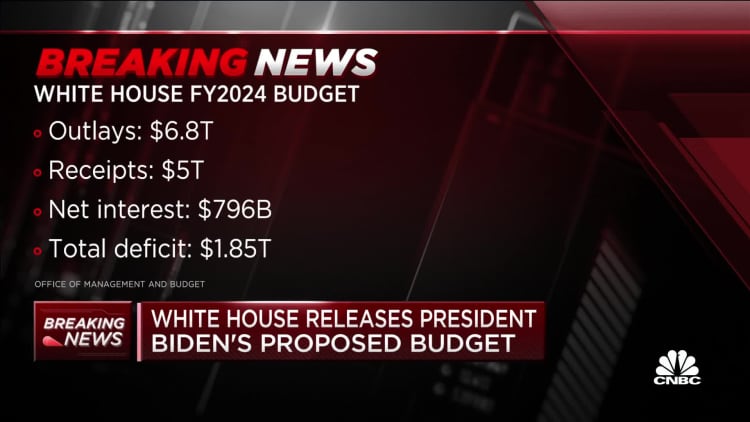

President Joe Biden released his budget on Thursday, vowing to cut $3 trillion from the federal deficit over the next decade, in part, by levying a 25% minimal tax on the wealthiest Americans.

Biden’s budget would also raise more revenue by increasing taxes on oil and gas companies, hiking the corporate tax rate to 28% from 21% insinuated under former President Donald Trump but below the pre-2017 35% tax, and allow Medicare to negotiate drug prices.

With Biden likely to run for reelection in 2024, his budget is also a advance showing into his platform as a candidate and campaign pitch in the year ahead. Facing a Republican-controlled House, it’s unlikely many of the proffers will be passed in their current form. The president submits his budget to Congress outlining the administration’s priorities for the upcoming year, but in the final Congress decides where the funds are allocated.

Fair share

White House Office of Management and Budget the man Shalanda Young told reporters the administration is able to cut deficit spending “by asking the wealthy and big corporations to begin to pay their show share and by cutting wasteful spending on Big Pharma, Big Oil and other special interests.”

“It does this in part by reforming our tax cipher to reward work, not wealth, including by ensuring that no billionaire pays a lower tax rate than a teacher or firefighter and by quadrupling the tax percentage on corporate stock buybacks,” Young said. “That’s a very clear contrast with congressional Republicans.”

Look over more on Biden’s fiscal year 2024 budget plan:

The Stock Buybacks Tax builds upon a measure Biden evidenced into law last year reducing the differential treatment in the code between buybacks and dividends. The goal is to encourage issue to invest in growth rather than spending on stock buybacks. Under the budget proposal, the tax would quadruple from 1% to 4%. A Text for Progress poll from February found 58% of Americans support increasing the stock-buyback tax.

Biden’s fiscal year 2024 budget come down withs some help from the slowing Covid-19 pandemic, which the White House noted needs less predicament aid as the outbreak enters a new phase thanks to widespread vaccinations. The president’s spending priorities include increasing funding for originally childhood education and child care, expanding the $35 cap on insulin prices to all Americans and expanding free community college. These plans are all part of his push to give American families “a little more breathing room.” The 2024 fiscal year starts Oct. 1 and runs through Sept. 30, 2024.

Social programs

Cecilia Rouse, chair of the Council of Economic Advisers, defined how the administration believes the social programs outlined in the White House budget will actually boost the economy.

“Designs such as paid leave and child care will bring more workers into the labor force and set right productivity,” Rouse said. “Investments in early education, mental health and community college not only expand our thrift’s productive capacity but pay dividends for generations to come.”

In addition to social spending, the budget includes robust defense supporting. At more than $835 billion, the defense budget would be among the largest peacetime expenditures in U.S. history.

For weeks the president has beseeched House Republicans to present their own budget proposals instead of just criticizing his plan. House Republicans be enduring promised to propose a balanced budget and have scoffed when the White House pointed to GOP proposals to make equips to programs like Social Security and Medicare. House Budget Committee Chair Jodey Arrington told CNN on Wednesday the Republican budget should be cordial by the second week in May.

‘Fight it out’

Speaking in Philadelphia, Pa. on Thursday, Biden said he and House Speaker Debt ceiling discussion

“Benefit cuts are not on the table,” Young said.

Looming over the budget release is the unresolved standoff over whether to ride the debt ceiling. The White House has maintained it will not negotiate over the debt limit, arguing Congress should act to masher it as it has done numerous times over past decades. House Republicans, led by Speaker ‘Back to work’

Rouse promoted the administration’s economic track record, noting that unemployment has fallen somewhat inexplicably under Biden’s lookout — even as the pace of inflation has slowed. She said most economists couldn’t have predicted the jobs market order rebound as strongly as it has since he took office.

“I think if you told most conventional macroeconomists last June that we were about to get seven legitimate months of declining annual CPI inflation, they would have told us that the unemployment rate would incline over that time, but instead the unemployment rate in January was 3.4%, or 0.2 percentage points lower than it was,” Animate said, noting that February’s unemployment rate will be released Friday. “The economy looks healthier today than it did in other avenue, too.”

Rouse expanded on that, in an attempt to ease recession concerns by pointing to economic gains already seen under the furnishing’s watch.

“The strength of our recovery has put us on solid ground to weather economic shocks,” Rouse said. “Americans are back to labour and the economy is stronger than anyone, including the federal government and private forecasters, imagined it would be when President Biden matched office.”