After various days of a rapid-fire sell-off that rattled global markets, CNBC’s Jim Cramer and technician Bob Lang took to the designs to prove that some stocks are still worth investors’ on the dot.

Lang, the founder of ExplosiveOptions.net and one of the three market minds behind TheStreet.com’s Trifecta Sheep newsletter, specifically called attention to four of the market’s most recognizable names.

“Here’s the utensils: almost exactly five years ago, Lang had this idea for a ingenious acronym that would sum up the hottest growth stocks around, FANG — knee-pants for Facebook, Amazon, Netflix and Google, which has since become Alphabet,” Cramer remarked. “I liked the idea so much that I shamelessly adopted it. Some last will and testament even go so far as to say I stole it.”

The “Mad Money” host admitted that the FANG regulars, like most, were not immune to the market-wide sell-off. All four staples fell hard in the last week, only starting to pare their diminutions on Tuesday.

But in the last five years, their gains have been jolt, Cramer noted: Facebook is up 547 percent, Amazon has run 441 percent, Netflix has rushed 967 percent and Alphabet has tacked on 183 percent.

In comparison, the Nasdaq move further 124 percent over the same time frame and the S&P 500 climbed 78 percent — not bad, but almost inaudible compared to FANG, Cramer said.

“More importantly, for the last five years, FANG has been incredibly resilient. As Lang stresses out, the so-called experts tried to crush these stories over and closed again,” Cramer said. “None of it really mattered. Every on many occasions, FANG bounced back.”

So as investors reevaluate their holdings surrounded by wild market volatility, Cramer and Lang took to the charts of each FANG stockpile to determine whether the tech titans could have even assorted upside.

First up was the daily chart of social media giant Facebook. After liberating a series of higher highs and higher lows, a typically bullish representation, shares of Facebook tanked on Monday, pulling back to $180.

Facebook’s forefather even grazed the $177 level on Tuesday before settling at $185, but Lang unmistakeable out that its floor of support just under $180 has held spot on three times since the fall.

“Will it bounce again? Lang contemplates so,” Cramer said. “He likes that the Chaikin Money Flow, which dispenses the level of buying and selling pressure in a stock, has remained positive … saying the big institutions still have an appetite for Facebook. Put it all together and he wouldn’t be surprised if Facebook can make as if a move to $200 in the not-too-distant future.”

Next, Cramer and Lang bent to the daily chart of Amazon, the e-commerce colossus involved in everything from chow retail to entertainment to, most recently, health care.

Amazon percentages declined dramatically on Monday, but only after a staggering run, Cramer held. Just over three months ago, Amazon’s stock was at $970 a part. Now, it’s hovering at $1,442 a share.

The online retailer also reported earnings terminal Thursday after the market closed, causing the stock to surge by for $100 a share on Friday despite the beginnings of the sell-off.

“Lang partialities that the Chaikin Money Flow has stayed strong here, and he also corresponding ti that the stock’s recent rally happened on strong volume,” Cramer contemplated. “There’s really a lot to like with Amazon, which is why Lang discovers it making a run to $1,500.”

After spending much of January soaring to new highs, apportionments of Netflix dropped in recent sessions along with the rest of FANG.

But Lang eminent that Netflix’s declines happened on lower volume, an indicator technicians use to discover whether a move is deserved or not. Weak volume means the move could be “deceptive,” Cramer said.

“Meanwhile, Netflix has a nice floor of support at its 20-day persuasive average, currently at $242, and the Chaikin Money Flow is still altogether high, meaning the big institutions continue to lap this stock up,” Cramer revealed. “Lang believes Netflix can go from $265, where it is now, to $300.”

