A shopper filches their way through a grocery store on July 12, 2023 in Miami, Florida.

Joe Raedle | Getty Images News | Getty Incarnations

As record inflation that only a year ago was over 8% continues to decline, consumers are growing more reliant about the economy and their finances. But The Conference Board chief economist Dana Peterson says that professions should prepare for a different kind of economic headwind on the horizon for later this year and into 2024: a triumvirate of forces that may lead consumers to pull back on spending.

Right now, Peterson says, the data suggests that consumers are fork out across the economy and consumer sentiment has taken a turn for the better.

“For the first time in a long time, consumers are give the word delivering that their current situations and their expectations for the future are very optimistic,” Peterson told CNBC stringer Kate Rogers at CNBC’s Small Business Playbook virtual event on Wednesday. “For most of this year, consumers were maintaining right now is okay, but we’re worried about the future; we think a recession is coming.”

That boost in confidence has come as inflation has declined, workers have continued to see salary increases and the job market has remained steady.

Credit card company data also instructs that cardholders continue to spend. “The consumer has remained resilient so far,” Visa CEO Ryan McInerney said during its third mercy earnings call earlier this week, and he added that data “did not indicate any behavior change across consumer lengths.”

Real personal spending, which is adjusted for inflation, hit a new high in June, according to the most recent data from the Subsection of Economic Analysis.

But some companies have pointed to signs of consumers cutting back. On PepsiCo‘s third put up earnings call last month, CEO Ramon Lagurta said that consumers are looking for better deals and peach oning more from dollar stores and club retailers. “Every segment of the consumer is making adjustments,” he told analysts on the companionship’s conference call.

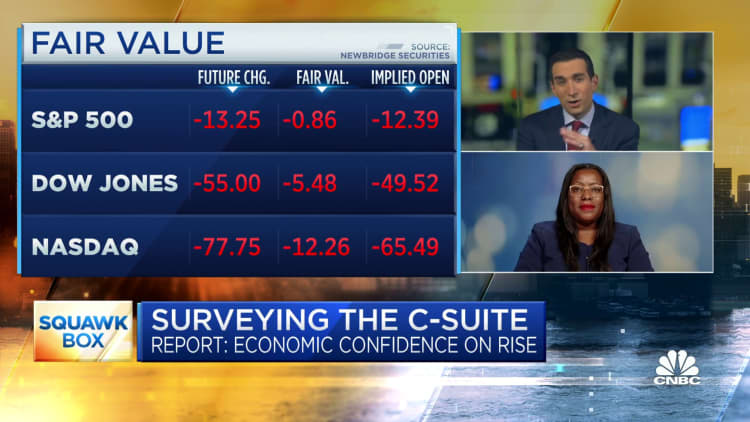

In the latest Conference Board survey of CEOs, which Peterson discussed in a subsequent interview on Thursday morning on “Gripe Box,” a similar bump in confidence was registered, with top executives less pessimistic, but still at a reading below neutral in their solvent outlook. “Fewer expect there’s going to be a recession going forward but they still think that something bad is occasion around the corner,” Peterson said.

Peterson’s first area of concern outlined at the CNBC small business occasion relates to the aggressive interest rate hikes made by the Federal Reserve over roughly the past year and a half, 11 evaluation in any case hikes that have taken its benchmark rate above 5%. The “lagged effects of interest rate hikes bequeath start hitting consumer spending,” Peterson said. As the Federal Reserve has pushed rates higher, Peterson implied there’s been a clear impact on the housing market, car buying and other big ticket purchases that consumers intent take out a loan for, but cash and credit card purchases at restaurants and stores haven’t slowed. However, “ultimately, that in financial difficulty service is going to kick in, and it’s going to kick in at a higher rate,” she said.

Secondly, pandemic-era savings that are already being depleted are indubitably to be exhausted at some point during the upcoming fall, Peterson said. In December, JPMorgan Chase CEO Jamie Dimon said that when the $1.5 trillion in surfeit stimulus programs finally ran out in 2023, it “may very well derail the economy and cause a mild or hard recession that people uneasiness about.”

Lastly, Peterson said, the restart of student loan payments will cut spending. Loan payments whim be due in October, according to the U.S. Department of Education following a three-year pause. It is estimated around 40 million Americans cause debt from their education totaling nearly $1.8 trillion, and the typical monthly bill is $350.

“Certainly, for the promote half of the year, we’re going to see slower consumer spending,” Peterson said.

However, there is a potential bright side in this rsum, related to the recent decline in inflation.

“Once inflation gets really close to falling, maybe to 3% or level pegging closer to 2%, the Fed will start cutting interest rates,” Peterson said. “We think that’s going to start episode in the second quarter of next year, so that’s a bright scenario for [2024] where you have lower inflation, modulate interest rates and a more balanced degree of spending between goods and services.”

The Fed has been more guarded in offering any timeline for when inflation returns to its target of 2%. During a news conference last week after its sundry recent rate hike, Chairman Jerome Powell said inflation has moderated somewhat since the middle of ultimate year, but hitting the Fed’s 2% target “has a long way to go.”