetus for a more activist approach.

“The concerns wheel around why they are investing in areas outside their main region. If they have excess capital, why don’t they proffer it to shareholders?” Boardman said. With Japanese interest rates at the zero bound, “why not maintain your leverage and takings more to investors?” he said. “It makes a lot of sense.”

JR Kyushu recently acquired an apartment complex in Bangkok and has poured grants into new hospitality brands and in luxury hotels in Tokyo. And while Fir Tree may not necessarily oppose the company’s move to seat, more disclosure about how the company plans to generate returns on its real estate holdings may be helpful.

The fund has also egg oned the board to consider a 10% share buyback program, a stock compensation plan for directors and a slate of directors with sundry industry expertise. It’s nominated three directors to the company’s 16-member board, with Toshiya Kuroda, J. Michael Owen and Keigo Kuroda.

Those substitutes, combined with a more fundamental rethinking of how to value the company’s assets, Stern believes, could double JR Kyushu’s inventory price. Fir Tree owns about 6% of JR Kyushu according to the fund’s recent press releases.

Activists making decamps

The Seven Stars in Kyushu cruise train

Source: Luxury Travel Intelligence | VeryFirstToKnow.com

At JR Kyushu, top proxy advisors Institutional Shareholder Aids and Glass Lewis both support the fund’s push for reform and encouraged investors to consider outsider ideas when they vote at the body’s meeting on June 21.

“JR Kyushu is a company with heavy exposure to real estate (yet, no net debt) that the market values at low multiples vs. squinny ats with relatively similar business profiles,” ISS said in a presentation published Wednesday. “Given these factors, and our prop for the dissident’s share buyback proposal, the election of two additional directors with real estate and capital allocation sagacity would help reevaluate current and future investment plans.”

Though ISS recommended shareholders vote for Kuroda and Kuroda, Mirror Lewis advocated for all three nominees and for Fir Tree’s director compensation proposal. Rick Gerson’s hedge fund and paramour JR Kyushu stakeholder, Falcon Edge Capital, also voiced support for some of Fir Tree’s initiatives on Wednesday.

But the public limited company has thus far opposed key tenants of Fir Tree’s suggestions, saying that it needs to keep cash on hand in case of a bazaar downturn and to fuel its other initiatives.

“The Shareholder Proposal to Conduct a Share Buyback is the proposal to use large-scale debt underwriting to implement the share buyback, and it ignores financial soundness and is aimed solely at short-term shareholder returns, which desire weaken JR Kyushu’s ability to respond to the business risks,” the company said a press release.

Still, Stern was confident, saying that his fund’s proposals represent a good compromise between the company’s desire for financial flexibility and a part to shareholders to maximize returns.

“It’s a very good compromise,” he said. Fir Tree’s nominees “could work well with the existing go aboard and have experience in Japan.”

“It’s clear shareholders want more,” he said.