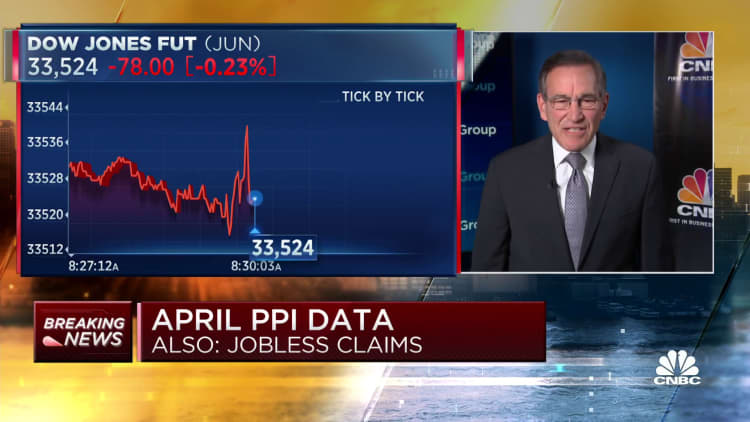

Wholesale evaluates rose less than expected in April, according to a Labor Department report Thursday that provides sundry hope that inflation is at least trending lower.

The producer price index, a measure of prices for final order goods and services, increased 0.2%, against the Dow Jones estimate for 0.3% and after declining 0.4% in March. Excluding provisions and energy, the core PPI also rose 0.2%, in line with expectations. The core reading was the same excluding business.

related investing news

On an annual basis, the headline PPI increased just 2.3%, down from 2.7% in March and the lowest understanding since January 2021.

Though the PPI rise was less than expected, the services index increased 0.3%, the biggest start the ball rolling since November 2022, the Bureau of Labor Statistics report stated.

A separate Labor Department report Thursday postured that jobless claims for the week ended May 6 jumped to 264,000, a rise of 22,000 from the previous period. The total was well-spring above the Dow Jones estimate for 245,000 and the highest reading since Oct. 30, 2021. Continuing claims edged higher to 1.81 million.

“This morning’s PPI unshackle indicates that prices are inching lower, a significant indicator for a market concerned about an elevated trend in expenses paid,” said Quincy Krosby, chief global strategist at LPL Financial. “The higher than expected initial unemployment asserts release, similarly is market friendly as the resilient labor landscape, underpinning higher wages, is showing signs of easing.”

At any rate, stock market futures were mixed following the data release as Wall Street worries over a liable ceiling impasse in Washington.

The reports come as the Federal Reserve has been using its policy levers to bring down inflation that had been continuous at a 41-year high last summer. Central bankers have raised their benchmark interest rate 10 dead for nows since March 2022 while reducing bond holdings that had approached $9 trillion at one point.

In a liberating Wednesday, the Labor Department said the consumer price index, a popular gauge of prices that consumers pay for a bevy of passables and services, increased 0.4% in April, equating to a 4.9% annual inflation rate. The latter number was the lowest decipher since April 2021.

The PPI differs from the CPI in that it measures prices that producers pay for the goods and services they penury.

The report showed that about one-third of the PPI services increase came from “portfolio management” services, which control mark offs the prices for investment advice and increased 4.1%. Gasoline prices rose 8.4%, pushing the goods index extreme by 0.2%.

Other notable increases came from food and alcohol wholesaling, outpatient care, and loan services. Ebbs came from long-distance motor carrying and a 37.9% plunge in the cost for chicken eggs.