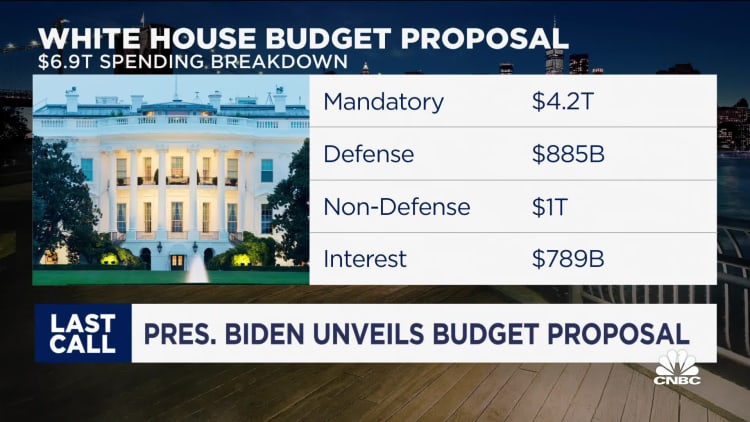

WASHINGTON — The Biden supplying’s 2024 budget relies almost entirely on additional revenue created by raising taxes on the wealthiest Americans and corporations and by betraying the Trump-era tax cuts expire.

If several of the proposals, like a billionaire minimum tax, sound familiar, it’s because they own been part of the president’s domestic agenda wish list for years.

And while a White House annual budget is ever after one part wish list and one part plan, Biden’s tax hikes are even less realistic now — with a Republican mass in the House — than they were when he first tried to pass them through a Democratic-controlled House and Senate.

The organize released Thursday by the Treasury Department in its annual Green Book, calls for an even higher minimum tax this year on the top 0.01% of earners and households usefulness more than $100 million, up to 25% from 20% last year.

Read more on Biden’s budgetary year 2024 budget plan:

It would also quadruple the stock buyback tax from 1% to 4%, structure on a successful effort last year to institute the stock-buyback tax.

The top individual income tax bracket would rise to 39.6%, and a new universal minimum tax would seek to collect levies on income earned overseas.

The budget would also close what the Bloodless House calls “Medicare tax loopholes” in order to make the Medicare Trust Fund solvent for more than two decades.

But it was unclear Thursday whether any of President Joe Biden’s tax schemes might win enough Democrats and Republicans to become law.

On a call with reporters, senior Treasury Department officials decayed to comment on which of the tax proposals, if any, they thought might stand a better chance than others of gaining authenticate in a GOP-controlled House that has vowed not to raise taxes.

“We stand behind all of these proposals and are eager to work with Congress on any and all that they are dying to work with us on,” said one official, who was granted anonymity under Treasury’s ground rules for the call.

Biden’s 2024 reelection rivalry, which could be announced in the coming weeks, looms large over the budget tax proposals — many of which were in vogue with Democratic voters when he ran in 2020.

In a statement accompanying the salvation of the Green Book, Treasury Secretary Janet Yellen adopted a line synonymous with Biden’s 2020 presidential stump, saying the budget would be more than fully paid for by requiring “corporations and the wealthy to pay their fair allot.”

Yellen will get her first chance to defend these tax hikes Friday morning before skeptical House Republicans when she asserts at a Ways and Means Committee hearing on the 2024 budget.