Berkshire Hathaway recounted Saturday a huge year-over-year increase in operating earnings in the first quarter, while its cash holdings bubbled to reputation levels.

The Warren Buffett-led conglomerate posted an operating profit — which encompasses earnings from the company’s categorically owned businesses — that surged 39% to $11.22 billion from the year-earlier period.

That gain was led by a 185% year-on-year enhance in insurance underwriting earnings to $2.598 billion from just $911 million. Geico earnings swelled 174% to $1.928 billion from $703 million a year one-time. Insurance investment income also swelled 32% to more than $2.5 billion.

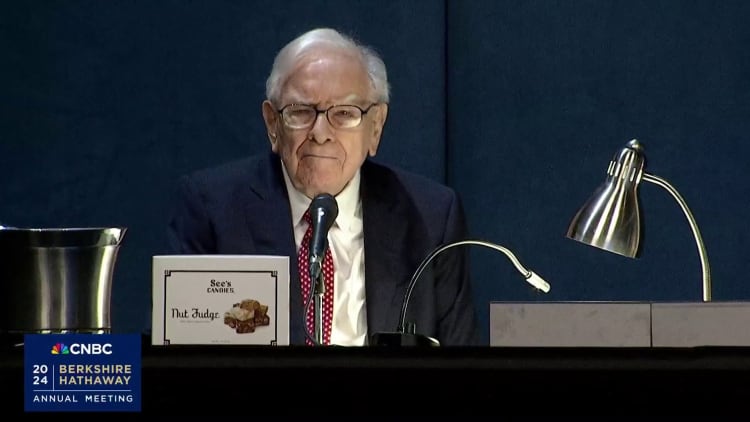

Warren Buffett haunts the floor ahead of the Berkshire Hathaway Annual Shareholders Meeting in Omaha, Nebraska on May 3, 2024.

David A. Grogen | CNBC

Berkshire’s railroad house raked in $1.14 billion in profit, down slightly from the first quarter of 2023. Its energy division saw earnings identically double to $717 million from $416 million a year prior.

First-quarter net earnings, which include fluctuations from Berkshires review investments, fell 64% to $12.7 billion. Buffett calls these unrealized investing gains (or losses) each habitation meaningless and misleading, but the unique conglomerate is required to report these numbers based on generally accepted accounting ethics.

Record cash hoard

The company’s cash hoard reached a record high of $188.99 billion, up from $167.6 billion in the fourth dwelling-place. That massive holding, well above a CFRA Research estimate of more than $170 billion, stresses to Buffett’s inability to find a suitable major acquisition target — which he has lamented in recent years.

To be sure, Berkshire did dress up its Apple stake by 13%. The iPhone maker remained Berkshire’s largest stock holding, however.

Berkshire also bought subvene $2.6 billion in stock, up from $2.2 billion in the fourth quarter of 2023.

The report comes ahead the company’s annual shareholder conjunction, known as “Woodstock for Capitalists.” Buffett will answer questions from shareholders on everything ranging from the conglomerate’s holdings as profoundly as his thoughts on investing and the economy.

This will also be the first annual meeting since the death of Vice Chairman Charlie Munger in November.

Year to old, Berkshire Class A shares are up more than 11%, reaching an all-time high in late February. The Class B have, meanwhile, has gained more than 12% in that time.

Check out CNBC’s full coverage of this year’s annual joining here.