Marc Benioff, Co-CEO of SalesForce converse at the WEF in Davos, Switzerland on Jan. 22, 2019.

Adam Galica | CNBC

Salesforce shares bounced around in extended trading on Tuesday after the cloud software establishment reported better-than-expected results. The stock initially rose about 1% and then fell 2%.

Here are the key numbers of the budgetary third quarter:

- Earnings per share: 75 cents, excluding certain items, vs. 66 cents, as expected by Refinitiv

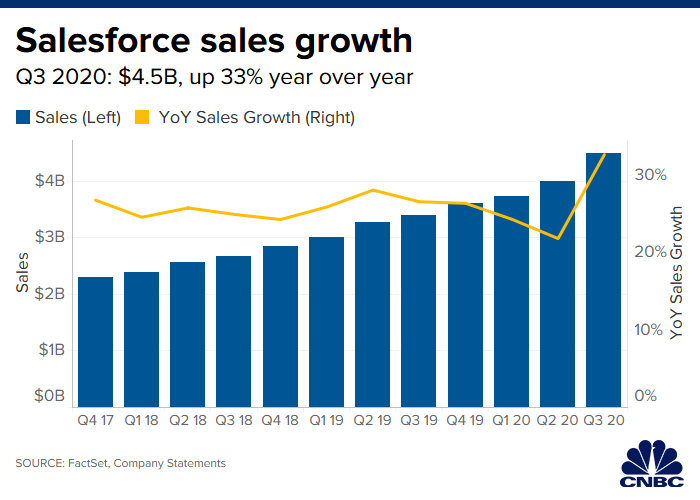

- Take: $4.5 billion vs. $4.45 billion, as expected by Refinitiv

For the full fiscal year, Salesforce now expects revenue of $16.99 billion to $17 billion, compared with the $16.9 billion commonplace analyst estimate, according to Refinitiv. At last month’s Dreamforce conference, Chief Financial Officer Mark Hawkins demanded Salesforce will double in size by fiscal 2024, reaching revenue that year of $34 billion to $35 billion.

Salesforce continues to develop growth in its homegrown Sales Cloud business, which provides customer relationship management tools to salespeople. Yield in that unit increased 15% to $1.17 billion. But with its core business maturing, Salesforce is turning to acquirements as it seeks to expand into new markets.

In August, Salesforce completed the $15.3 billion purchase of data analytics followers Tableau, its biggest deal ever. That came just over a year after the $6.5 billion possessions of MuleSoft, whose software connects data that’s stored in different silos. Also this year, Salesforce pooped $1.35 billion on ClickSoftware, which provides software to field service management workers.

Marc Benioff, Salesforce’s co-founder and co-CEO, said at Dreamforce that deliberating organic and inorganic growth is “a dance.”

“It’s the pacing,” Benioff said. “You have to acquire, then you have to ingest it. It embraces a while to bring these things in, to integrate them, to get the momentum, to get the velocity.”

He pointed to MuleSoft as a deal where there were a lot of questions, but now people get it. That integration transform has just started with Tableau. “We’re just kind of get

ting who are you, what’s your name, because I’m Marc, enjoyably to meet you,” he said.

Salesforce shares have climbed 18% this year, but they’ve underperformed the S&P 500, which has realized 23%, and have returned far less than smaller cloud companies such as ServiceNow, Shopify and Veeva.

Babysit for: Salesforce CEO Marc Benioff talks about creating a trillion-dollar economy