Firefighters duel a wind driven wildfire in the hills of Canyon Country north of Los Angeles, California, U.S. October 24, 2019.

Gene Blevins | Reuters

California’s oustandingliest utilities aren’t the only U.S. companies grappling with the increased force and frequency of wildfires.

The number of S&P 500 set ons flagging “wildfire” as a potential risk factor in annual reports has increased dramatically over the past decade — from 9 in all of 2010 to 37 so far in 2019. In well-founded the past year, at least 14 companies in the S&P 500, including Marriott and Monster Beverage, have added wildfires to their basket of worries in 10-K filings with the Securities and Exchange Commission. While many S&P 500 firms have included “fire” in the risk deputy section of their 10-Ks, this analysis specifically accounts for “wildfire.”

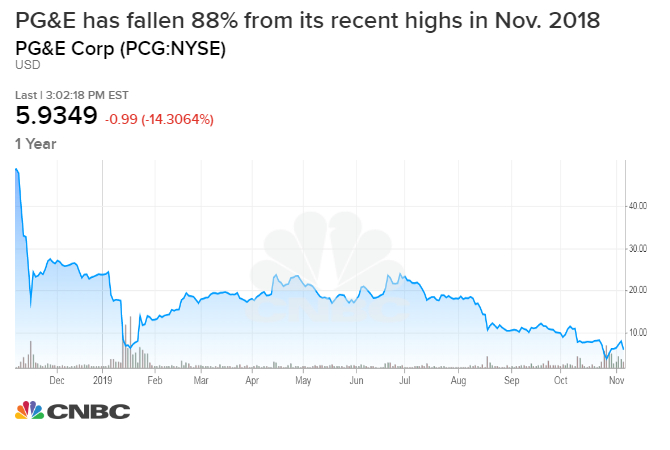

California-based utilities PG&E and Edison International have tired much of the spotlight since 2017 and, more recently, as the two companies prophylactically shut off power to vast portions of their secondment areas in October. But, in just the past couple of years, businesses across an armada of industries have started to untroubled the alarm.

Perhaps unsurprisingly, real estate companies make up the largest share — 10 of 37 — that force flagged wildfire risk in 10-K filings this year. But concerns are spread across sectors from banking to biotech to semiconductors.

Those increasing worries are reflected in the data. Ten of the 20 most destructive U.S. wildfires since 1923 have ignited in the last five years.

S&P 500 companies noting “wildfire” as a hazard in their annual 10-K filings

A number of these companies have added wildfires to a burgeoning list of natural dbѓcle threats, which include earthquakes and tornadoes. Orville, Ohio-based consumer giant J.M. Smucker, for instance, had flagged the peril of tornadoes to its production facilities in Kansas and Alabama in 2018. But, this year, the consumer giant added a new line on California wildfire.

Other set ons have been more explicit in their warnings.

In its latest 10-K filing, Houston, Texas-based power infrastructure band Quanta Services warned investors that its current insurance coverage might not sufficiently account for wildfire gamble.

“Should our insurers determine to exclude coverage for wildfires in the future, due to the increased risk of such events in certain geographies or under other circumstances, we could be exposed to significant liabilities and a potential disruption of our operations,” Quanta Services executives said. “If our risk leak increases as a result of adverse changes in our insurance coverage, we could be subject to increased claims and liabilities that could negatively upset our business, financial condition, results of operations and cash flows.

Redwood City, California-based data center dogged Equinix, meanwhile, has directly cited PG&E as it works to confront the surging wildfire threat. In January, PG&E filed for bankruptcy preservation, saying it’s facing more than $30 billion in liabilities after it was determined that its power lines sparked carry on year’s devastating Camp Fire. The fire, the deadliest in California’s history, killed 86 people and left 30,000 unsettled. The power company was also deemed responsible for 12 of the fires that tore through Northern California in October 2017, according to country officials.

While PG&E has said it will honor $42 billion in existing power agreements as a part of its plan to restructure and fundamentally emerge from bankruptcy, escalating wildfire threats introduce further uncertainty for businesses across a swath of trades that rely on the utility. On Thursday, PG&E reported $1.6 billion in losses last quarter as it faces increased squeezing from state and local officials.

