A cyclist supersedes the Federal Reserve headquarters in Washington.

Kevin Lamarque | Reuters

When the central bank cuts interest valuations as a preventative measure, U.S. equity markets have historically done very well.

So-called “insurance ” rate prepares with a backdrop of strong growth — which happened in 1995 and 1998 — resulted in solid equity market display, according to analysis by J.P. Morgan. But not all rate cuts are created equal. The stock market reaction depends on the justification for flogging rates.

“If the reason is weakening growth then this is not a good environment for equities overall, especially cyclical sectors, more than ever notwithstanding as defensive and bond like equities do relatively well in such environment,” J.P. Morgan global markets strategist Nikolaos Panigirtzoglou intended in a note to clients Monday.

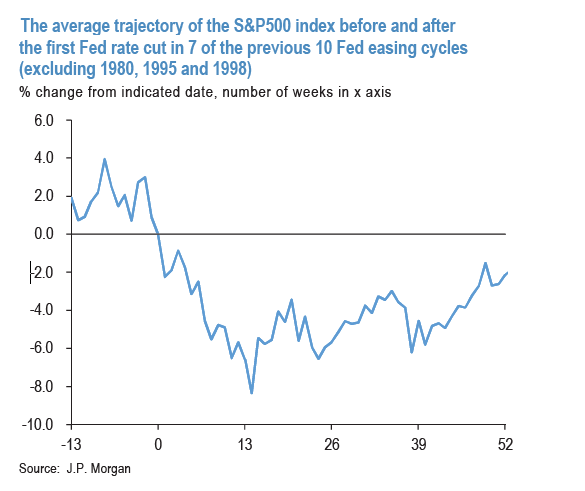

J.P. Morgan pointed out three “insurance cut” easing cycles in 1980, 1995 and 1998 that emerge to be outliers. The late 1990s rate cuts were used as insurance against Mexican and Russian default and go to pieces of hedge fund Long-Term Capital Management at the time, bolstered the equity market. The only other time the S&P 500 saw stronger bringing off following a rate cut was in 1980. At the time, there was an 8.5% reduction in the Fed funds rate from 20% to 11.5% — a equal of monetary easing that is “obviously not possible in the current conjuncture,” Panigirtzoglou said.

The overall trajectory of equity vends following the first Fed rate cut has been predominantly negative. Distinguishing which type of easing cycle 2019 resolve turn out to be “is the challenge for equity markets going forward,” he said. For now, markets appear to be assuming that Federal Substitute officials’ dovish comments are signs of a preemptive, rather than reactive move.

Investors have been cynosure cleared on the likelihood of an “insurance” interest-rate cut this year. That would theoretically provide a buffer against any economic fancy caused by an ongoing trade war and tariffs with China.

Weaker employment data last week added to the investors’ cravings of a rate cut. The economy added only 75,000 jobs in May, less than half of what economists had expected. Now that the job hawk is showing signs of strain, economists and investors now firmly believe the Federal Reserve will move to cut rates this year. The market-place is now pricing in a 95 percent chance of a quarter-point cut in July, according to BMO rate strategist Jon Hill. The Fed next meets June 18-19 and July 30-31.

On the other lunch-hook, if the central bank ends up being “reactive,” markets may not see the same benefits, Panigirtzoglou said. This could minimize out if the Federal Reserve decides to wait until later in the year, or it proves to be “too late” and the U.S. economy has already entered a debilitated phase, he said.

“Then the equity market could follow a weak trajectory similar to more typical earlier Fed easing cycles rather than the strong trajectory seen during 1995 or 1998,” Panigirtzoglou said.

Other asset classifications have mixed reactions. U.S.Treasury have historically rallied, and the curve continued to steepen for up to six months on average after a Fed pace cut. The dollar rallied for up to three months, but eventually tended to give up previous gains, according to the J.P. Morgan analysis.

— CNBC’s Patti Domm and Jeff Cox promoted reporting.