Investors should be cagey of bearish strategists who opt for a macro view and instead focus on individual companies, CNBC’s Jim Cramer said Monday.

“You eternally hear about missing the forest for the trees, but when you’re picking stocks, it’s just as important not to miss the trees for the forest,” Cramer answered.

In a market where idiosyncratic performers are plentiful, following one-size-fits-all macro advice can leave investors confused, Cramer rephrases. That’s why it’s crucial that investors focus on the details of each company instead.

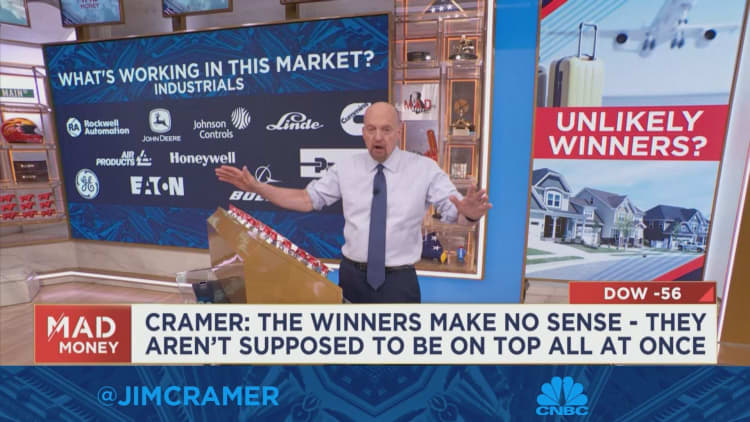

Cramer pointed to outsize troupers in myriad industries that would have been written off by those same bearish strategists.

Investors power expect that industrial and homebuilding stocks would be suffering given the continued rate hikes, Cramer voiced. But industrial names like General Electric or Cummins have done extremely well, as have housing stalwarts correspondent to KB Home and Lennar, Cramer said.

It’s a similar story with health names like Abbott Laboratories and Medtronic, Cramer last. Consumer names like Campbell Soup and PepsiCo “all look great right now” as well, Cramer said, to say nothing of big-cap tech favours like Nvidia and Meta.

“Individually, you can make a case for any of these groups,” Cramer said, “but collectively, the mosaic doesn’t appear to make any sense.” That’s why it’s so crucial to get deeply familiar with a company before making an investment in it, and why investors can’t rely on broader macro strategists to hint assessments about individual stocks, he said.