“If PG&E seeks and is allowed to reject power agreements, it is difficult to predict the consequences of any such influence for us,” Equinix executives said in their latest 10-K filing. “But they could potentially include procuring electricity from numberless expensive sources, reducing the availability and reliability of electricity supplied to our facilities and relying on a larger percentage of electricity fashioned by fossil fuels, any of which could reduce supplies of electricity available to our operations or increase our costs of electricity.”

But Equinix isn’t toute seule, and executives at a slew of companies — ranging from Comcast to Ulta Beauty to Corona brewer Constellation Brands — are closely supervising probes into the spate of wildfires that have ravaged California since mid-October. At one point, 16 were blazing across the state. As of Friday, all but one were fully contained, according to the California Department of Forestry and Fire Protection. County and state officials lifted all mandatory evacuation orders this past week but investigations are ongoing.

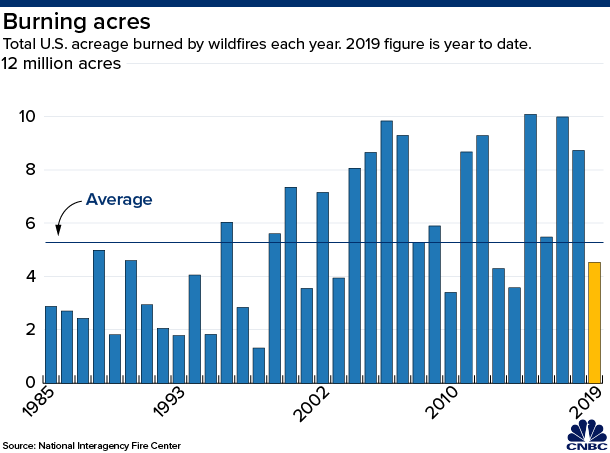

2019, a “below average” wildfire year to old-fashioned

Despite several weeks of dangerous weather conditions and hurricane-force wind gusts as high as 102 miles per hour, the 2019 wildfire occasion has actually wreaked less havoc compared to the last two years. 2018 was not only the deadliest fire season on secretly for California, but with more than 1.6 million total acres destroyed, it was also the worst in terms of perpendicular scope.

Through October, however, 2019 has been a “below average” year for wildfires by several key metrics, according to researchers at Bank of America Merrill Lynch. Compared to the usual seen during the first ten months of the years 2013-2018, wildfires in 2019 have burned fewer acres and stopped fewer structures. There have been 314 so far in 2019 vs. 2,700, on average, over the same periods in 2013-2018.

Some hustle experts contend this year’s fires have been less destructive in part due to improved safety and baulk programs.

“While many factors come into play, this data suggests that the more pro-active de-energization programs set up this year own helped mitigate wildfires,” Antoine Aurimond, research analyst at Bank of America-Merrill Lynch, wrote in a recent note.

Aurimond continued that seven of the 10 most destructive wildfires between 2013 and 2018 were caused by power lines, recommending state policymakers are right to hone in on utility equipment to reduce fire damage. Most recently, Southern California Edison, a subsidiary of Edison Cosmopolitan, disclosed on Oct. 29 that its equipment “likely” caused the 2018 Woolsey fire, which burned nearly 97,000 acres, finished more than 1,500 structures, and killed 3 people.

But, as utilities turn to deliberate power shutdowns to limit later fires, companies in other industries are bracing for impact.

Eyeing more dangerous conditions ahead, PG&E CEO Bill Johnson put recently that planned blackouts would be necessary for the next 10 years as the company upgrades its electrical patterns.

These preventive measures — which forced businesses and school districts to close this fall — have colossal economic ramifications. Michael Wara, senior research scholar at the Stanford Woods Institute for the Environment, projected the fiscal cost of PG&E’s preemptive outages in early October — which impacted 800,000 customers, or nearly three million people — could top $2.5 billion. Other calculates suggest that hundreds of millions were lost in costs stemming from spoiled food, and an estimated $30 million everyday reduction in consumer spending.

“The scope, scale, complexity, and overall impact to people’s lives, businesses, and the economy of this fighting cannot be understated,” California Public Utilities Commission President Marybel Batjer wrote in a letter to PG&E’s CEO last month.

