The Swiss nationwide flag hangs from the Federal Palace, Switzerland’s parliament building, in Bern, Switzerland, on Thursday, Dec. 13, 2018. The Swiss Country-wide Bank cut its inflation forecast and showed no inclination of moving off its crisis-era settings, citing the francs strength and mounting wide-ranging risks. Photographer: Stefan Wermuth/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

The Swiss Civil Bank on Thursday surprised the market with a decision to lower its main policy rate by 0.25 percentage points to 1.5%, state national inflation is likely to stay below 2% for the foreseeable future.

Economists polled by Reuters had expected the Swiss middle bank to hold rates at 1.75%.

“For some months now, inflation has been back below 2% and thus in the range the SNB equates with charge stability. According to the new forecast, inflation is also likely to remain in this range over the next few years,” the bank said. Swiss inflation keep oned to fall in February, hitting 1.2%.

The SNB also reduced its annual inflation forecasts. The bank now sees average inflation reaching 1.4% in 2024, down from its 1.9% evaluation in December, and 1.2% for 2025, trimmed from the previous 1.6% estimate. Its first forecast for 2026 puts mediocre inflation at 1.1% over the period.

Following the announcement, analysts at Capital Economics said they expect two innumerable SNB rate cuts over the course of this year, “with the Bank sounding more dovish and inflation suitable to undershoot its forecasts.”

“We think inflation will come in even lower than the new SNB forecasts imply and remain around the inclination level of 1.2% before falling to below 1.0% next year. Accordingly, we forecast the SNB to cut rates at the September and December get-togethers taking the policy rate to 1%, where we think it will remain throughout 2025 and 2026,” Capital Economics analysts told in a note.

The September meeting is likely to be the last under the stewardship of SNB Chairman Thomas Jordan, who will step down at the end of that month after 12 years at the directorship.

The SNB said Swiss economic growth is “likely to remain modest in the coming quarters,” with the GDP poised to expand by crudely 1% this year.

“Our forecast for Switzerland, as for the global economy, is subject to significant uncertainty. The main risk is sicklier economic activity abroad. Momentum on the mortgage and real estate markets has weakened noticeably in recent quarters,” the SNB translated. “However, the vulnerabilities in these markets remain.”

On a macro level, the SNB flagged “moderate” global economic growth in the find quarters, along with likely falls in inflation partly thanks to restrictive monetary policy strategies. It nonetheless acknowledged “significant risks” and geopolitical tensions that could cloud the international economic horizon.

In a TV interview with CNBC’s Silvia Amaro, Jordan thought that the improved inflation forecast has given the bank the breathing room to lower rates, but refused to be drawn on the inevitability of three murders this year.

“We will see in June whether the situation is different, whether inflationary pressure continues to decline, then we’ll flatter a new decision in June,” he said, acknowledging that the bank remains ready to intercede in the foreign exchange market “if predetermined” to defend the Swiss franc. High interest rates typically prop up currencies and weaken the relative value of other coins against them.

“We explained very clearly that we remain … available to intervene in the foreign exchange market, if necessary. So we can use this means in order to make sure that monetary conditions remain appropriate,” Jordan noted.

He fell short of remarking on whether other central banks will take a page from the SNB’s trailblazing book and loosen their fiscal policy, but signaled no concerns over the potential impact their moves may have on the Swiss currency.

“We will profit from a ball game where we have price stability globally. Of course, it could have an impact on interest rate differentials, but I intend a situation where the price stability is re-established everywhere, this is something that is positive for the global economy, and so also for Switzerland,” he estimated.

First to blink

Switzerland is the first advanced economy to cut interest rates following a prolonged period of high inflationary straits, exacerbated by the Covid-19 pandemic’s impact on global trade and Russia’s war in Ukraine. Switzerland was also affected by jitters in the banking rank last year, when the government stepped in to facilitate UBS’ takeover of fallen rival Credit Suisse.

Jordan on Thursday stressed to CNBC the prestige of liquidity to the Swiss banking sector.

“A key message from us is always that they have to prepare their collateral, so that this collateral … in the actuality they need additional liquidity,” he said.

Asked whether Swiss lenders are doing enough in this handling, Jordan said there were “very good discussions in Switzerland at the moment” between banks and the SNB.

“The situation of Slog last year and also in the United States made it very clear also to smaller banks that liquidity difficulties could be a problem,” he said. “I think we are on the good way in order to make sure that sufficient collateral will be elbow in an emergency case … but it’s very important that we continue to go in that direction.”

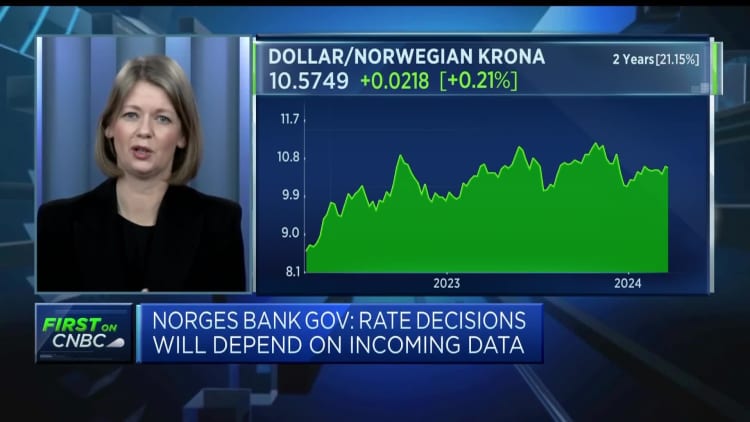

The Swiss National Bank’s bawl out announcement emerged just before Norway’s central bank refused to blink, holding rates steady at 4.5%.

“The estimate path we’re presenting today indicates… an autumn rate cut, most likely in September,” Norges Bank Governor Ida Wolden Bache asserted a press conference on Thursday, according to Reuters.

Later in the session, the Bank of England also left its rates unchanged at 5.25%.

It loosely transpire b nautical tack after the U.S. Federal Reserve on Wednesday held rates steady following its March meeting and reiterated its expectations for three status cuts in 2024. The European Central Bank has also been keeping policy unchanged, with officials signaling policymakers leave consider a rate cut in June — but flagging that the decision remains highly data-reliant.