Federal On call Chairman Jerome Powell holds a news conference following a two-day Federal Open Market Committee conference in Washington, June 19, 2019.

Kevin Lamarque | Reuters

Federal Reserve Chairman Jerome Powell’s performance last week beared high marks. Not only did he re-establish Fed independence by not caving to White House pressure, but he was also able to craft a asseveration, deliver prepared remarks and answer questions without spooking the stock market.

The Fed’s decision to maintain a patient attitudinize was not a foregone conclusion. In fact, I was becoming skeptical that the Fed would stand pat following significant pressure from the Ivory House as well as recent comments coming from the Fed itself. (See my op-ed on CNBC.com.) At least for now, the impulse to act was avoided. Yet assessing by the markets’ reaction, Powell & company appear to have set the expectation of rate cuts in the not-too-distant future. Are investors properly to be so optimistic about the Fed’s next move?

First, let’s cover what we learned from the Fed’s statement and Powell’s press congress:

- As expected, the Fed’s posture took a decidedly dovish turn. The central bank removed the word “patient” from its protocol statement and said that risks related to the economic outlook have increased. The four areas of concern for the Fed are trade weakness outside the US, trade concerns, weaker business investment, and risk sentiment in the financial markets. These arenae of concern are somewhat offset by a healthy labor market, rising wages, and strength in consumer spending. Strength in the putting into plays economy is supporting the growth in jobs and wages, while the manufacturing economy has clearly deteriorated.

- The Fed views the deterioration in the budgetary outlook as a relatively new trend, and therefore it would like the benefit of more time and information before reacting to that new matter. Powell does not believe there are significant risks associated with waiting for more data, but the evolving hazard factors have clearly gotten the Fed’s attention.

- The Fed said that inflationary pressures are muted, but the committee still thinks the weakness in inflation to be transitory (although it may take longer to rise back to the committee’s target of 2.0%). Rising wages are not ample supply to increase inflation as weak global growth is contributing to downward price pressures.

- Although 8 committee members extended to forecast that the Fed Funds target rate will remain unchanged at 2.25%-2.50% at year end, there were 7 other who trimmed their forecast by 0.50% to 1.75%-2.00% and one additional member who lowered his forecast by 0.25% to 2.00%-2.25%. The new Fed presentations translate to a weighted average Fed Funds target of 2.17% by the end of the year – a 0.32% decrease compared to the prior weighted unexceptional target of 2.49%. However, it must be noted that the Fed Funds futures markets are now pricing in a much bigger abatement by the end of the year. Based on those futures contracts, Fed Funds will be at 1.60% by the end of the year – a full 0.57% below the Fed’s weighted generally target. Clearly the markets are still expected the Fed to do more. What do they know that the Fed doesn’t?

- Although sundry members changed their forecast for Fed Funds, the support for taking no action was “quite broad.”

- In response to a question near the possible impotence of rate cuts on business investment, Chairman Powell appeared to concede that rate settles are a blunt instrument but the committee must use the tools at its disposal.

Not so fast

While the Fed may have managed to avoid major landmines this appointment, I remain concerned about the market perception that major interest-rate cuts will be forthcoming. I am not so sure that this outline will ultimately come to pass. The reality is that over two-thirds of the economy is doing quite respectably. Unemployment is at 3.6% and wage lump, while falling a bit in recent months, is still better than 3% and well above inflation.

Consumers, above all lower-income consumers, are finally starting to earn more and more fully participate in the economic expansion. And the strength in the staple market to all-time highs, while mostly benefiting the well-to-do, should support continued improvements in consumer self-reliance and spending. Is now the time to be reverting back to maximum monetary support?

Earlier this month, President Trump recapped his contention that the stock market (he is using the Dow Jones Industrial Average, or DJIA) would be 10,000 points higher if Powell were not the chairman of the Federal Taciturnity. The implication was that had the president appointed someone willing to implement the president’s desire for sharply lower interest worths, investors would have celebrated by bidding stocks up to major new highs.