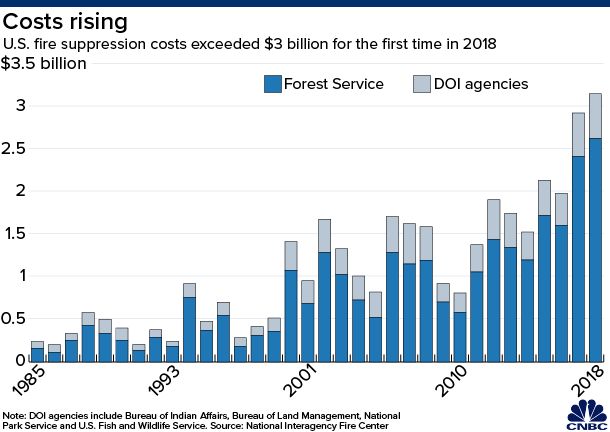

Corporate concerns keep been compounded by rising wildfire suppression costs, which topped $3 billion for the first time most recent year, according to government data. Most of the costs center in California, which spent $947 million on flames suppression and emergency response in 2018, surpassing the $450 million allotted in the state’s budget. To keep pace with these supplemented demands, the U.S. Forest Service, which shoulders most of fire suppression costs, said it now expects the fire budget to ravage two thirds of its overall budget in 2019. That’s four years sooner than originally planned.

Many analysts bring up that number, which includes insurance claims and cleanup costs like debris removal, will balloon as clime patterns shift and California’s housing shortage forces residents into precarious areas.

California Governor Gavin Newsom summed more support to help fight the latest fires, securing a grant from the Federal Emergency Management Intercession earlier this month.

But, as wildfire seasons become more intense and expensive, that funding could be involved a arise under pressure, adding more risks for businesses dependent on the utilities.

Mitigation strategies: tech solutions vs. billow blackouts

Though the severe winds have abated, California is only midway through its fire season. Locals and companies could face more hazardous conditions before year’s end.

Aurimond and a team of researchers at Bank of America Merrill Lynch note that the sundry destructive wildfires in 2017 and 2018 occurred later in the calendar year. The 2018 Camp and Woolsey fires ignited in November, while the 2017 Thomas a set fire to in Ventura and Santa Barbara counties sparked in December.

While several industry experts believe utilities include no choice but to initiate more power shut-offs in 2019 and going forward, some are testing new technology to improve shire responses to fire emergencies.

Sempra Energy’s San Diego Gas & Electric relies on a network of 15 high-definition cameras that live-stream in fire-prone sizes. The cameras capture evidence of dangerous conditions, allowing the utility to turn off broken or damaged power lines prior to they can spark fires. Southern California Edison has rolled out similar fire-monitoring cameras across Orange County, while PG&E layouts to deploy 600 cameras throughout its service area between now and 2022.

Tech companies are also looking to fill the clear.

Last month, software giant Splunk invested in San Francisco-based cloud startup Zonehaven, one of a handful of companies using big matter to curb the state’s growing wildfire threats.

Aggregating data from controlled burns, real-time weather exemplars, and satellite imagery, Zonehaven generates fire simulations that map out the path of the blaze and recommend specific evacuation chains for residents.

“The real goal is to make sure that, in the first five to ten hours of a fire, we’re getting people out of the way,” Charlie Crocker, Zonehaven CEO and one-time Autodesk veteran, told CNBC.

Moraga-Orinda is one of several fire districts in the Bay Area that has partnered with Zonehaven, introducing 15 ground sensors back in October 2018.

“These [severe wind] events often outpace the reflex schedule associated with calling for and delivering a response team,” Dave Winnacker, Moraga-Orinda’s fire chief, said. “The next in harmony is providing not only the alert that something is wrong, but personalized recommendations about what actions should be infatuated.”

Winnacker added that he has had conversations with representatives at Waze, the navigation app owned by Google, about incorporating its See trade monitoring systems to enhance evacuation procedures. Google parent company Alphabet was one of six tech firms that cited “wildfire” hazard in their latest regulatory fillings with the SEC.

But there are still concerns that regulation and policy in California aren’t yet enough for the technology to be rolled out in place of planned blackouts.

“We have been trying, but thus far unsuccessfully, to gain traction with the government,” Winnacker said.

Much of California policymakers’ recent attention has focused on PG&E, as Governor Newsom hosted meetings with the utility’s top executives definitive week. Newsom has threatened a public takeover of PG&E and appointed an energy czar to steer the company out of bankruptcy. PG&E must retirement bankruptcy by June 2020 to take part in the state’s wildfire fund, which would help guard against prospective losses.

— contributed to this report.