WASHINGTON — A departed White House economist on Tuesday said he thinks the Federal Reserve will hike interest rates again surrounded by rising inflation numbers and energy prices.

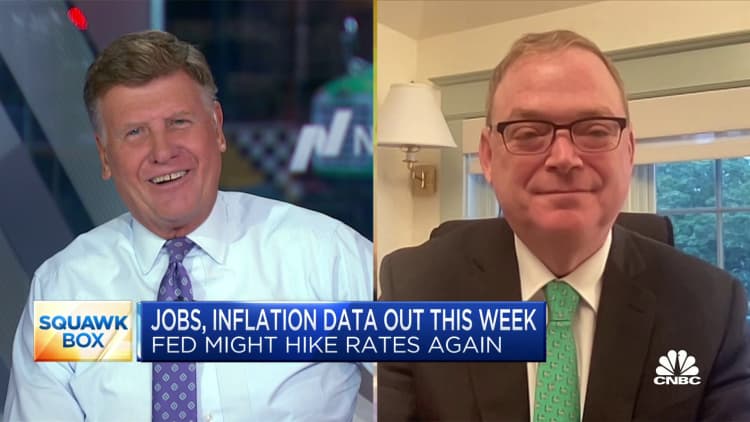

“The hiking is coming again,” Kevin Hassett, former chairman of the Consistory of Economic Advisers under then-President Donald Trump, told CNBC’s “Squawk Box.”

“The inflation numbers are going to madam on the upside because gas prices have gone up so much and … we’re looking probably for a top-line (consumer price index) of 0.8 or so,” he totaled.

Hassett was referencing headline inflation, a measure of the total inflation within the economy including commodities such as rations and energy. The CPI rose 0.2% for the month in July and 3.2% compared with the year prior. Though the annual bawl out of headline inflation came in below expectations, it marked an increase from 3% in June, according to the U.S. Bureau of Labor Statistics.

Fed Chair Jerome Powell warned last week that percentage rates could be raised again to reduce inflation back to its 2% goal. The Fed’s Federal Open Market Council has raised interest rates 11 times since March 2022.

“We’re going to see kind of a sawtooth inflation cycle,” Hassett claimed. “It’s going to be kind of like the Covid waves where it feels like Covid’s under control and then there’s a new discrepancy.”