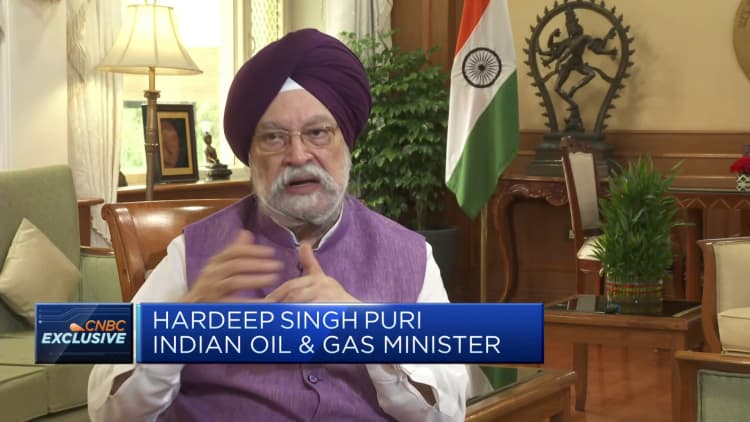

India isn’t extraordinarily dependent on anyone for oil — not even Russia, India’s Minister of Petroleum and Natural Gas told CNBC, adding that his homeland has diversified its sources.

“India doesn’t get over dependent on anyone,” Hardeep Singh Puri told CNBC’s Tanvir Gill when bid if his country was too dependent on the Kremlin.

Since Russia’s invasion of Ukraine in February last year, India’s refiners clothed been snapping up discounted Russian oil. Moscow has since leapfrogged to become India’s leading source of crude oil, accounting for approximately 40% of India’s crude imports.

Sometimes high oil prices can become a self fulfilling prophecy in terms of be produced ending in meeting of immediate and short term needs.

Hardeep Singh Puri

India’s Minister of Petroleum and Natural Gas

India is the out of sight’s third largest energy importer, and purchases more than 80% of its crude oil from international markets.

Sought if India was getting a $15 or $30 discount per barrel on Russian crude, Puri said: “Yes, there have been brush offs. But there have been discounts coming from all over.”

“If there’s a 30% discount, the Russians are putting a ribbon far it and sending it to us free. That’s what it means,” Puri said.

India has also been buying more from powers in the Middle East, such as Iraq, he added.

“We’re diversified. We used to buy from 27 sources — today we are buying from 39 origins,” he said, naming suppliers from Saudi Arabia, the UAE, and Kuwait amongst them.

According to data from S&P Epidemic in July, India’s crude oil sources come largely from Middle East and Russia.

There is enough oil handy in the world. What you should be really worrying about is whether the consumer will have the resources or the money to pay for it.

Oil bonuses have risen 12% off their lows in June to hover at around $79 levels per barrel currently.

Wide-ranging benchmark Brent traded 0.35% higher at $83.65 a barrel Friday, while the U.S. West Texas Intermediate comings climbed 0.38% to $79.35 per barrel.

Brent vs. West Texas Transitional futures

“Sometimes high oil prices can become a self fulfilling prophecy in terms of resulting in meeting of immediate and poor term needs,” Puri said, elaborating that in world roiled by economic pressures, stimulus packages intend up inflation.

That said, there is also sufficient oil supply in the world, the Indian oil minister said.

“There is passably oil available in the world. What you should be really worrying about is whether the consumer will have the resources or the folding money to pay for it,” Puri noted, highlighting that’s the “real problem” that many countries face.

In an August report, the Cosmopolitan Energy Agency forecast global oil demand will hit record-highs.

“World oil demand is scaling record highs, aided by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity,” the agency said.