Earnings for Warren Buffett’s Berkshire Hathaway vaulted in the first quarter, thanks in part to a rebound in the conglomerate’s insurance business.

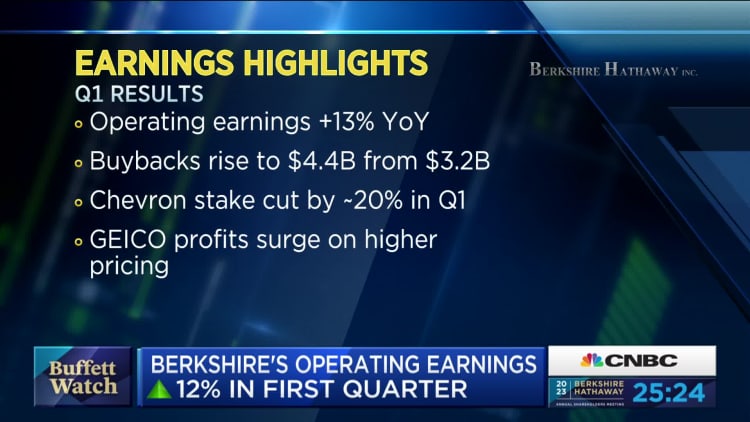

Operating earnings, which encompass profits from the conglomerate’s fully-owned charges, totaled $8.065 billion in the first quarter. That’s up 12.6% from $7.16 billion a year prior.

akin investing news

Profit from insurance underwriting came in at $911 million, up sharply from $167 million a year one-time. Insurance investment income also jumped 68% to $1.969 billion from $1.170 billion.

Geico saw a big turnaround in the station, returning to a big underwriting profit of $703 million. The auto insurer suffered a $1.9 billion pretax underwriting defeat last year as it lost market share to competitor Progressive. Ajit Jain, Berkshire’s vice chairman of bond operations, previously said the biggest culprit for Geico’s underperformance was telematics.

The company’s railroad business, BNSF, along with its dynamism company saw year-over-year earnings declines. Operations classified under “other controlled businesses” and “non-controlled businesses” had minute increases from the year-earlier period.

Warren Buffett at Berkshire Hathaway’s annual meeting in Los Angeles, California. May 1, 2021.

Gerard Miller | CNBC

Berkshire’s mazuma change hoard swelled to $130.616 billion from $128 billion in the fourth quarter of 2022. Berkshire also repurchased $4.4 billion benefit of stock — the most since the first quarter of 2021 — up from $2.8 billion at the end of last year.

Berkshire’s net earnings, which files short-term investment gains, increased to $35.5 billion in the quarter from $5.6 billion in the same period a year ago, on a first quarter comeback in Warren Buffett’s equity investments, such as Apple. Though Buffett cautions investors to not pay notice to quarterly fluctuations in unrealized gains on investments.

The company’s latest quarterly results come ahead of the conglomerate’s annual shareholders convention, an event known as “Woodstock for Capitalists.”

Berkshire Class A shares are up 4.9% this year through Friday’s detailed, lagging the S&P 500’s 7.7% advance. However, the stock is less than 3% below an all-time high.

— CNBC’s Yun Li aided reporting.

Follow CNBC’s livestream of Berkshire Hathaway’s 2023 annual meeting starting live at 9:45 a.m. ET Saturday here.

Root for live highlights and updates of the meeting here.