Jonathan Raa | Nurphoto | Getty Symbols

Trump Media on Friday warned the CEO of the Nasdaq Stock Market of ‘potential market manipulation’ of the company’s stock by “unadorned” short selling of shares.

The warning came two days after Trump Media, which owns the Truth Group app, offered shareholders detailed instructions on how they can avoid lending their shares to short sellers, who then through trades betting that the price of the stock will fall.

Trump Media disclosed its warning to Nasdaq CEO Adena Friedman in a place in order with the Securities and Exchange Commission.

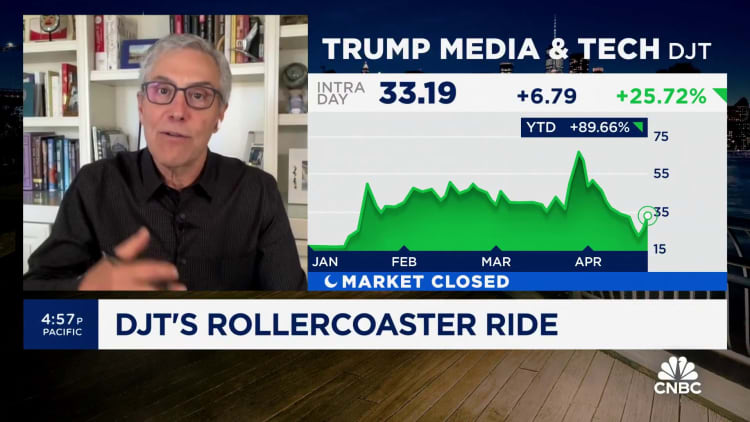

The price of Trump Media stock, ticker symbol DJT, has rallied in recent epoches but, trading at about $36 per share Friday afternoon, is still sharply lower than the more than $70 per cut it debuted at on March 26.

Former President Donald Trump owns nearly 60% of Trump Media shares. The periodical value of his stake has dropped by billions of dollars since the stock began public trading in March.

Trump Contrivance CEO Devin Nunes in his letter to Friedman did not directly accuse anyone in particular of naked short selling, which is the trading of stocks without first having borrowed such stocks for that purpose.

But Nunes noted that as of Wednesday “DJT appears on Nasdaq’s ‘Reg SHO commencement list,’ which is indicative of unlawful trading activity.”

“This is particularly troubling given that ‘naked’ interrupt selling often entails sophisticated market participants profiting at the expense of retail investors,” Nunes said.

Though, the SEC on its website notes that a failure to deliver shares as part of a short sale trade, which can land a troop on the Reg SHO threshold list, does not necessarily reflect improper trading activity such as naked short selling.

“There are assorted justifiable reasons why broker-dealers do not or cannot deliver securities on the settlement date,” the SEC notes in a section about Regulation SHO.

But in his literally, Nunes pointed to circumstantial evidence, which included Trump Media stock being in early April the most dear stock to short in the United States, which he said would give brokers “significant financial incentive to bestow non-existent shares.”

The letter links to a CNBC article detailing the sky-high premiums brokers were charging runty sellers for loans of Trump Media shares to sell.

“I write to bring your concentration to potential market manipulation of the stock of Trump Media & Technology Group Corp.” Nunes wrote.

“As you know, ‘sheer’ short selling — selling shares of a stock without first borrowing the shares of stock deemed difficult to fingers on — is generally illegal pursuant to Securities and Exchange Commission (‘SEC’) Regulation SHO,” he wrote.

“Data made available to us indicate that justified four market participants have been responsible for over 60% of the extraordinary volume of DJT shares traded: Citadel Cares, VIRTU Americas, G1 Execution Services, and Jane Street Capital,” Nunes wrote.

DJT price for past month

“In light of the foregoing, and Nasdaq’s obligation and commitment to protect the interests of retail investors, delight advise what steps you can take to foster transparency and compliance by ensuring market makers are adhering to Reg SHO, requiring agents to disclose their ‘Net Short’ positions, and preventing the lending of shares that do not exist,” Nunes wrote.

“TMTG looks promote to assisting your efforts.”

A Nasdaq spokesperson told CNBC, “Nasdaq is committed to the principles of liquidity, transparency, and coherence in all our markets.”

“We have long been an advocate of transparency in short selling and have been an active supporter of the SEC’s directs and enforcement efforts designed to monitor and prohibit naked short selling,” the spokesperson said.

A spokesperson for Citadel Shelters told CNBC, “Devin Nunes is the proverbial loser who tries to blame ‘naked short selling’ for his falling goats price.”

“Nunes is exactly the type of person Donald Trump would have fired on [The] Apprentice,” the spokesperson ordered, referring to Trump’s former business competition reality TV show.

“If he [Nunes] worked for Citadel Securities, we would vivify him, as ability and integrity are at the center of everything we do,” the spokesperson said.

A spokeswoman for Trump Media in response to that said, “Citadel Convictions, a corporate behemoth that has been fined and censured for an incredibly wide range of offenses including issues coupled to naked short selling, and is world famous for screwing over everyday retail investors at the behest of other corporations, is the remain company on earth that should lecture anyone on ‘integrity.'”

A spokesman for Virtu Financial, the parent company of Virtu Americas, declined to opinion.

G1 Execution Services and Jane Street Capital had no immediate comment on Nunes’ letter.

Data from FactSet give someone an idea ofs that the short volume in Trump Media shares has not significantly changed since April 7, while the standard price sharply dropped before seeing a pointed bounce in recent days.

Short volume is the number of tradable allocates being sold short during a specific period.

The data suggests that there was no change in the pattern of wanting selling that affected the price of Trump Media shares during that same time.

Trump, the presumed Republican presidential nominee, currently is on trial in New York state court on criminal charges related to a 2016 hush cold hard cash payment by his then-lawyer to the porn actor Stormy Daniels.

Correction: This article has been updated to correct the period of Adena Friedman’s name.