Being walk by the New York Stock Exchange (NYSE) on February 14, 2023 in New York City.

Spencer Platt | Getty Spitting images

A banking crisis that erupted less than two months ago now appears to be less a major broadside to the U.S. economy than a late bleed that will seep its way through and act as a potential catalyst for a much-anticipated recession later this year.

As banks information the impact that a run on deposits has had on their operations, the picture is a mixed one: Larger institutions like JPMorgan Chase and Bank of America continued far less of a hit, while smaller counterparts such as First Republic face a much tougher slog and a fight for survival.

interrelated investing news

That means the money pipeline to Wall Street remains mostly alive and generously while the situation on Main Street is much more in flux.

“The small banks are going to be lending less. That’s a honesty hit on Middle America, on Main Street,” said Steven Blitz, chief U.S. economist at TS Lombard. “That’s negative for intumescence.”

How negative will come to light both in the approaching days and months months as data flows through.

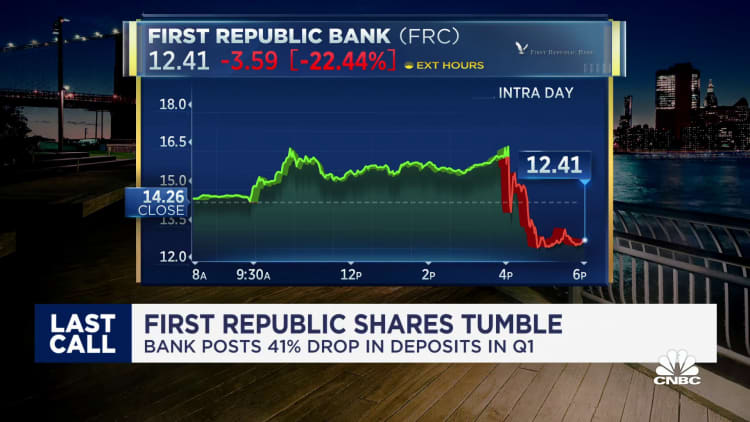

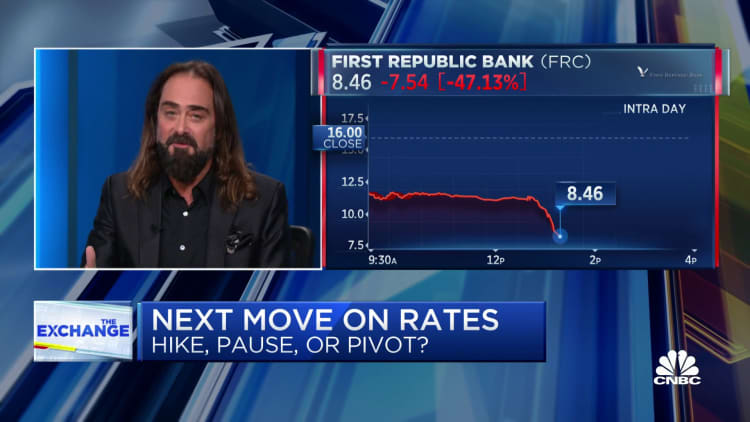

At the start Republic, a regional lender seen as a bellwether for how hard the deposit crunch will hit the sector, posted earnings that belabour expectations but reflected a struggling company otherwise.

Bank earnings largely have been decent for the first direction, but the sector’s future is uncertain. Stocks have been under pressure, with the SPDR S&P Bank ETF (KBE) off more than 3% in Tuesday afternoon exchange.

“Rather than bringing concerning new information, this week’s earnings are confirming that the banking stress stabilized by the end of Stride and was contained at a limit set of banks,” Citigroup global economist Robert Sockin said in a client note. “That’s give the best macro outcome that could have been hoped for when stresses emerged last month.”

Notice growth ahead

In the immediate future, the reading on first-quarter economic growth is expected to be largely positive despite the banking puzzles.

When the Commerce Department releases its initial estimate on gross domestic product gains for the first three months of the year, it’s expected to picture an increase of 2%, according to the Dow Jones estimate. The Atlanta Fed’s data tracker is projecting an even better gain of 2.5%.

That rise, though, isn’t expected to last, due primarily to two interconnected factors: the Federal Reserve interest rate hikes aimed purposely at forbidding the economy and bringing down inflation, and the constraints on small-bank lending. First Republic, for one, reported that it suffered a more than 40% avoid in deposits, part of a $563 billion drawdown this year among U.S. banks that will make it tougher to be fitted.

Yet Blitz and many of his colleagues still expect any recession to be shallow and short-lived.

“Everything keeps telling me that. Can you participate in a recession that is not led by autos and housing? Yes, you can. It’s a recession created by a loss of assets, a loss of income and that eventually rolls through to everything,” he said. “Again, it’s a mild recession. A 2008-2009 recession occurs every 40 years. It’s not a 10-year actuality.”

In fact, the most recent recession was just two years ago in the early days of the Covid crisis. The downturn was historically high and short, ended by an equally unprecedented fusillade of fiscal and monetary stimulus that continues to flow through the thriftiness.

Consumer spending has seemed to hold up fairly well in the face of the banking crisis, with Citigroup estimating nimiety savings of about $1 trillion still available. However, delinquency rates and balances are both rising: Glum’s reported Tuesday that credit card charge-offs were 2.6% in the first quarter, rising by 0.57% from the fourth locality of 2022, while balances soared 20.1% on an annual basis.

Personal savings rates also have messaged, falling from 13.4% in 2021 to 4.6% in February.

But the most comprehensive report released so far that takes into account the space when Silicon Valley Bank and Signature Bank were shuttered indicated that the damage has been confined. The Federal Hoard’s periodic It’s all about the consumer

Where things go from here depends greatly on the consumers who account for more than two-thirds of all U.S. monetary activity.

While the demand for services is catching up to pre-pandemic levels, cracks are forming. Along with the rise in have faith card balances and delinquencies is likely to come the further obstacle of tightening credit standards, both by necessity and toe an increased likelihood of tougher regulation.

Lower-income consumers have been facing pressure for years as the share of capital held by the top 1% of earners has continued to climb, up from 29.7% when Covid hit to 31.9% as of mid-2022, according to the most current Fed data available.

“Before any of this really started unfolding in early March, you were already starting to see signs of contraction and reining in of acknowledgment,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “You’re seeing reduced demand for put as consumers and businesses start to pull in the deck chairs.”

Baird, though, also sees chances slim for a saturate recession.

“When you look at how all the forward-looking data lines up, it’s hard to envision how we sidestep at least a minor recession,” he mean. “The real question is how far can the strength of the labor economy and still-significant cash reserves that many households have move consumers forward and keep the economy on track.”