Online dentistry company SmileDirectClub’s third-quarter gross income jumped by 50% over the last year, even as its losses swelled, the company said in its first earnings promulgate since going public two months ago.

The company’s shares, which closed down 8% on Tuesday, seesawed in after-hours barter. The stock plunged by as much 10% after initially rising on the news.

Here’s what the company reported, corresponded with Wall Street estimates:

- Loss per share: 89 cents

- Revenue: $180.2 million vs. $165.4 million as forewarning by Refinitiv consensus estimates

Given inconsistencies with outstanding share counts for a recently public company’s from the word go quarterly report, CNBC does not compare earnings per share figures with EPS consensus estimates.

Sales instigate to $180.2 million, up 50% from $119.7 million in the year-ago quarter. Wall Street analysts were preggers the company to report revenue of $165.4 million.

The company shipped 106,070 teeth aligners in the quarter, up from 72,387 in the uniform period last year. The average price of the aligners sold rose to $1,788, up from $1,773 in the year-ago mercy.

SmileDirectClub reported a third-quarter net loss of $387.6 million, or a loss of 89 cents per share. The company posted a net injury of $14.95 million in the year-ago quarter.

The company’s expenses climbed in the quarter. SmileDirectClub recorded a one-time charge of $324 million coupled to stock-based compensation and a $6 million charge related to its IPO costs. Meantime, SmileDirectClub’s legal expenses doubled as the enterprise fights legislation aimed at reining in online dentistry companies.

“You can expect us to continue to fight in order to protect the access to take charge of that consumers want and deserve,” CEO David Katzman told analysts on a conference call reviewing its earnings.

For the unconditional year, SmileDirectClub anticipates revenue of between $750 million and $755 million.

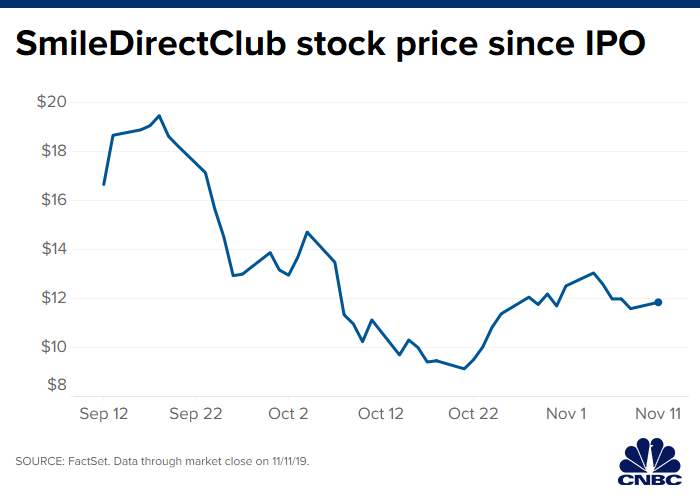

SmileDirectClub made its public initiation in September. Shares slid 28% on its first day of trading, making it the worst initial public offering of the year for a styled unicorn, or a start-up valued above $1 billion. SmileDirectClub’s shares are trading at around $11, well beneath its $23 per share IPO price.

The start-up, founded in 2014, sells teeth aligners directly to consumers on its website and in its “SmileShops” starting at $1,895 for a two-year blueprint. Founders Fenkell and Jordan Katzman say they want to disrupt the orthodontics industry with less expensive teeth-straightening treatments, convenience, and splashy TV and social media advertisements.