FTX CEO John J. Ray III aims to tell the House Financial Services Committee on Tuesday that the cryptocurrency exchange under Sam Bankman-Fried went on a $5 billion “squander binge” and comingled assets with those of his hedge fund, Alameda Research, according to the executive’s prepared look ats.

Ray lists those items among five things that he and his team have discovered since replacing Bankman-Fried newest month, when the company filed for bankruptcy. The crypto trading firm imploded in spectacular fashion following a run on assets compare favourably with to a bank run.

Ray said in his remarks that while “many things are unknown at this stage,” the new team knows the trail:

- Customer assets from FTX were commingled with assets from Alameda.

- Alameda used client lucres to do margin trading, exposing them to “massive losses.”

- FTX went on a “spending binge” from late 2021 in the course 2022 when approximately “$5 billion was spent buying a myriad of businesses and investments, many of which may be quality only a fraction of what was paid for them.”

- The firm made more than $1 billion in “loans and other payments…to insiders.”

- Alameda’s task as a market maker for crypto inspired it to place money into other exchanges that were “inherently unsafe.”

The observes validate some details about the collapse that have been previously reported by media outlets, including CNBC, Bloomberg, The New York Antiquates, The Wall Street Journal.

The committee made Ray’s opening testimony public on Monday, a day before the hearing that purpose focus on FTX’s collapse.

John Ray, chief executive officer of FTX Cryptocurrency Derivatives Exchange, arrives at bankruptcy court in Wilmington, Delaware, US, on Tuesday, Nov. 22, 2022.

Sarah Silbiger | Bloomberg | Getty Tropes

Bankman-Fried said in a Monday interview on Twitter Spaces that he plans to testify at the upcoming House hearing via video from his fingers on in the Bahamas.

Although Ray only mentions Bankman-Fried by name twice in his seven page opening remarks, it’s clear that innumerable of his initial criticisms about the company are directed toward the organization’s former leadership.

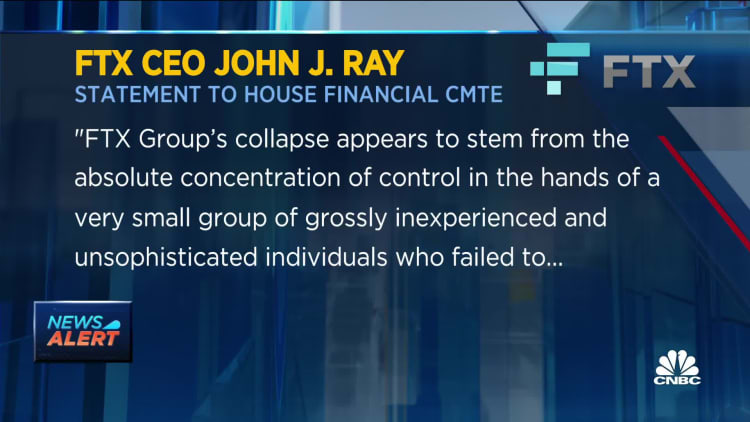

Ray, in his statement, said, “[N]eternally in my career have I seen such an utter failure of corporate controls at every level of an organization, from the deficiency of financial statements to a complete failure of any internal controls or governance whatsoever,” Ray says in his statement, echoing similar proclamations he made in the company’s bankruptcy filing.

Other issues at FTX, according to Ray’s opening remarks:

- The use of computer infrastructure that sent individuals in senior management access to systems that stored customer assets, without security controls to block them from redirecting those assets.

- The storing of certain private keys to access hundreds of millions of dollars in crypto assets without gear security controls or encryption.

- The ability of Alameda, the crypto hedge fund within the FTX Group, to borrow funds kept at FTX.com to be used for its own trading or investments without any effective limits.

- The absence of audited or reliable financial statements.

- The lack of personnel in pecuniary and risk management functions, which are typically present in any company close to the size of FTX Group.

- The absence of independent governance all over the FTX Group.