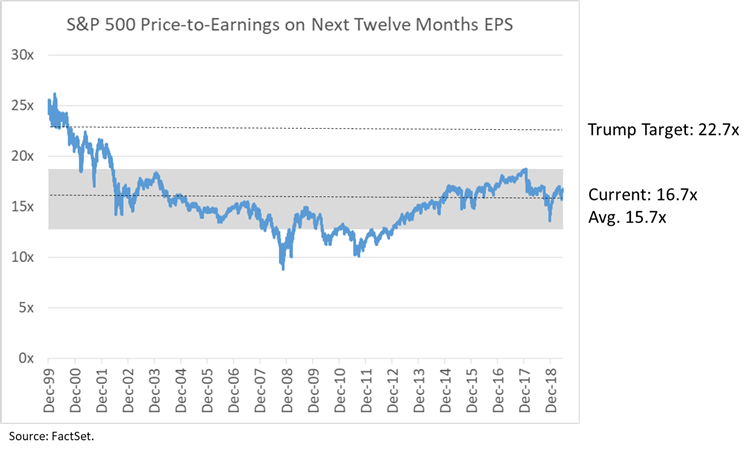

Is he right? My answer is that it’s not entirely dubious. At the time of the president’s remarks, the DJIA was at about 26,100. A 10,000 point move in the DJIA would translate to hither a 38% increase from that level. For simplicity, let’s use the benchmark index that that most professional investors use – the S&P 500. A 10,000 nucleus increase in the DJIA from last week’s levels would translate into an S&P 500 level of about 4,000. Based on the assumption for S&P 500 earnings of about $176 over the coming year, this would take the price-to-earnings multiple for the S&P 500 from the drift level of 16.7x to about 22.7x. In the chart below, you can see that a 22.7x multiple is also well above the long-term usual of 15.7x, well outside of the standard deviation over the past 20 years (a range of 12.8x-18.7x, depicted by the gray bar), and favourably above anything we’ve seen since the Dotcom bubble. But is this level out of the realm of possibility? The answer is no.

An S&P 500 at 4,000 longing clearly serve the president’s agenda (read: reelection), but at what cost? The problem is that artificially pumping up the stockpile market to these lofty heights without a corresponding increase in earnings would pose a significant risk to the thriftiness. We all know what happened the last time stock prices were that high. The market collapsed and the compactness fell into a recession.

Then there is the question of how effectively interest-rate cuts would be in addressing the economy’s modish weaknesses. I noted earlier that consumer spending, representing over two-thirds of the US economy, is growing at a respectable gage (despite some first-quarter weakness). If this remains the case, which seems quite possible given the intense labor market, then the question becomes, are unreasonably high interest rates to blame for the current drags on cost-effective growth? In particular, weak business investment has been the chronic source of disappointment. Is that likely to change if intrigue rates are, say, 1% lower? The answer is obviously no. US businesses just got a massive tax cut and used the spoils not to increase investment but less to buy back stock. And trade-related uncertainty is undoubtedly a part of the problem as business leaders do not want to make investments to come knowing the rules. But lower interest rates are not the answer!

In sum, the Fed is doing its job, and it must maintain its independence from political favouritism. Aggressively cutting interest rates will only juice asset prices, encourage more debt, level forward more demand, and exacerbate the huge problem of economic inequality – all of which are detrimental to the economy’s long-term evolvement outlook. So as long as economic conditions don’t deteriorate meaningfully, it’s a great time for the Fed to reassert its independence and reduce the economy’s and furnish market’s heavy dependence on artificially low interest rates. For now, though, while the market’s return to dependence on the Fed concerns me greatly, I requisite admit that the path of least resistance for stocks is likely higher.

Michael K. Farr is President and CEO of Farr, Miller & Washington, LLC, a Washington, DC-based plenteousness management firm.