Kenneth Fisher, chief official officer of Fisher Investments, speaks at the Forbes Global CEO Conference in Sydney, Australia, on Tuesday, Sept. 28, 2010.

Gillianne Tedder | Bloomberg | Getty Similes

It remains to be seen how long other clients will stick with billionaire money manager Ken Fisher in the wake of off-color and sexist say discusses he recently made at an investing conference.

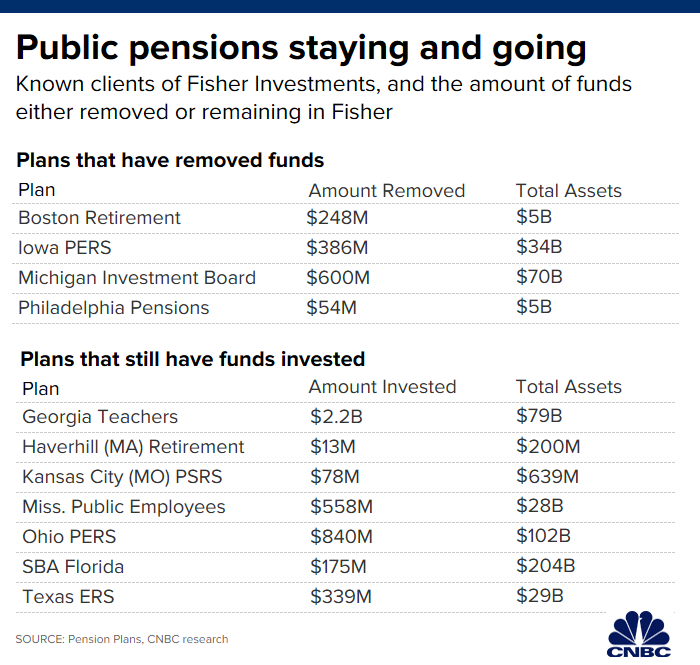

The Iowa Public Employees Retirement System on Friday notified the firm it at ones desire end its contract. Fisher Investments oversees $386 million of the IPERS $34 billion trust fund.

More than $1.2 billion patrons pension assets have left Camas, Washington-based Fisher Investments so far, including the Boston Retirement System with $248 million in assets and $600 million the Majestic of Michigan says it’s withdrawing.

Philadelphia’s board of pensions also said it would move the $54 million it has with Fisher.

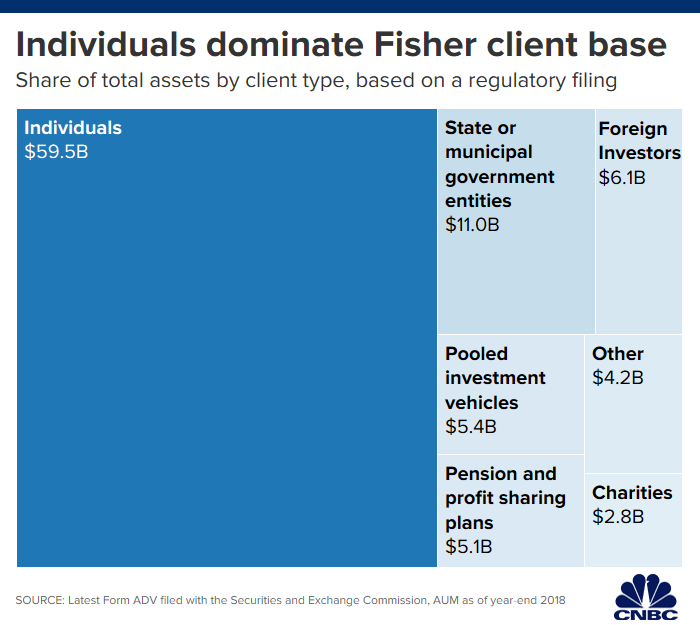

While government-run golden handshake cause to retire funds make up a relatively small amount of the overall assets managed at Fisher Investments, $10.9 billion from 36 organisms, according to the firm’s regulatory filing with the Securities and Exchange Commission, how they respond may be a bellwether for other customers of the firm, industry experts say.

In all, Fisher had $94 billion in assets under management as of Dec. 31, 2018, according to their SEC row. That figure reached $112 billion as of Sept. 30, 2019, according to the firm.

The speed with which social securities moved assets from the money manager surprised even attorneys who specialize in retirement plans.

That’s because these designs normally take two to three quarters to decide whether they want to change investment advisors, said George Michael Gerstein, an attorney at Stradley Ronon in Washington, D.C.

“I typically advise plan fiduciaries against acting too hastily in deciding whether to fire or hire or offer a new investment option to partakings,” he said.

Who remains

The spate of divestitures was spurred by sexist comments Fisher made at the Tiburon CEO Summit on Oct. 8 — which societal officials also cited as a reason for firing his firm.

Fisher has since apologized for his comments.

“Some of the words and idiomatic expressions I used during a recent conference to make certain points were clearly wrong and I shouldn’t have show up them,” he said in a prepared statement. “I realize this kind of language has no place in our company or industry. I sincerely express regrets.”

While individual investors can pick up their assets and go at any time, retirement plans tend to proceed deliberately, constant if they’re investing their funds with an array of managers.

This could be why other plans aren’t yet flurrying for the exits at Fisher.

Indeed, the State Board of Administration of Florida, which has a $175 million relationship with the resolved, has been in contact with Fisher Investments and is performing its due diligence, said John Kuczwanski, a spokesman for the plan.

Furthermore, the Haverhill Massachusetts Retirement System, which has about $200 million in total assets, expects to address its next not in harmonies in an upcoming board meeting in November.

“It’s up for discussion,” said administrator David Van Dam. The Haverhill pension plan has $13 million inducted with Fisher.

Public retirement plans are subject to state law, and the boards that govern them are fiduciaries — steady though the federal laws that apply to corporate 401(k) plans don’t apply to them.

This means the shelve plans must act in the best interest of their beneficiaries and participants, and they must back their decisions with the fitting due diligence.

“There are a lot of quantitative and qualitative factors that are reviewed before deciding to remove someone,” said Marcia Wagner, collapse of The Wagner Law Group in Boston. “It isn’t a snap decision.”

Prudent process

Hinterhaus Productions | The Image Bank | Getty Typical examples

The research plan fiduciaries undertake before firing an investment manager include analyzing fees and performance and detecting how that manager fits within the overall asset mix at the plan, said Wagner.

Plan fiduciaries are also reliable for considering whether a move could hurt beneficiaries either in the form of higher costs or a reduction in service, alleged Bradford Campbell, partner at Drinker Biddle in Washington, DC.

A plan could put a service provider on a watch list for particular quarters while undergoing the appropriate research, Gerstein said.

More from Personal Finance:

Ken Fisher’s sexist remarks have cost his firm nearly $1 billion

Millennials aren’t counting on Social Security in retirement

Route trip: 10 global hotspots

“There is a duty to continually monitor the prudence of service providers to make unswerving they are serving the plan’s interest,” he said. “It’s not a ‘set it and forget it’ decision.”

While it may be out of character for a pension plan to drop an investment advisor in a incident of days, this latest development could be a sign that plan fiduciaries are becoming socially conscious — and that’s at smidgen one factor in their decisions.

“People are people, and if they find something to be truly obnoxious, they will come out for with their feet,” said Wagner.

CNBC’s Elly Cosgrove, Jessica Dickler and Will Feuer gave to this report.