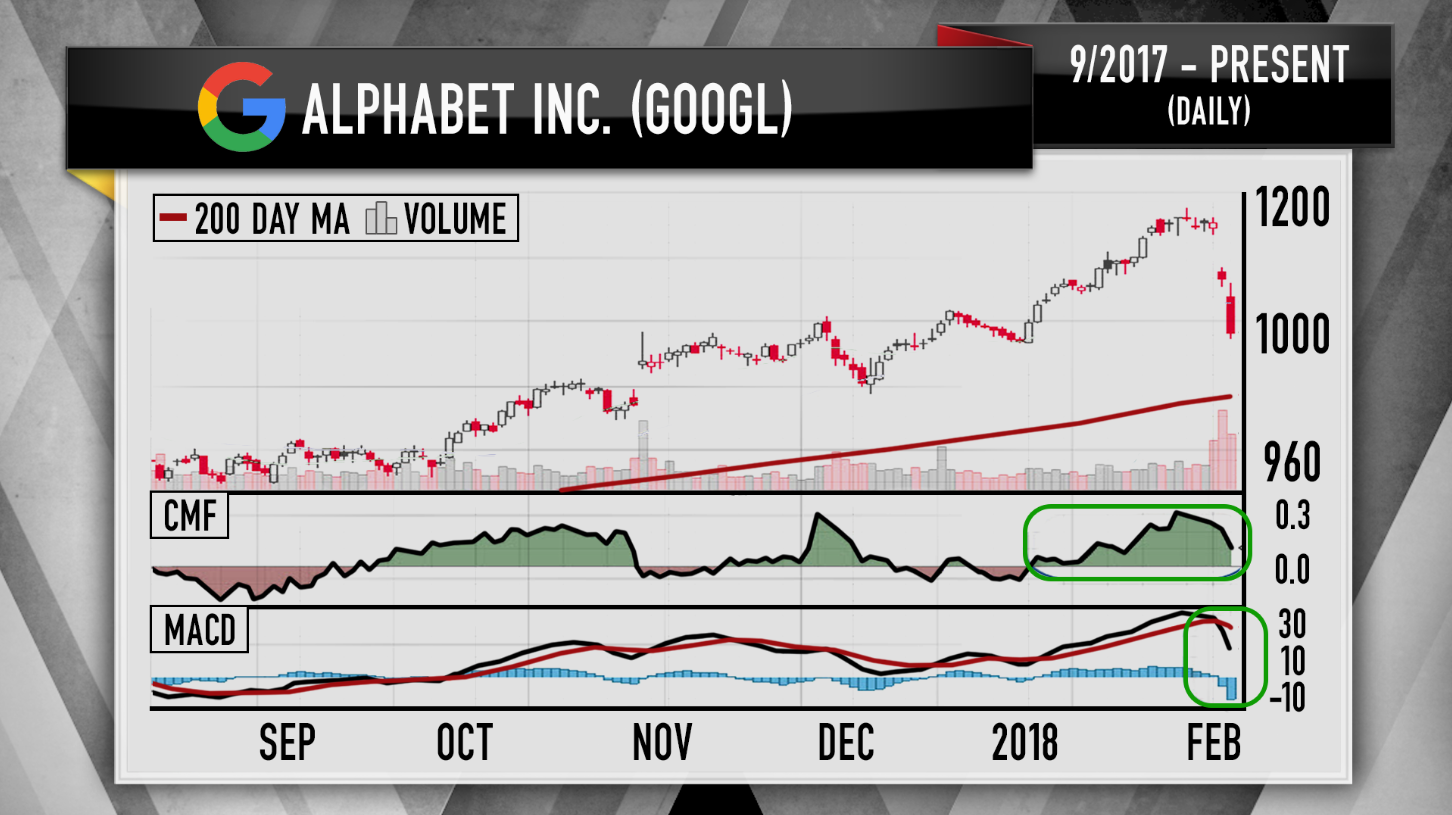

Finally, Cramer drifted to the daily chart of Google parent Alphabet.

Shares of Alphabet deduced a nosedive after the company’s weaker-than-expected earnings report last Thursday, mournful even more at the start of this week.

“This is the one FANG component that Lang’s not view quite so sanguine about,” the “Mad Money” host said.

Lang noticed that the trade in’s moving average convergence divergence indicator, or MACD, which facilitates technicians spot changes in a stock’s path before they materialize, recently made a bearish move, depicted on the chart by the black ceil accept bribes crossing below the red.

The MACD tends to be a reliable indicator, but Cramer telling out that Alphabet’s money flow was still strong. Still, all apparatus considered, Lang came out fairly bearish on Alphabet.

“Put it all together and Lang could see Alphabet backside out at the current levels,” Cramer said. “He thinks the $1,050 level make be a buying opportunity, and if the stock can settle down a bit, he wouldn’t be surprised if it can chair back to $1,200. But he says it’s probably going to $1,050 first.”

“For five years, Facebook, Amazon, Netflix and Alphabet outlasted everything that the bears had to throw at them, and each time they earned out stronger than before,” Cramer said. “The charts, as interpreted by the beyond belief Bob Lang, suggest that this time may be no different. He does count on Alphabet to pull back some more before it can find its position. But as for Facebook, Amazon and Netflix, he’s optimistic. Me? I remain a FANG stalwart.”

Disclosure: Cramer’s lenient trust owns shares of Facebook and Alphabet.

Questions for Cramer?

Gather Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s era? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – VineThemes, comments, suggestions for the “Mad Money” website? madcap@cnbc.com