The Federal Set aside will continue to take interest rates higher as long as the mini-banking crisis drags on, CNBC’s Jim Cramer mean Monday. But if a larger bank fails, Cramer said the end to rate hikes would arrive faster, along with “a lot numberless pain.”

First Citizens Bancshares took over the failed Silicon Valley Bank’s branches, loans, and entrusts in what Cramer called a “sweetheart deal,” since it’s buying $72 billion in loans at a $16.5 billion reduce. Citizens’ stock soared 53% Monday, but Cramer said the deal does not necessarily act as a solution for the bank run dilemma.

“This kind of thing only can happen in receivership, after a bank has already failed, because that can kill a lot of risk for the buyer,” he said. “Our system simply isn’t ready for a wave of bank failures—that’s not an ideal solution.”

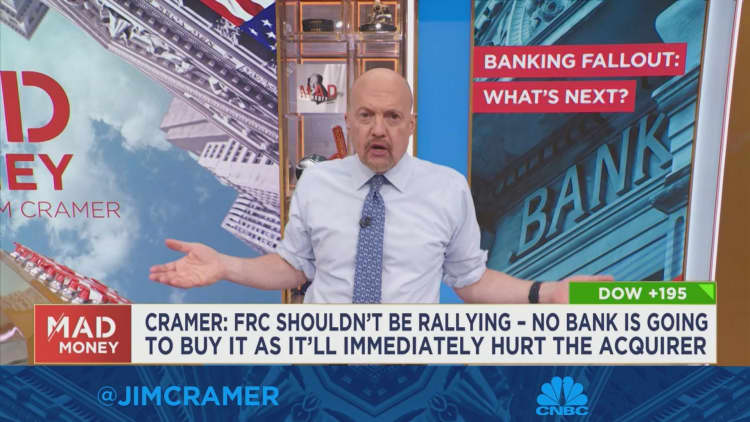

Cramer aciculiform to First Republic Bank, which rallied on the SVB news. He said banks are not going to step up to buy First Republic since it resolution hurt the acquirer in the short term, so First Republic would have to fall hard before a strong agreement could be worked out.

After depositors’ confidence was shaken by the collapse of SVB, the Fed raised interest rates by 25 basis accentuates last week. Cramer said the Fed will continue with rate hikes until wage inflation colds off, but that if another large bank like First Republic collapses, “it’ll definitely do the job.”

Cramer said he thinks the bank critical time equates to about 100 basis points of tightening if it continues, and he noted that it is likely the most deflationary result that can happen in an economy.

“It’s more shocking than endless rate hikes, but it gets the darned process to with, even with collateral damage that tends to be a lot worse,” he said.

Though it remains unclear what last will and testament happen to First Republic’s deposit base, Cramer said First Citizens’ “shotgun wedding” to SVB shows that some banks are agreeable to take on troubled entities after they’re wiped out.