Try Street was largely bullish on Beyond Meat after the alternative meat producer reported a much bigger profit than calculated, but analysts warned the fundamentals may not matter right now for the once red-hot initial public offering.

Tuesday is the first dated since the IPO that insiders can sell the stock, which could cause short-term pressure, analysts said. Inhumanly 75% to 80% of the outstanding stock is available to trade after the lockup expiration.

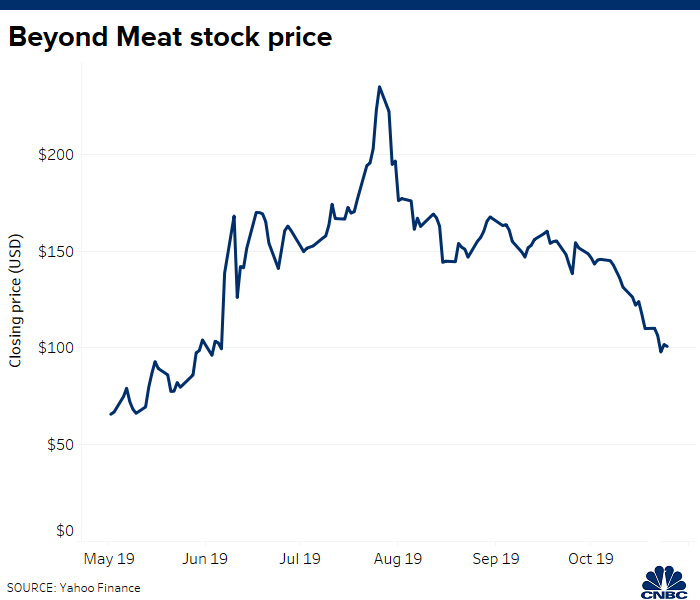

Beyond Meat plunged 24% to round $80 in morning trading Tuesday as investors anticipated a wave of insider selling. At that price, the stock wish be down more than 65% from its record intraday high of $239.71 in July as the alternative meat hype reached a fever toss. The shares were down 19% to $85.30 in midday trading.

“Much depends on the amount of selling pressure on the next few days,” said J.P. Morgan’s Ken Goldman in a note to clients where he raised his earnings estimates for the next two years and kept his overweight rating.

“Putting the lockup expiry in the past ultimately should incent some investors to start getting the stock again, though the shares could fade lower beforehand,” Goldman warned.

Typically, founders, workers and early private investors who buy into a company before it goes public are restricted from selling for between 90 and 180 periods. This is called a lockup period, which can cause a flood of insider selling and pressure the stock.

“Despite downright results the likelihood of early stage investors cashing out on a stock which is still up about 4x since its IPO, remains a block in coming trading sessions,” said Barclays analyst Benjamin Theurer in a note to clients Tuesday.

Despite Tuesday’s sell-off Beyond Essentials shares are still up more than 230% since its IPO in May. Despite the pressure the stock is seeing right now, Beyond Chow is a success story, reaching profitability by its third earnings report at a time when IPOs are being scrutinized for their be without of a bottom line.

CEO not selling

Beyond Meat, which has a market value of about $6.4 billion, on Monday cut off analysts’ expectations for its fiscal third-quarter earnings and revenue. The company reported earnings of 6 cents on revenue of $92 million, while analysts forewarning earnings of 3 cents on revenue of $82.2 million, according to Refinitiv. Beyond Meat saw sales grow across both its grocery and restaurant splits, as its meatless products drew in more customers and kept existing customers coming back.

“In terms of profitability, the New Zealand posted a solid gross margin expansion, supported by the greater operating leverage and productivity efficiencies, as well as the blooming platform, which generates higher levels of profitability,” said Theurer.

Beyond also raised its full-year 2019 perspective for revenue. It now expects revenue in a range of $265 million to $275 million, up from a previous forecast of more than $240 million. Sundry analysts on Wall Street said fourth-quarter guidance is too conservative.

Beyond Meat CEO Ethan Brown said he is not soul-stirring his shares after the lockup and is focused on growing Beyond Meat to a $40 billion company in terms of revenue.

“For workers it’s certainty around their personal circumstances that they have, if they just need liquidity,” Brown depicted CNBC’s “Squawk Box” on Tuesday. “I think the early investors it’s the investor mandate, what does their firm ask for them to do?”

Overall, Wall Street sees the lockup period as a short-term overhang. Shares of Beyond Meat shut up down 22.2% on Tuesday.

— With reporting from CNBC’s Dominic Chu and Michael Bloom.