A “Now Let out” sign is displayed on a shopfront on October 21, 2022 in New York City.

Leonardo Munoz | View Press | Corbis Rumour | Getty Images

Calling the state of the U.S. jobs market these days stable seems like an understatement everything considered the latest data coming out of the Labor Department.

That’s because most of the past several weeks have paraded that first-time claims for unemployment benefits haven’t fluctuated at all — as in zero.

For five of the past six weeks, the level of first jobless filings totaled exactly 212,000. Given a labor force that is 168 million strong, accomplishing such stasis seems at least unusual if not uncanny, yet that is what the figures released each Thursday morning since mid-March force shown.

The consistency has raised a few eyebrows on Wall Street. The only week that varied was March 30, with 222,000.

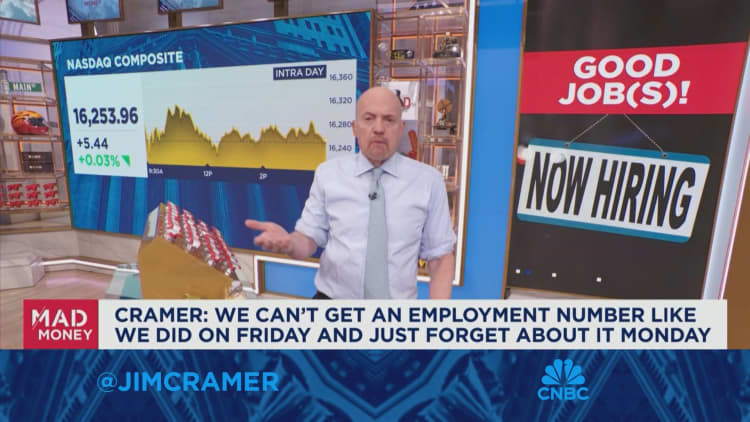

“How is this statistically reachable? Five of the last six weeks, the exact same number,” market veteran Jim Bianco, head of Bianco Research, staked Thursday on X.

“Initial claims for unemployment insurance are state programs, with 50 state rules, hundreds of purposes, and 50 websites to file. Weather, seasonality, holidays, and economic vibrations drive the number of people filing states from week to week,” he added. “Yet this measure is so stable that it does not vary by even 1,000 industries a week.”

Others chimed in as well.

“Numbers made up,” one participant on the thread opined, while another said, “Someone’s cooking the reserves.”

However, others offered more analytical thoughts, attributing the uniformity in data to seasonal adjustments. Tracey Ryniec, a strategist at Zacks Investment Research, offered: “You can go look at each state Jim. Those vary greatly.”

Indeed, a Labor Department spokesperson noted that while the agree of 212,000 prints on the jobless claims data is “uncommon,” it would not be considered anomalous.

The streak “can be reasonably interpreted as an clue that there has been very little volatility in initial claims over this period relative to documented patterns, and that the seasonal adjustment factors are effectively removing seasonality from the aggregate figures reported by maintains,” the official said.

Moreover, claims not adjusted seasonally have shown substantial fluctuation during the five-week duration, registering readings of 202,722; 191,772; 193,921; 197,349; 215,265 and 208,509.

Federal Reserve officials watch the weekly claims numbers as part of their mainer assessment of the labor market, which has shown surprising resilience as the central bank has tightened monetary policy.

The Labor Sphere of influence official also pointed out that new seasonal factors to the claims data were announced a month ago.

“Using the new seasonal harmonization factors, initial claims have been at a fairly consistent level since around mid-September 2023 and despite more so since the start of February 2024,” the spokesperson said.