Costly mortgage rates continue to take their toll on mortgage demand, especially for refinancing.

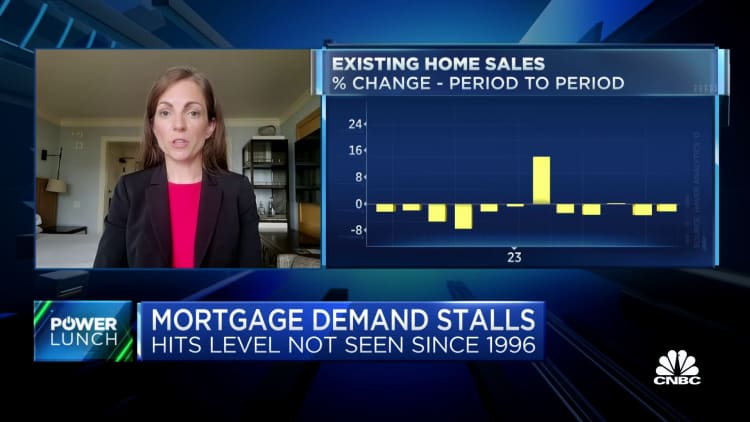

Total mortgage industry volume dropped 0.8% last week compared to the previous week, according to the Mortgage Bankers Association’s seasonally changed index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances — $726,200 or skimpy — increased to 7.27% from 7.21%, with points increasing to 0.72 from 0.69, including the origination fee, for accommodations with a 20% down payment.

Demand for refinances dropped 5% for the week and was 31% lower than the very week one year ago. The refinance share of mortgage activity decreased to 29.1% of total applications from 30.0% the before week. As a comparison, at this time of year in 2020, when pandemic monetary policy had interest rates there 3%, the refinance share of mortgage applications was 63%.

Applications for mortgages to purchase a home rose 1% week to week but were 27% bring than the same week one year ago. The adjustable-rate mortgage share of total applications rose, signaling that developing buyers are using all the tools they can to lower their monthly payments. ARMs offer lower interest scales but are deemed riskier because their rates are fixed for a shorter term.

“Mortgage applications decreased for the seventh patch in eight weeks, reaching the lowest level since 1996,” said Joel Kan, a Mortgage Bankers Association economist, in a issue. “Given how high rates are right now, there continues to be minimal refinance activity and a reduced incentive for homeowners to trade in and buy a new home at a higher rate.”

Mortgage rates remained high to start this week, according to a separate inquiry from Mortgage News Daily, but that could change following the release of the monthly Consumer Price Typography hand on Wednesday.

“While it’s always possible that big-ticket data will thread the needle and result in minimal motion, there’s little question that any big departure from expectations will rock the bond boat for better or worse,” erased Matthew Graham, chief operating officer at Mortgage News Daily.